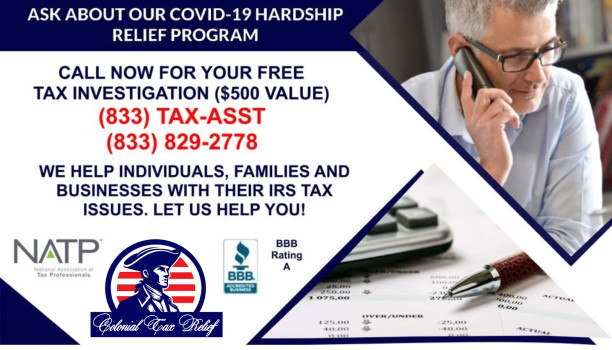

Colonial Tax Relief

Reviews Summary

About This Listing

Who Can Work with a CPA?

*Note: CPAs may specialize in different areas. Be sure to check credentials and service offerings.*

First-Time Clients

If this is your first time working with a CPA, don’t worry — most professionals offer a free consultation and will walk you through what to expect. You may be asked to complete an intake form, share financial documents, or set clear goals for your session.

What to Know Upfront:

*Note: Every CPA operates a bit differently. Don’t hesitate to ask questions before committing.*

What to Bring

*Tip: Organize your documents in advance to save time and ensure accuracy.*

Preparing for Your Appointment

*Note: Preparation helps you make the most of your CPA’s expertise.*

How to Get Started

Other Helpful Info

*Note: Every CPA is different — take time to find one who fits your goals and style.*

Features

Contact Information

Address

25096 Jefferson Ave suite b

Murrieta, California 92562

Phone

+1 833-829-2778Hours

Customer Reviews

Due to excellent judgement on my part on answering the right phone call and the expertise of two extremely intelligent caring men I am now able to sleep at night! Colonial Tax Relief has given me the piece of mind in knowing that my tax nightmare, as so many of us have, is in good hand. These gentleman know what needs to be done to fix all my problems and really get down to business on a very personal caring level. They truly care about you and your individual tax and financial situation as I have spent

I would like to highly recommend Colonial Tax Relief, for their exceptional customer service care that I have received from this five star company. Scott and Michael together have gone beyond what one would expect from a tax service business. Every time I have had the opportunity to speak to either one of these fine gentlemen, I sincerely feel like I am speaking to old friends. Thanks again for the outstanding customer care! Simone Y.

Let me start this post by saying LOOK NO FURTHER, for assistance with tax debts. I must admit I've had my share of incompetent so called tax relief companies. I will admit I had a bit of skepticism going Into this one as well. However Michael, Scott and their whole team definitely restored my faith in believing there are companies that do exactly what they say they are going to do. They definitely get the job done. They settled an amount for me that I thought was impossible. Thank you guys! The highest rec

Dealing with the IRS or any three letter government agency can be a very overwhelming and stressful situation. After consulting with Scott over the phone, I was absolutely convinced that any questions I had would be answered with all due care and respect for any situation I have or will have in the future in dealing with any IRS issues. This company is a diamond in the rough among tax consultation companies. These gentlemen are serious about helping you and will go to bat for you to keep the IRS off your ba

Michael and the team at Colinial Tax Relief are absolutely top notch! Walking in I was expecting the worst of outcomes. By the time my appointment was finished I was in a completely different frame of mind about my taxes. It was a huge burden off of my shoulders. Thank you Colonial for everything you did for me!

I highly recommend Colonial Tax Relief. Mike and Scott have gone ?above and beyond? to be there for me in dealing with the tax situation. They have always been available when I needed them. ( would give 10 STARS if possible!!!) Heart Felt Thanks!!

Scott and Mike made the process of preparing for my taxes smooth and easy. Would recommend everyone to check out Colonial Tax Relief for a peace of mind in these situations.

I absolutely recommend Colonial Tax Relief to anyone, who might have taxes issues with IRS. I asked Michael & Scott a lot of questions and they clearly explained me what to do in my situation. They were so kind, patient, understanding and very helpful! Their price is competitive and affordable. They did a great job and I completely satisfied. Again, I highly advise to call Colonial Tax Relief. Boris Grinblat

Colonial Tax Relief,has helped me with my taxes and they explained the whole steps, and procedures, Always dependable, affordable. I recommend that you give them a call. Less stressful ??

My husband and I highly highly recommend this company!! They've helped so much with our taxes thats been butchered by other places. Mike and Scott are very friendly and knowledgable and guided us throughout the whole tax process. Not to mention they are very affordable and will answer any questions you have, especially with Tax Debt. We will definitely keep using them in the future.

I would recommend them because they make sure they keep you updated about your case , and they also make sure they help you in anyway with your payment. So I fill very happy about my choice with dealing with them because they get the job done and that calms down my stress with dealing with my tax debt.Scott and Mike are the ones on my case.

Thank you for helping my mother with her back taxes. It is a much needed relief off my plate to try and help. Look forward to any future help that is needed with you. Christina G.

I just want to say thank you colonial tax relief. I owed the IRS over 20,000 dollars and colonial tax relief came in and helped me and now I don't owe anything.

I kept putting off the IRS stuff until it just kept adding up. I was always apprehensive of financial-based institutions but knew I needed the services of a tax settlement company to help me handle this, so I begrudgingly contacted colonial tax relief. To my surprise, they weren't the shady, money-hungry types of guys i was expecting. They helped make everything manageable and digestible thank you! If you need tax relief services in orange county, these guys are it!

The los angeles colonial tax relief team was extremely thorough, knowledgeable, and patient. Even though i asked them numerous questions, the person i spoke to remained professional and empathetic all throughout. They helped me cut my tax liability by over 90%.

These guys absolutely brought me back from the abyss on my tax issues! The IRS has been so hard to work with since Covid and almost impossible to get on the phone. It took an act of God in my opinion to get done what Scott and Michael have gotten done for me, and I can never thank them enough. I would highly recommend this company to anyone !????

Scott helped me tremendously they work great and fast definitely get what you need done . I highly recommend

Scott and Mike were very helpful and knowledgeable about the great work they do. I was so relieved to not have to worry about how they got it done, it was just DONE! What a RELIEF! Thanks Scott and Mike??????????

Thank you to the Colonial Tax Relief Los Angeles team for being extremely helpful, and patient and getting this sorted out. I appreciate all the time you spent on the phone with me!

Aside from not having to carry the stress of the IRS? seemingly unending follow-ups, colonial tax relief ultimately gave us the best resolution we could hope for, given our situation.