Boytan & Associates

Reviews Summary

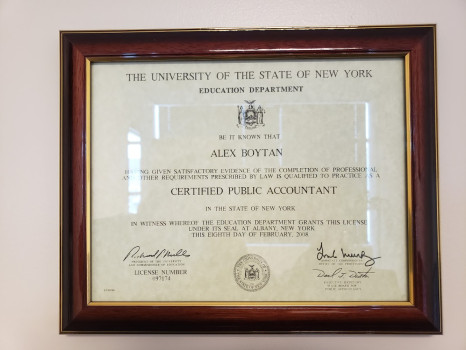

About This Listing

Who Can Work with a CPA?

*Note: CPAs may specialize in different areas. Be sure to check credentials and service offerings.*

First-Time Clients

If this is your first time working with a CPA, don’t worry — most professionals offer a free consultation and will walk you through what to expect. You may be asked to complete an intake form, share financial documents, or set clear goals for your session.

What to Know Upfront:

*Note: Every CPA operates a bit differently. Don’t hesitate to ask questions before committing.*

What to Bring

*Tip: Organize your documents in advance to save time and ensure accuracy.*

Preparing for Your Appointment

*Note: Preparation helps you make the most of your CPA’s expertise.*

How to Get Started

Other Helpful Info

*Note: Every CPA is different — take time to find one who fits your goals and style.*

Features

Contact Information

Address

800 Cross Pointe Rd STE B

Gahanna, Ohio 43230

Phone

+1 614-947-0888Hours

Customer Reviews

Highly Reliable and Trustworthy Accountants I have been using the services of Alex Boytan and his Associates for the past 12 years, and I can confidently say that they are the best in the business. From the first year I had them file my taxes, I knew I had found a reliable and trustworthy partner for my financial needs. As a new immigrant then, they treated me with respect and care like a part of their family. Alex has consistently provided exceptional service, demonstrating a deep understanding of comple

Great CPA office. I know my paperwork is filed correctly when Alex Boytan and his team is handling it. Thank you Alex, Olga, Alena and Ina! Great work! Always on point.

I heard good feedback about this place for at least 10 years and decided to give them a try. I used Boytan & Associates for 3 years now and very happy with their professional approach and tax return service. Highly recommended!

The accountant who met with us was knowledgeable, efficient and took the time to explain our tax returns to us. I found their service fee for tax preparation to be very reasonable. My only regret is that I didn't find them sooner. I will be using them exclusively going forward and highly recommend that others use them as well.

My experience with Boytan & Associates has been nothing short of phenomenal. The team?s expertise is unparalleled. They go above and beyond. What truly sets them apart is their personalized approach ? they are always available to answer questions, provide insightful advice, and make complex accounting concepts understandable. Most importantly, their commitment to integrity and transparency instills confidence and peace of mind. I highly recommend Boytan & Associates to anyone seeking a reliable, knowledgeab

Running a small business comes with its stresses. But Boytan and Associates has been a massive help with alleviating the stress of tax season and all the preparation that leads up to it. They are a knowledgeable team and are willing to explain any questions when I have any.

This is an amazing tax firm. I personally deal with Tatyana. Her and Boytan are amazing that would be do. They are up-to-date with all the tax laws and are great advisors. I highly recommend if you fall in the category of being a small business or large corporation.

I opened a small business in 2018 and was completely overwhelmed with trying to navigate a new world of book keep and taxes. I was "lucky" enough to stumble upon Boytan and associates. Although I am a small operation compared to their normal client's, they still treat me with the same care and respect as a multi million dollar business. I can text or call at any point and they are responsive. I have no worries when tax time comes knowing I am in the great hands of Boytan and associates. I tell every sm

Great office!!! Robert Wolfe, CPA is a cut above the rest! His broad knowledge of numerous finance aspects will enhance your bottom line.

Professional and top of the line CPA service. Very knowledgeable in tax code and great customer service. Recommend, A+.

Excellent service. Robert knew exactly what our issues would be. Everything was done perfectly, timely, and reasonably priced.

Knowledgeable staff that went over and beyond for me and my family. Very professional business and treated us as family from day one! Thank you for everything!

Professional, well prepared, and the outcome exceeded our expectations.

Great place with great people!

Very professional , smart and helpful team . I would highly recommend it.

Knowledgeable personnel, positive atmosphere, great partner

very helpful and knowledgeable would highly recommend

The best CPA you can find!!