Abbas Accounting & Tax

Reviews Summary

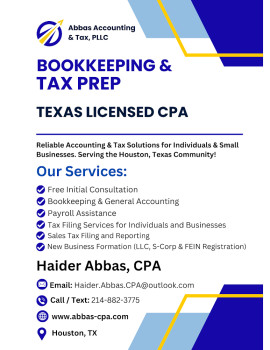

About This Listing

Who Can Work with a CPA?

*Note: CPAs may specialize in different areas. Be sure to check credentials and service offerings.*

First-Time Clients

If this is your first time working with a CPA, don’t worry — most professionals offer a free consultation and will walk you through what to expect. You may be asked to complete an intake form, share financial documents, or set clear goals for your session.

What to Know Upfront:

*Note: Every CPA operates a bit differently. Don’t hesitate to ask questions before committing.*

What to Bring

*Tip: Organize your documents in advance to save time and ensure accuracy.*

Preparing for Your Appointment

*Note: Preparation helps you make the most of your CPA’s expertise.*

How to Get Started

Other Helpful Info

*Note: Every CPA is different — take time to find one who fits your goals and style.*

Contact Information

Address

17410 Waeback Dr

Richmond, Texas 77407

Phone

+1 214-882-3775Hours

Customer Reviews

Haider is an exceptional accountant. His CPA background and exceptional knowledge of the US tax code has been a great asset to my businesses. His work is very clean and thorough, while always making an effort to communicate with me each step of the way. I would highly recommend him for anyone looking to grow their business!

I had an excellent experience with Abbas Accounting & Tax in Richmond. Their team is professional, knowledgeable, and genuinely cares about helping their clients. Haider Abbas made the process simple and stress-free, providing clear explanations every step of the way. Their expertise saved me both time and money on my taxes. I highly recommend Abbas Accounting & Tax to anyone seeking reliable, trustworthy, and friendly accounting services.

My husband and I can not tell you how grateful we are for Abbas Accounting & Tax. Haider is so helpful and very very knowledgeable. So many of our neighbors recommended him and we are glad we reached out. We now feel confident and actually have an understanding on how we SHOULD fill out our W4 and our taxes. We finally have a trusted tax & accounting expert that we will continue to utilize every year! Thank you!

I've known Haider Abbas for many years, and I can confidently say he is one of the most knowledgeable and trustworthy CPAs out there. He genuinely cares about his clients and takes the time to explain everything in a way that makes sense. Whether it?s tax preparation, accounting, or financial advice, he goes above and beyond to ensure accuracy and maximize savings. His professionalism, attention to detail, and commitment to client success truly set him apart. If you're looking for a reliable CPA who will al

I started working with Haider Abbas and have nothing but good things to say about his knowledge, his quick communication, and his willingness to help and guide my business through the complicated tax issues and scenarios. Highly recommend him!

Haider has been incredibly helpful in guiding me through my tax filing process and helping me understand the advantages available to me. He took the time to explain everything clearly, making sure I was informed and confident in my decisions. Beyond just taxes, Haider also provided valuable insights into forming my LLC, helping me structure it in a way that benefits me both financially and legally. His expertise, professionalism, and willingness to go the extra mile truly set him apart.

Haider is an excellent CPA, he knows exactly how to file your taxes and is extremely knowledgeable in his craft. Very sincere and easy to work with as well as reliable. I highly recommend him to anyone who needs help filing taxes or opening an LLC.

Great service. Haider Abbas explains taxes in a simple manner and helps to make sure you are getting your full refund, by knowing the tax laws so well. Would highly recommend to everyone!

He?s done our taxes for over ten years and has saved us so much money every year. Haider has great knowledge and expertise with the ability to communicate effectively and adapt to our needs. It has been a pleasure working with him for over a decade! Highly recommend.

Best place to get your taxes done. Haider has great knowledge & expertise to handle your business or personal taxes.

Mr. Haider Abbas does a phenomenal job on doing my tax returns!