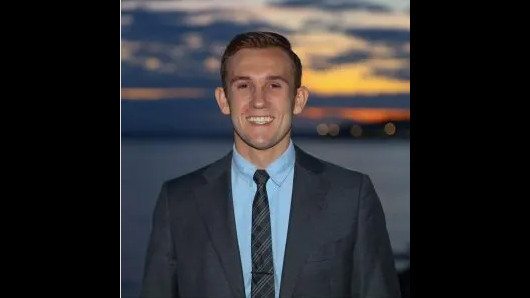

Colby Cross, CPA

Reviews Summary

About This Listing

Who Can Work with a CPA?

*Note: CPAs may specialize in different areas. Be sure to check credentials and service offerings.*

First-Time Clients

If this is your first time working with a CPA, don’t worry — most professionals offer a free consultation and will walk you through what to expect. You may be asked to complete an intake form, share financial documents, or set clear goals for your session.

What to Know Upfront:

*Note: Every CPA operates a bit differently. Don’t hesitate to ask questions before committing.*

What to Bring

*Tip: Organize your documents in advance to save time and ensure accuracy.*

Preparing for Your Appointment

*Note: Preparation helps you make the most of your CPA’s expertise.*

How to Get Started

Other Helpful Info

*Note: Every CPA is different — take time to find one who fits your goals and style.*

Features

Contact Information

Address

600 1st Ave S # 329

Seattle, Washington 98104

Phone

+1 425-484-8775Hours

Customer Reviews

Colby's great. The intake process is pretty clear and lists any tax-forms that should be provided, which helped me organize all my different forms in one place ahead of filing. He was professional and responsive for the actual filing and provided understandable explanations for the filing amounts. I've previously used online tax software which is a bit cheaper, but not having to worry about missing deductions or current crypto regulations was a relief. Would recommend.

Colby always does a great job completing our taxes. His timely work, communication, and knowledge is so appreciated. You definitely want the best when you are entrusting them with all your personal information and family finances.

Very pleased with the tax services with Colby thus far, he's very professional and responsive. He is well versed in the emerging crypto tax processes and law, as well as general tax law and accounting practices. I feel like I'm good hands with Colby.

Colby was very helpful and made my taxes easy. There's a comment that says he overcharges, but I disagree. I contacted other crypto accountants and most charge over $500 per hour just to calculate and review your taxes + $750 to do the tax return (if you have more than 200 transactions they may charge more), e-file and paperwork. Also I didn't have to call him, just uploaded my paperwork and that was it, easy ??

TLDR; Colby seems like a fine person, but overcharges for something you can do with software and doesn't seem to provide a service measurable to my standards. Colby himself seems like a good person and was very responsive to emails in my preliminary discussions with him. Colby's firm advertises as a crypto accounting company and, in my experience, he was not providing me with any service that I couldn't and haven't done on my own. I have used services such as Koinly in the past, and from my conversations

My experience with Colby was phenomenal. This was my first year using a CPA because of a lot of crypto transactions I had. I usually do my own taxes. I looked around many other CPAs and firms and found that either they were over priced or just horrible at communication. Colby was none of those. He was always there to answer any of my questions or concerns as a new investor and guided me through the whole process smoothly. I would highly recommend Colby. Look no further. Thank you for all your hard work Colb

Short version: If you need a tax accountant who is well versed in crypto currency tax laws Colby is your guy, trust me! My experience with Colby from start to finish was awesome. I literally can not think of one issue along the way to complain about. The crypto tax accountant i originally used for the last 2 years vanished which put me into a little bit of a panic. I had issues with my previous crypto trading history which needed to be amended, I had to have this years taxes reported and i had a ton of cry

Colby is diligent and efficient. We were lucky to find him!

Colby was a huge help with my taxes this year. He worked super fast and had them all done in a matter of days. He was a pro and knew exactly what information I needed to get him. He was a pleasure to work with and I honestly can't recommend him high enough. Class act.

As an expat, I found it very intimidating starting from scratch in a new country. Colby's help in navigating the complex US tax system has been indispensable to me. The advice he offers is both thoughtful and professional. In my experience many CPA's will never respond to an email that they don't have an easy reply for. However, Colby has always followed up to acknowledge that he's seen my query and direct me in a practical way.

After my experience using Colby for my crypto taxes this past year, I plan on using him going forward. My crypto trade history was long, complex and ultimately confusing from using a variety of different exchanges over time. After the initial crunching of the numbers, we realized there was a major error somewhere in my trade history. After some back and forth discussion, Colby was able to pinpoint the discrepancy to a formatting error in a document from one of the early exchanges I had used. Colbys services

Colby Cross, CPA is perhaps the best CPA; I have ever encountered. I spent countless hours trying to research a great CPA that knows his/her field in accounting and cryptos. He was very knowledgeable about all the accounting practices. Colby was able to save me some money on my taxes. Mr. Cross is a professional with substantial experience in crypto-accounting. Not only is he a professional, but a very personable individual. There are a lot of accountants in the field that can do an efficient job, but Colby

Colby is great. I'm very happy with the outcome of my returns. There has been some follow up correspondence with the IRS and Colby has been there every step of the way.

Colby does excellent work at very reasonable rates. He has great communication and is very easy to work with. I've worked with many accountants over the years and Colby is one of the best. Highly recommended!

Colby just banged out my 2022 personal taxes along w crypto and calculated losses Accurately year over year, got this done in 2 DAYS FROM TIME OF CONTACT! yea I had to provide all dox and I did but BooM He did this in 2 days and no he dint slack on it, Everything was included in the filling, I checked. Thx Colby!

Colby is an excellent CPA. I was referred to him by a friend and he was able to help me when I was a pinch. He's now my go-to accountant. I'm lucky to have found him!

Worst experience with Colby. As opposes to other firms, he charges $250 upfront to come up with tax amount owed. After that, he just ghosts after multiple follow ups on email and call, even when one is ready to pay the taxes. Will not recommend him to anyone ever

I was in a bit of a jam and Colby really helped me out. I am much happier working with someone who clearly has a good grasp of the tax questions related to crypto than I was with my previous accountant. Highly recommend and I will be back next year for sure. :)

I had a great experience working with Colby Cross. My taxes are a pain and Colby worked with me to make it easy and accurate. They did a fantastic job and I will be using them again.

Colby was l incredibly fast and efficient in helping me prepare my 2023 tax return. I would highly recommend his service and expertise in the process!

This was my first year working with Colby, and I was impressed by his attention to detail and expertise when it came to nuanced tax situations. Communication was quick, clear, and informative.

Very professional and experienced Crypto Tax accountant. He asked us to gather all the informations and took care of the rest. His work was very accurate and efficient in compiling all the data needed from us for filing of this 2020 tax year. I would highly recommend him to anyone needing a crypto tax accountant!

Best possible 1st Impression over the phone, Best possible communicator. Very eXcited to be working with Colby.

Very helpful and was able to accommodate my unique circumstances! My go to cpa from now on.