BORISMTAX

Reviews Summary

About This Listing

Who Can Work with a CPA?

*Note: CPAs may specialize in different areas. Be sure to check credentials and service offerings.*

First-Time Clients

If this is your first time working with a CPA, don’t worry — most professionals offer a free consultation and will walk you through what to expect. You may be asked to complete an intake form, share financial documents, or set clear goals for your session.

What to Know Upfront:

*Note: Every CPA operates a bit differently. Don’t hesitate to ask questions before committing.*

What to Bring

*Tip: Organize your documents in advance to save time and ensure accuracy.*

Preparing for Your Appointment

*Note: Preparation helps you make the most of your CPA’s expertise.*

How to Get Started

Other Helpful Info

*Note: Every CPA is different — take time to find one who fits your goals and style.*

Features

Contact Information

Address

97-77 Queens Blvd STE 1102

Forest Hills, New York 11375

Phone

+1 212-430-6881Hours

Customer Reviews

Our company is deep and wide in the golf cart industry in the tri state area. We chose to look into working with the team at Boris tax planning and advisory because of the great content he speaks about on YouTube. Our experience so far has been informative and refreshing and have gotten a different perspective on how to operate our business and tax planning. We would highly recommend anyone who has a business to give Boris and his team a chance. They are on track to save our company $28,000.00 this year alo

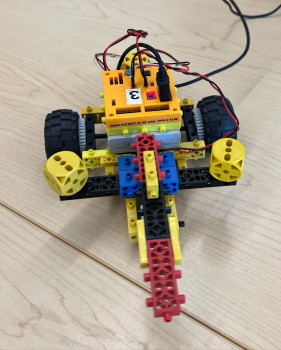

This is Mr. Javier from RoboThink, we do robotics and coding classes for children, I attended several Boris seminars and talent lies not only in his deep technical tax knowledge but also in his remarkable ability to engage and inspire trust. His staff possesses a unique gift make me feel that I doing the right steps to save $40K in taxes.

I switched to Boris M Tax about a month ago, and I've been very happy so far with their advisory services for my editorial/publishing S Corp (which I recently incorporated after years of freelancing as a sole proprietorship). I'm projecting a tax savings this year of more than $12,000 over last year as a result of their customized tax plan, and even more for next year! I love that there's a portal where I can ask questions and get detailed answers within a few days, and I don't have to wait until tax filing

As a speech language pathologist, I have little time to spend focusing on taxes and accounting, but also recognize the importance and want to make sure things are being done correctly, on time and effectively. I have struggled with past CPAs and felt that they were not helping me maximize my profits and have felt that I'm over paying taxes, but never knew what I could do. I am blown away with how professional, knowledgeable, friendly and helpful everyone at Boris M Tax has been. They've provided clear, h

My Industry is Insurance, I decide to do Tax Planning because i came across a you tube video with Boris and I was impressed and wanted to learn more. My Estimated Tax Saving is about $17K, I recommend Boris and his team because the are detail and in my opinion have a wealth of knowledge on how to save on taxes and prepare for your retirement.

As a physician couple, we were concerned about how high our tax bills were and becoming. After a few meetings and implementations of several strategies, we already felt unprecedented comfort that we were taking advantage of every nook and cranny of tax savings we were entitled to. A fantastic and cogent overview that we wholeheartedly recommend to anyone wishing to optimize their tax burden, which in our case ultimately amounted to over $100k a year.

I was introduced to BORISMTAX through a trusted business associate, and from the start, their team demonstrated deep expertise in tax strategy, planning, and optimization. My company specializes in providing IT services in the commercial and government sectors. We engaged BORISMTAX for tax planning services, looking for ways to maximize our deductions, streamline our tax processes, and ensure we were leveraging all available tax benefits. Their strategic approach led to nearly $30,000 in tax savings in jus

We are in the Water, Mold, Fire, and Smoke restoration industry. A friend recommended I look into Boris, and I liked that his firm specializes in tax reduction. They aren't tax preparers who help you save. They are tax reduction experts who can also do bookkeeping and file your taxes. Big Difference! They are proactive and creative to legally keep as much of my money in my pocket as possible. I don't mind paying a little extra for their services because it pays for itself through the tax strategies they pro

I work as a psychiatric nurse practitioner who opened a private practice several months ago. I am not very business savvy and do not know much at all about taxes and tax strategies. I pulled up a few YouTube videos and came across Borris' videos. After watching several of his videos I opted to utilize his services. I found their customer service to be outstanding. Also, they came up with a tax strategy that will save me about $75,000 on an annual gross income of over $600,000. I could net have done all this

As a consultant in the cabinet industry with some real estate investments, taxes have always felt like a bit of a maze?until I started working with BORISMTAX. They didn?t just help me file; they gave me a real strategy. My estimated tax savings came out to around $16,000, which speaks for itself. What I appreciate most is how they take away the confusion that usually comes with taxes. Instead of guessing or stressing, I now have a clear plan moving forward. It's a no-brainer?I'd recommend BORISMTAX to anyo

I'm a psychiatric nurse practitioner decided to work with the group to see how I can pay less taxes and learn new strategies. After meeting with the team, I will be saving $126,000 after implementing the new strategies. I would highly recommend their services. The team is friendly, informative, and easy platform. This is a must do for business owners.

I am in the real estate and retail industry. My CPA is basically only file tax returns for me without helping me save money through tax strategies. I have saved roughly $25000 on taxes since I started working with Boris M. I would highly recommend working with Boris.

I am in the Financial and insurance industry. I really need someone that is very knowledgeable and can help me with my business as well personally taxes and I am doing an s-corp and want to make sure I get all the tax savings I can. I am estimating to receive over 24,000 in tax savings this year. I will recommend this company with Boris and everyone on his team because I have received 5 star customer service and they are extremely knowledgeable and deliver results.

I am a chiropractor in Arizona. I heard about Boris through a Facebook video and liked the information he was giving. I have hired them for not only tax planning but also bookkeeping. I am very please so far the estimated tax savings is $42,825 for 2025 and this will increase each year.

I'm in the service and retail industry, my tax burden was increasing due to growth and changing tax laws. I reached out to Borismtax to take control of my situation. We're currently working on my first plan which should save me an annual 50k+ in taxes which will benefit my employees greatly as well as assist in financing future growth. Win, Win, Win!

I work in tech consulting and hired Boris and team to help manage my tax strategy. I'm not a tax/accounting expert and the team made it easy for me to implement the strategies they recommended. Our plan shows us saving roughly $90K/year.

We are in the the real estate industry -- we decided to seek out a tax advisor after reading several business books and determining we were paying too much in taxes. I found Boris on YouTube and his whiteboard calculations confirmed our suspicions that we were overpaying. After onboarding with Boris and having our business reviewed, we ended up with an estimated savings of over $35k a year. We would recommend using this service.

We work in the Home Care Industry. I saw some of Boris's videos on Youtube. He seemed to have a wealth of Knowledge so I decided to try them out. The process has been good so far. I have an estimated savings of $47k (which is great) so we will see how this goes. I will be telling my other partners about him.

As a management consulting firm, we partnered with Boris M Tax to optimize our tax deductions and planning. Their team helped us save approximately $39,000 in taxes. I highly recommend them for maximizing your business deductions.

Medical Physician office. Attracted to Boris M Tax from the wonderful tax saving videos on Youtube. Extremely impressed by the tax savings and would recommend without hesitation.

I am a Farmer and finally was convinced to get tax planning, wish i did it sooner. Boris and his team are saving me over $58K in a year. Totally recommend them.

I have owned and operated my martial arts school for 32 years. After watching several of Boris' YouTube videos, it was a no-brainer to hire them to start saving money. Last year, I was hit with a $10,526 tax bill because all my bookkeeper did was report the numbers. Boris and his team have shown me several ways they are going to save me at least $15,000 this year in taxes. Things I have never heard about or was told by other accountants that I could not qualify for. Now I don't have to be afraid of making t

Boris really knows his stuff and has a great staff. He helped me with PPP loans, which was VERY helpful during the pandemic. He is handling my tax planning and tax strategy now, as well as my bookkeeping. His is a full service operation that is very responsive, professional, and knowledgeable. I cannot recommend BORISMTAX highly enough. Special kudos to Tao and Adriana, as well as Boris himself.

Boris and his team are an excellent addition to my team. I have been looking for help in this are of my business for the last 9 years... Now I can truly say I have a complete team. I am in the car industry business, in the past I didn't know anything about tax planning but watching Boris YouTube videos I've learn the importance of planning ahead. I highly recommend their service.

As a small business owner, I was shocked at how much money is paid in taxes each year. We decided to reach out to Boris M. Tax Inc. to help us with tax planning to see how and what we could save. My projected tax savings for 2024 is $34,407 and my co owners estimated tax savings is $12,623. I am very happy with the tax strategies they have taught us about and with the support I have received implementing them.

As a real estate professional I was intrigued by Boris and his approach to tax planning proactively, rather than just completing a tax return at the end of the year. I will be saving thousands of dollars that my past CPA's have missed in deductions. I have never had an accountant or CPA tell me about some of the ways I can be saving on my tax strategy like Boris has. He and his staff are very professional and methodical in their approach. I've been very happy so far and would highly recommend Boris and his

My husband and I are very pleased with Borismtax services. We're working mainly with Tao and Boris. They are very knowledgeable tax advisors and they are available for you when you have questions. They got us out of the mess that was created by the advise of our previous accountant. Boris was so kind that he even took time and had conversation with our son (senior in high school) about colleges and accounting career. Highly recommended.

Just signed up with the team. Had a couple of meetings and so far they are coming across much better than the "tax strategy" firm I left. Instead of giving the generic list of strategies they are willing to pretty much "walk with me through" all the tax savings I can capture. Instead of having me figure out how to get the tax benefit they will provide the tools and guidance to maximize my savings. They also have a great app to communicate with the team. They foresee over 60k in tax savings this year so let'

Review for Boris M. Tax Planning Services: As a Finance Broker and Real Estate Investor, managing my taxes efficiently is crucial for my financial success. I decided to seek tax planning services from Boris M. Tax after hearing numerous high recommendations and experiencing a very informative onboarding interview that showcased their expertise. I am thrilled to report an estimated annual tax saving of between $40,000 to $60,000, which significantly impacts my financial strategies and growth. The importanc

After expanding my search beyond California, I found Boris while looking for a tax planner who could offer more than just tax preparation services. Being in the manufacturing industry, I needed a team that understood the specific challenges and complexities of my business. I decided to work with Boris and his team because of their proactive approach to tax planning and their ability to offer tailored strategies. Over the past few months, they have helped me identify opportunities for significant tax saving

Initially, I looked into working with Boris because I liked his focus on tax strategy and his ability to articulate his strategy. It has ended up being the best financial decision I have made. I am big on communication and with Boris, I always get timely updates from his team. They are continually looking for ways to improve my situation. One of the things that has worked well in our relationship so far is our open and transparent conversations. There is no stress, confusion, or uncertainty in the way w

We recently transitioned to BORISMTAX for all of our tax needs and are thoroughly impressed with the level of service that Boris and his team have been providing us! We've been through a tax-planning "Boot camp" over the last few weeks scrutinizing our current financial situation and are delighted to see how much we will be saving with the various Tax-Planning strategies that Boris and his team intend to implement. The entire team is amazing! They use state of the art software to communicate with you and a

Boris and his team are excellent at providing business owners like me what we truly need, PEACE OF MIND. It my first meeting with Boris, he diagnosed where I could save a lot on my taxes and also helped me make some big life decisions. I am very happy with his services and highly recommend Boris and his team. He is also quick to respond with specific answers to questions when I feel like a dummy. Think you Boris!

We are in the office furniture industry and needed a great tax strategy partner as our business is growing. In our search we found Boris via YouTube. I highly recommend his YouTube channel for valuable information. They put together a great tax strategy for this year and in 2024. They are also helping us with our tax returns. The process was easy and they were very patient and had a heart of a teacher. If you are seeking tax planning, tax strategy, forming a corporation, or business guidance, Borismtax

Boris is a true professional. His team takes the absolute most care for clients. We are currently working with him after being with a different firm and his firm is hands down 100% better. His structure, planning and follow up are second to none. I would highly recommend this team for your tax needs. I am in the coaching industry. He has already showed me how he can save my company thousands in taxes this year.

I am in the digital marketing industry and decided to work with Boris after seeing his excellent Youtube videos. Boris & his team are professional & thorough. He saved my company over $15k in taxes and I would recommend the service to any company seeking to minimize their tax burden.

Very happy that I made the decision to hire Boris and his team. I have been through 5 CPA's throughout my career and have not felt comfortable with any of them except Boris. I feel truly taken care of and like I have a team of qualified professionals working on my account. Very happy with my decision!

Boris and his team are amazing to work with!! This year they saved us over $70,000 in taxes with their tax strategies and planning. Already we see the savings for 2023 as well!! If you were thinking about switching to a new organization for tax strategies and tax preparation I would not hesitate to choose Boristax and their team of professionals. From day one onboarding with their organization, has been nothing but 5 stars!

I'm a new customer to Boris Musheyev's accounting firm. So far, I am beyond satisfied if not ecstatic! I have a strong team of professionals assigned to me. They are organized, experienced, communicative and extremely responsive. For the first time, I have found a firm that will not only listen to me but provide me with a tax strategy, not just taking my money to complete forms! With the first week, they identified mistakes that my previous accountant made and are filing an amended return. That alone will

Pangche and Shirley have been instrumental in helping our business reduce the impact of taxes as we have started up our new Gourmet Food Truck! After some extensive searching we came across Boris' Tax Planning services and watched many of his informative videos on YouTube, detailing many aspects of owning an S-Corp and saving on taxes. We would absolutely recommend this firm to anybody who has a small business and would enjoy a lower tax bill. We are expected to save just under 40,000 in our first full y

Im a dentist and have an S corp. I?ve been looking for a tax strategist who can give a clear advice on what to do to save taxes. Boris? team has it down. They are very clear about their job and communication. So glad I found the team. Ps. I?m expecting to save about $16000 in taxes.

Boris really knows his stuff. I hesitated to pull the trigger for a couple of years to invest in Boris' service. However, he just finished my tax plan, and I can say it's money well spent. I am looking forward to saving money on my taxes based on the insight gained from Boris' plan. I'm a lawyer in Albany, GA, and I was skeptical of using the services of someone in New York who I found on Facebook or disclosing all my financial information to someone I had not met in person. Yet, following the presenta

I am so happy to have Boris and Borismtax Corporation helping me with my tax planning. I will benefit greatly from the tax strategy I was given. I will be saving $25,361 in 2023 and my 2024 savings should be around $33,444... it feels great. I highly recommend BORISMTAX, INC let them show you how you can save money on taxes utilizing proper tax planning with tax strategies

I am in the financial services industry. Boris and his team will save me $27,999 in 2023 and $39,083 in 2024 from their tax planning guidance for my company. Wow! Was paying too much in taxes, had no tax strategy, and would highly recommend exploring a relationship with Boris and his team.

My experience so far with Boris and his team has been easy and smooth. They truly pay for themselves and leave you wishing you only started working with them earlier. We're already prepared to save over triple what they cost us and their knowledge for maneuvering the entertainment industry tax code is excellent.

I highly recommend BorisMTax for tax planning strategy services. I first came across Boris from a pamphlet he offered for free on Facebook. I downloaded it and read it and I was immediately impressed with his knowledge of the tax code and his passion to guide his clients to save money with their taxes. Equally impressive is the fact that I only dealt with Boris, the owner of the tax firm, during all my appointments. That showed me that he is fully hands on with the work that went into my tax planning po

Chose Boris after watching multiple video posts on YouTube while researching tax strategies for small business. He is very easy to watch! My wife and I both have begun working as independent Anesthesia providers this year.We were tired of paying over and above on income taxes. After joining and our initial consultation ,we are on track to saving over $26k in taxes this year. His partner, Pangche, is really awesome. She put together a specific and individualized tax strategy plan for us. Would highly recomm

I just started with Boris and team, and the team has been very attentive to my needs. We first reviewed my current business and what I have been doing, and over the last several weeks, we have been discussing and implementing tax strategies to save on my taxes. My favorite thing about this firm is that the people articulate everything very well, and also make me feel that no question is too stupid or silly to be asked. Appreciate you all!

Boris and his team really understand tax law and how to get your personalized tax plan implemented in your business. I am in the construction industry and they have saved me over $50k already the first year. After years of not knowing what to do or who to believe, I?m more than satisfied with this relationship.

I am delighted to share my experience with Boris M Tax, particularly the outstanding tax planning and strategy services they provided Lucky Dog Construction Inc. as a millwright and pipe processing construction company. Industry: Lucky Dog Construction Inc. is a millwright and pipe processing construction company. Our business involves intricate operations, requiring specialized tax considerations. Reason for Choosing Boris M Tax: After sensing discrepancies in our corporate S corp taxes, we knew we neede

Boris and his team are top notch. I have some real estate, a service company with 9 employees, and my last 2 accountants really messed up our books. I turned to a large firm who charged me an arm and a leg in hourly fees with zero outcomes to help fix their mistakes. My smaller accountants didn?t know how to handle a scaling business and multiple businesses. Boris?s team had the knowledge and customer service to help me fix my tax issues right away and create a tax plan for my future. Boris does not believe

My husband and I are extremely pleased with the tax plan provide to us by Boris Musheyev. Not only has he identified areas of great tax savings, he has shown us his personal investment in our future. This means a tremendous amount to us as we know moving forward with Boris will continue to give us the best tax strategies possible.....which in turn provides more security for our future!

Boris is the real deal. Over the years I have worked with a lot of "experts" in different fields who made big promises but didn't end up delivering. Boris vastly exceeded my expectations! I chose to work with Boris after reading his S-CORP tax strategy book which had some interesting insights. After meeting with him it was pretty clear he is an expert on the topic and could help me put together a tax plan instead of just having someone prepare my taxes. We are still in process of implementing all of his

Boris has been of great help setting up our not-for-profit organization. He made the otherwise painful process of obtaining and filing the tax exempt status incredibly easy and fast. He continues to impress with impeccable service and deep knowledge of his craft. Boris is very responsive, timely and always treats our requests with urgency. Boris constantly provides well thought out, justified, and professionally communicated solutions. I highly recommend Boris and the services he provides.

Boris, you are truly an Expert at your job! You did a tremendous job organizing and sorting through my documents. Your whole team is very professional, responsible, and extremely responsive to calls, emails and texts. You not only did my taxes for past few years but gave me a vast amount of education as well. You treated my businesses as your own and saved me a lot of money due to your knowledge. I highly recommend Boris and his team! Thank you very much for all your diligent work. You guys are the best !

Boris has been extremely helpful with helping me to figure out the ins and outs of tax strategy for my solo law practice. He is extremely easy to communicate with and his tips and tricks should save both myself and my company a lot of money in the future. I feel like he truly listened to my current situation and my future goals and took everything into account before developing my Tax Plan. Highly recommended!

Boris Musheyev is just amazing. There are many reasons why we choose to do our taxes with him, the most important being the fact that he always leaves all lines of communication open. My wife and I transferred over to Boris two years ago, he was such a breath of fresh air. Our previous accountant didn't explain anything to us, she just pressed a few buttons on her computer and sent us on our way. Boris was able to get us returns that we didn't even know existed. He explains to us what we are and aren't able

I would highly recommend BORISMTAX and his team. They help me with my LLC & Incorporated companies. Its the advice and tax planning throughout the year that I value, not just end of year tax filing. Very organized and responsive!

Boris has prepared my taxes for the past couple of years. I am very satisfied with his service. I feel very comfortable with his office staff. He's a very cheerful person and shows confidence in all of his experience and therefore I trust his expertise, Thank you Boris for your great services..

I have been extremely impressed with Boris and his team. They are very responsive and certainly know their trade. We work directly with Pangche Yang and she is wonderful. The amount of potential tax savings they are showing me is well over $60k I highly recommend this firm!

Boris and his team were excellent! We were looking for a new tax expert and am so glad we went to Boris. He is very knowledgeable, professional, and had a great blend of personal interaction such as phone with easy technology like uploading files, etc. He also helped me with my small business taxes. Highly recommend and will be using again in the future! -Megan

His book I purchased was specifically for S-Corp businesses. We realized he was an accountant that understood the LEGAL way to maximize our tax deductions so we can pay what we owe but not overpay. The first year he saved us way more than he charged for his services. He did this by just reviewing a small thing that our previous CPA missed that was worth several thousand dollars. His team is patient with us, understands we are busy running a business and works with us on meetings and things they need to h

I am in the legal industry and needed professional guidance on my tax situation. I had the pleasure of working with Pangche and Tao. They were very diligent, patient, and focused. I highly recommend Boris and his team for your tax planning and filing.

Highly recommend BorisMTax group for tax planning. They were immediately able to provide our law firm with a tax strategy that was clear, actionable, easy to implement, and will offer great savings for years to come. We look forward to continue to work with Pangche and the entire team!

Boris is a true professional. He thoroughly examines the entirety of your specific tax situation and provides detailed and unique tax saving options that maximizes your tax savings. In addition, Boris is very fast to respond to any questions that you may have. I look forward to working with Boris and his team in the future.

I came across Boris and his company through an advertising campaign that they had about tax codes and strategies for S Corps. I paid a small fee for the 3 year lookback on my company an personal taxes as I was tired of receiving a huge tax bill every year with our prior accountant. Turns out that for years we only had someone who solely prepared tax returns, not someone who could create a tax strategy that could save us tens of thousands of dollars. We are expecting to save between 15 to 20k on taxes for 2

I cannot recommend BORISMTAX, Inc highly enough! Pangche and Shirley have been an absolute pleasure to work with, and their tax planning and advising services have been invaluable to my digital marketing business. As a business owner in the digital marketing industry, tax strategy and planning can be overwhelming and confusing. However, Pangche and Shirley have made the process not only manageable but enjoyable! They have taken the time to educate me on all the deductions and credits available, which has

Boris' tax work is very comprehensive. He provides a full presentation and templates to fill in with your personal financial info during the final review so that you can take advantage of all his suggestions. This was worth the fee!

We are a solar company and found Boris through one of his S-corp strategies books for tax season. After having interviewed many CPA's, we realized that we weren't getting what we needed to PLAN for tax season. Many of these CPA's simply prepared our taxes, which didn't put us in a position to take advantage of the many available strategies and gimmicks in federal taxes. In fact, when we did tax estimates, we were surprised that many CPA's didn't gasp or have a negative reaction when we were expected to pay

I chose to work with BorisMTax because I needed more than just tax preparation services. With multiple businesses and income streams, I needed a company who could see the whole picture and help me plan accordingly. BorisMTax has done that and more. With intimate knowledge of the tax code and the ability to apply it to various situations, BorisMTax saved me $20k in taxes on one business transaction alone. I highly recommend BorisMTax for all business owners!

Boris has been my accountant for many years now and I have only the best things to say about his service. He has done both my personal and business taxes. He is always extremely quick to respond to any email or phone calls and is always helpful. What I love is that he can explain difficult concepts about taxes to me in a clear and simple way, always making to process quick and easy. His online portal system makes it extremely easy to upload documents each year. He has it down to a science, this year it

Very excited to get started. Medical/surgery business. Estimated savings of $130,000!

I have used Boris for a few years and I have been very satisfied with his teams proformance. Very quick and easy. Everything is done via email. Most importantly I saved money in my taxes by taking his advise. Thank you Boris and your team!

Boris and team provided an excellent review of my business and personal situation and provided a great tax savings plan. Impressed with the details of the plan and assistance getting it setup. I would recommend their services to others.

I had subscribed to Boris' newsletter a while back and finally decided to schedule a zoom appointment. To say I was hesitant is an understatement; but after the zoom meetings, I am so completely satisfied and confident that the tax strategies will save us money. Now I only wish I would have contacted him sooner! We are on track to save over $56K in 2022.

I have been using Boris for the past 2 years as my accountant and he really knows his stuff. He was very helpful and took his time to sort through my numbers at my convenience. I have yet to meet him in person because of my busy schedule and he was able to accommodate me. I emailed all my documents, filled out all the info on his site, he gave me a call to clarify and confirm all the numbers/papers and the rest is history. He tried to get me for me as many deductions/credits I would be eligible for. I got h

I've been working with Boris and his team for two years now and they have been instrumental in the successful growth of my nonprofit. They are responsive, reliable, and easy to communicate with. I recommend them every chance I get!

Boris Musheyev is a very professional and knowledgeable accountant who was able to save me a lot of money on my last year's return, as well as get me money back for returns filed by another accountant who missed a few deductions. I highly recommend him and his partner to take care of your accounting needs!!

Thank you Boris for working with us! The team was very professional, kind and prompt. We were a little late on the current year but look forward to seeing the savings on our next return!! Boris shared so many different legal strategies that we were not aware of. Thank you!

I scheduled a tax strategy call to learn more about their services and was very excited actually. However, they cancelled my call without a rhyme or reason. When I called their office asking for a reason, they said we cancelled it because our fees are $2,450 per quarter. I selected my net income range from $100k-$300k so they assumed I wouldn?t be able to afford their services (it?s the range option they gave. I could?ve had a net profit for $299K for all they know but they assumed the worst). Very shameful

The insight Boris and his team provided for our company saved us a ton of money. His Tax Planning strategies does work. Just follow the recipe and save money!

Great tax advisory service, they were able to find tax savings for my business and guided me every step of the way, would highly recommend.

Boris is very knowledgeable and provides customized assessments for your specific business needs. The recommendations for tax savings are amazing!

I have never met someone as patient and caring for his client. He works really hard and does the best job for you. I can't think of anyone else I trust as much as I trust Boris! And that's why I recommend Boris wholeheartedly.

Borris and his team are awesome. They showed us how to save $25k a year in taxes. They made the process very simple and easy to follow!! Great group to work with!!

Working with Boris and the team has been a game changer for our coaching business! They helped us develop a tax plan that is saving us $73,000.

Why did you choose to work with us- As our business?was growing I noticed the need to work with a more professional?CPA team. Working for a very short?time with? Boris and his team I believe?we made the right?choice.

THIS IS A SCAM !! when someone wants money western union there not a legit business. I contracted boris to do my tax planning becuase he claims he's the best. He missed stuff that was simple stuff . He is way over priced and he's stragies are no good. SAVE YOUR MONEY STAY AWAY !!!