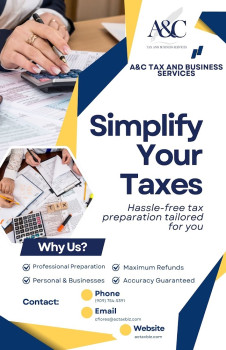

A&C TAX AND BUSINESS SERVICES

Reviews Summary

About This Listing

Who Can Work with a CPA?

*Note: CPAs may specialize in different areas. Be sure to check credentials and service offerings.*

First-Time Clients

If this is your first time working with a CPA, don’t worry — most professionals offer a free consultation and will walk you through what to expect. You may be asked to complete an intake form, share financial documents, or set clear goals for your session.

What to Know Upfront:

*Note: Every CPA operates a bit differently. Don’t hesitate to ask questions before committing.*

What to Bring

*Tip: Organize your documents in advance to save time and ensure accuracy.*

Preparing for Your Appointment

*Note: Preparation helps you make the most of your CPA’s expertise.*

How to Get Started

Other Helpful Info

*Note: Every CPA is different — take time to find one who fits your goals and style.*

Features

Contact Information

Address

2999 Kendall Dr

San Bernardino, California 92407

Phone

+1 909-330-2018Hours

Customer Reviews

I recently had the pleasure of utilizing their tax services, and I couldn't be more satisfied with my experience. They were incredibly knowledgeable and made the entire process easy and straightforward. They took the time to understand my needs and situation, which allowed me to maximize my savings significantly. This business truly deserves support for their quality of work and dedication to their clients. I highly recommend them to anyone in need of tax services!

Hands down the best experience ever! I don't have time to go and wait to get my taxes done but they offer virtual services!!! I got my taxes done virtually with them and it was quick and simple! Cynthia assisted me through the process from the questionnaire to sending me a secure link for signature! Just like that! Taxes done! Thank you so much guys!

Cynthia is such an amazing lady, works fast and communicates every step of the way! I refer everyone I know to her! I'll forever go to her for taxes!!!!

They are incredibly sweet and patient, definitely have a lifelong customer! Definitely saved me the headache of figuring it out myself.

Best tax company in town. Super easy experience and process. 10/10

Did my taxes online with them, everything was done super quick and easy !

Best Tax Services in Fontana! Got me the most money back!

First off hands down easiest year for me to file I've don't mine through turbo tax the past 3yrs and nothing compared. It was fast and had communication with Cynthia through every step let's not say she went above and beyond for me I found my tax lady for the next years to come definitely recommending her to all my family and friends

Great service, always available for their clients, fast and easy. 10/10!

As a typically Hispanic , I have trust issues specifically with my personal information. Years prior I had done my taxes with a family member and unfortunately that was a bad choice. I came to Cynthia and Anthony to help me with my taxes and they were able to have it resolved within 1 hr . very professional but most importantly legit .Thank you once again.

Always there to help and gets it done quick ! ????

Best Tax Services in Fontana! Got me the most money back!

Very professional ! Actually cares about their clients on top of everything and making sure you get your money !! Great people too found my tax guy !

Ask for Tony a true master of his craft

Called and asked if this was A&C Tax and was hung up on. So, NOT LEGIT!!!!

Excellent tax service!!! ??

Incredibly easy and quick would recommend to anyone!b

Great customer service