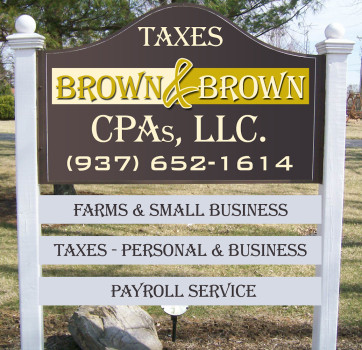

Brown & Brown CPAs, LLC

Reviews Summary

About This Listing

Who Can Work with a CPA?

*Note: CPAs may specialize in different areas. Be sure to check credentials and service offerings.*

First-Time Clients

If this is your first time working with a CPA, don’t worry — most professionals offer a free consultation and will walk you through what to expect. You may be asked to complete an intake form, share financial documents, or set clear goals for your session.

What to Know Upfront:

*Note: Every CPA operates a bit differently. Don’t hesitate to ask questions before committing.*

What to Bring

*Tip: Organize your documents in advance to save time and ensure accuracy.*

Preparing for Your Appointment

*Note: Preparation helps you make the most of your CPA’s expertise.*

How to Get Started

Other Helpful Info

*Note: Every CPA is different — take time to find one who fits your goals and style.*

Features

Contact Information

Address

3366 Riverside Dr

Upper Arlington, Ohio 43221

Phone

+1 614-451-5501Hours

Customer Reviews

Title: Disappointing Experience with Brown & Brown Tax Services Review: ?? We have been using Brown & Brown Tax Services for several years, even before COVID-19. Initially, they were responsive and prepared our taxes on time. However, our recent experience has been disappointing. Currently, it is difficult to get clear answers or timely updates from them. We have had to reach out multiple times for simple updates, which has been frustrating. After a mistake in our return, we decided not to use their ser

Working with Brown & Brown, CPA?s over the past five years we have remained satisfied customers. Jeremiah and his team gave us valuable tax advice relevant to our rental LLC. Our questions were always answered in a timely and thorough manner. Filing was straightforward and easily managed online. You are in good hands with this knowledgeable and professional firm. Highly recommend.

I have worked with Brown and Brown, CPA?s since 2010. We had a small business until recently, and Jeremiah and his team were always very helpful and willing to answer any questions in a timely manner. They are very professional and efficient and do an excellent job with customer service for their clients. They are also our personal accountants and always respond to any information requests quickly and knowledgeably. I have recommended Brown and Brown, CPA?s to several friends and family. They have alway

Brown & Brown CPA's has done my taxes for more than 5 years, and the service has always been excellent. They are always accurate, efficient, and very thorough. The checklist they go through with the client at the beginning of the process is very helpful to me because it helps me remember things I may have otherwise missed. They serve as a liaison with the IRS to answer any questions that might occur. When the tax returns are completed, I appreciate the preview copy of the tax returns prior to meeting in

Brown & Brown CPAs delivers exceptional service and provides excellent advice at reasonable rates. I have worked with Jeremiah Brown, CPA in a professional capacity for more than 20 years as both a co-worker and client. Brown & Brown CPAs are always on top of current accounting developments and go the extra mile for clients when difficult issues present themselves. I highly suggest hiring Brown & Brown CPAs for your bookkeeping, audit, tax or other accounting professional service needs.

I have worked with Brown and Brown CPAs since I started my small business in 2006. They were very helpful in answering my questions and helping me manage my Quickbooks. The have always been very thorough with my taxes and found several ways to lower the tax that I owed. I really felt like they wanted to get to know me and my business, so they could do the best job on my tax return. Very professional and trustworthy!

I stumbled upon Brown & Brown CPAs 4 years ago by a postcard they sent to me regarding their tax preparation services. They?ve completed my taxes every year since then. Jeremiah Brown has always done an excellent job getting this done quickly for me at a very reasonable cost. Each year we go through a detailed checklist to see what the potential opportunities might be that year for tax savings. There have been a couple of times where a question has come to me afterwards and it simply took a quick phone cal

I?ve used Brown and Brown for my tax returns the past five years and have had a very positive experience every time. Jeremiah and his team are thorough, efficient and always timely in their responses to questions and deadlines. I can?t recommend them enough.

My husband and I used Brown & Brown CPAs this year for the first time based on previous reviews being pretty stellar. We weren't disappointed. Their service costs were reasonable, quick and they kept us in the loop very well of how they filed for us. The only minor issue I had is that their actual building was the tiniest bit hard to find. It was an otherwise seamless and painless experience - which is how I like my tax filing to go.

We highly recommend these CPA's for many reasons. Professional, ethical, and accurate. We always count on them to do our annual reviews and tax returns in a timely and thorough manner. They guide us in staying up to date with accounting software and are always aware of the ever changing tax laws. We enjoy their upbeat and friendly attitude, as well. It makes the burden of accounting just a bit less burdensome.

?I?ve been a client of Brown and Brown for several years now and as a small business owner , I?m extremely pleased with Jeremiah and his team of accounting specialists and the efficiency with which they handle not only my yearly taxes, but also answering the odd question or two I will inevitably have during the year. Brown and Brown is a well-groomed, professional and, above all, personable business that I recommend for any business owner and non-business owner alike.?

Jeremiah and his team are very thorough, professional, accurate and efficient. They are always available when I have questions....even after tax season!