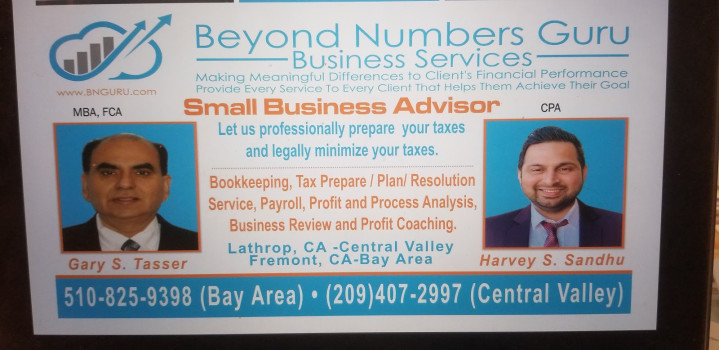

Beyond Numbers Guru Business Services

Reviews Summary

About This Listing

Who Can Work with a CPA?

*Note: CPAs may specialize in different areas. Be sure to check credentials and service offerings.*

First-Time Clients

If this is your first time working with a CPA, don’t worry — most professionals offer a free consultation and will walk you through what to expect. You may be asked to complete an intake form, share financial documents, or set clear goals for your session.

What to Know Upfront:

*Note: Every CPA operates a bit differently. Don’t hesitate to ask questions before committing.*

What to Bring

*Tip: Organize your documents in advance to save time and ensure accuracy.*

Preparing for Your Appointment

*Note: Preparation helps you make the most of your CPA’s expertise.*

How to Get Started

Other Helpful Info

*Note: Every CPA is different — take time to find one who fits your goals and style.*

Features

Contact Information

Address

43575 Mission Blvd #626

Fremont, California 94539

Phone

+1 844-526-4578Hours

Customer Reviews

I have been working with Beyond Numbers Guru for more than 2 years now. I am very happy with their service. They are very proactive and always there to help me. Gary is always available to take the phone call or prompt email communication. He was very proactive during my PPP application and the forgiveness process. He provided me all the required data promptly and always kept me informed about any changes in PPP rules. They do bookkeeping, payroll, and taxes for my 2 companies. Beyond Number Guru rocks!

We have an eCommerce business and was looking for expertise in bookkeeping and accounting but to do this all online and help with data integration. BNGuru has helped me automate my business helping linking my website, sales reports all into Xero which is our online accounting package. Not only has BNguru helped us set it all up but also get meaningful reports that help our cash flow and business. They have also helped us with online sales tax and international trade. In addition, BNguru helps us with the du

BNG has supported my company since the start in 2017. Gary & Harvey have been amazing throughout the 3 years we have been in business, have gone over & BEYOND normal accounting services to recommend business development and corporation growth advise. I have recommend this A++ service to both family / friends and look forward to their continued support. - Priority One Logistics LLC President, Mitchell Montoya

I've worked with Beyond Numbers Guru for a few years , I'm beyond satisfied with their customers service and attentiveness to my business. I can call them for anything and they will assist us. During this whole Corona pandemic they've assist me sooooo much. They offered so much assistance that I didn't even know exist. Beyond Guru had blessed me tremendously.

I have been very happy with the service we have been provided and continue to receive from Gary/Beyond Numbers Guru Business Services.