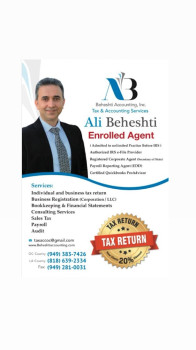

Beheshti Accounting INC. | Tax Return | Bookkeeping | Payroll | IRS Audit

Reviews Summary

About This Listing

Who Can Work with a CPA?

*Note: CPAs may specialize in different areas. Be sure to check credentials and service offerings.*

First-Time Clients

If this is your first time working with a CPA, don’t worry — most professionals offer a free consultation and will walk you through what to expect. You may be asked to complete an intake form, share financial documents, or set clear goals for your session.

What to Know Upfront:

*Note: Every CPA operates a bit differently. Don’t hesitate to ask questions before committing.*

What to Bring

*Tip: Organize your documents in advance to save time and ensure accuracy.*

Preparing for Your Appointment

*Note: Preparation helps you make the most of your CPA’s expertise.*

How to Get Started

Other Helpful Info

*Note: Every CPA is different — take time to find one who fits your goals and style.*

Features

Contact Information

Address

17870 Sky Park Cir # 280

Irvine, California 92614

Phone

+1 949-383-7426Hours

Customer Reviews

He is highly knowledgeable, detail-oriented, and consistently reliable. simply ensuring everything is submitted on time. His Communication is always clear and I truly appreciate his perfect work and nice attitude, and kindness. Highly recommended for anyone looking for trustworthy and expert accounting services!????????

Mr. Beheshti is very knowledgeable. He also explains every detail when doing my taxes so I can understand the law and the reason for everything. I am grateful for his services and highly recommend him to anyone who's looking for Tax or accounting services.

Mr. Beheshti possesses extensive expertise in tax law and demonstrates exceptional efficiency and a comprehensive understanding of relevant regulations. His proficiency allows for swift and accurate processing of tax-related matters.

Mr. Beheshti is professional, knowledgeable, and makes the entire tax process easy to manage. I highly recommend his services.

I cannot recommend Mr. Beheshti highly enough for anyone in need of top-notch tax services. His expertise in navigating the complex world of taxes and IRS forms is unmatched. What sets him apart is not just his profound knowledge, but also his kindness, patience, and dedication to ensuring that every client benefits from the lowest possible taxes and the highest possible returns. Mr. Beheshti employs the best tools in the industry to handle all kinds of tax situations, from personal to business taxes, no ma

I had the pleasure of working with Ali for my personal and business accounting needs and I couldn't be more satisfied with the level of service provided. Ali is a true professional, who is knowledgeable, efficient, and dedicated to ensuring that all of my financial needs are met. From the initial consultation, I knew that I was in good hands. Ali took the time to listen to my concerns and provided me with a comprehensive overview of the services that were available to me. Throughout the process, Ali was pa

Mr. Beheshti is one of the best tax accountant. Highly recommended

I had a WONDERFUL experience working with Ali!! I contacted him at the very last minute and needed several tax returns done immediately?not only were his prices reasonable, but he also stayed past work hours and finished all my returns the very same evening! The whole experience was very pleasant and I'll definitely be using him and his services again in the future. THANK YOU so much for everything!!!!

Mr. Beheshti is an excellent and polite tax professional with extensive knowledge in his areas of expertise. He has taken sufficient time for my consultation and provided me with valuable advice on my individual tax. I highly recommend working and consulting with him!

An honest man does not need reviews but I decided to write anyway. Mr Behesthi is both a kind hearted man and an expert in accounting. I recommend him to everyone.

Alex is the best tax accountant o highly recommend him. He is very professional and knowledgeable about everything about tax services. Thank you again.

My experience working with Ali has been great and enjoyable. He is very professional and experienced in his work. Ali goes above and beyond for his clients. In addition, he treats every person with respect and is always very friendly. I definetly recommend Ali as a professional, reliable, and trustworthy accountant.

Mr. Beheshti was professional, friendly, and easy to work with! I highly recommend working with him for tax preparation services!

I did my taxes myself last year and I received some returns. I assumed I'm doing something wrong since my expenses were higher than my income. So, I started looking for a tax guy with good reviews. When I saw this gentleman?s reviews, I turned to him. My experience with him: He was missing the main items, the biggest expenses he was gonna report to IRS! When he called to check the numbers with me, I reminded him of some items (expenses) he'd totally missed. Those mistakes would have made me pay IRS a number

I can't believe the bad review as I've had the best experience ever with Beheshti Accounting since 2016 (4years). Ali is so professional and go extra miles for his clients. I recommend him to everyone. Thank you so much Ali.

I highly recommend Ali Beheshti as a very professional , reliable , experienced & compassionate accountant to everyone , he goes above & beyond for his clients. He has taken sufficient time for my consultation and provided me with valuable advice .

I'm extremely grateful to work with Ali, he's knowledgable and a professional in his field. From the start, he's been supportive in answering any questions I might've had and helped direct a plan to start my business and organize my finances. Ali does it all. I've felt very comfortable working with him because of his kindness, generosity, and above all professionalism. Thank you Ali!

Mr. Ali Beheshti was a pleasure to work with, he was very attentive to my specific circumstances and responsive whenever I communicated. I am very pleased to have hired him, and plan to continue using his services in the future.

Mr Beheshti is accountant of choice for tax filling. He is professional, responsive, patient and accurate person. His good manners, kindness and his reliability makes him the person of choice in this business.

He is very knowledgeable and professional !!! My taxes were done very Fast with great Customer service and he is Honest I will use this company again and will refer him to my family and my friends Thank you Beheshti Accounting

I really enjoyed working with Beheshti Accounting firm, he provides excellent consultation and very quick response to my questions. He exceeded my expectations. Highly recommended.

Ali and his assistant are so friendly and professional. Ali will provide an excellent service and provide you with all info it may require filling out your taxes. Good luck

Ali is nice and professional. He patiently answers your questions that is significantly important when you're doing your taxes as an individual or a business owner. Highly recommended!

Mr Beheshti helped me for my tax problems. He is amazing person and He have so much knowledge as tax accountants Thank you for everything ????

Experienced, Respectful, and Professional, working with Mr. Beheshti is an absolute delight. Highly recommend his services.

Mr Beheshti was professional and he filed our tax in less than an hour, he made everything clear for us and we are so happy and satisfied that we chose him as our taxman.

He's my favorite accountant and tax preparer, he is a professional, knowledgeable and 100% recommended .

Strongly recommended. I'm so glad to get helped by him for five years. Very satisfied.

Finally I found an accountant than can do my taxes for very reasonable price thanks Alex

The most knowledgable accountant I have ever worked with. Professional, responsive and caring! Highly recommended!

Mr. Beheshti is a professional accountant and i am happy with my choice.

He is one of the professional accountant I have met.helpful and very nice personality.

Mr.Beheshti is a professional , knowledgable, responsible & compassionate accountant with fair & reasonable prices .

Very good service. He will teach you a lot and help you as an individual!

He is the best tax preparer and professional I Very recommended him.

I do highly recommend Mr.Beheshti Excellent service and very professional.

He is really knowledgeable and knows what he is doing. 100% recomanded

First time and very happy with the service I received ??

Very professional attitude and freindly.Definitely recomended.

I highly recommend Beheshti Accounting as a very reliable , experienced & compassionate accountant to everyone

He cares about your business, highly recommended.

He is friendly, professional and honest person

He is the best.. totally recommend..

Excellent and professional service, highly recommend him

That was a very bad experience, he's so rude ,not recommended ??????

Working with beheshti was super good experience