Courtney CPA, P.C.

Reviews Summary

About This Listing

Who Can Work with a CPA?

*Note: CPAs may specialize in different areas. Be sure to check credentials and service offerings.*

First-Time Clients

If this is your first time working with a CPA, don’t worry — most professionals offer a free consultation and will walk you through what to expect. You may be asked to complete an intake form, share financial documents, or set clear goals for your session.

What to Know Upfront:

*Note: Every CPA operates a bit differently. Don’t hesitate to ask questions before committing.*

What to Bring

*Tip: Organize your documents in advance to save time and ensure accuracy.*

Preparing for Your Appointment

*Note: Preparation helps you make the most of your CPA’s expertise.*

How to Get Started

Other Helpful Info

*Note: Every CPA is different — take time to find one who fits your goals and style.*

Features

Contact Information

Address

66 West St Suite 2

Mansfield, Massachusetts 02048

Phone

+1 508-803-1388Customer Reviews

As a small business owner who has poured my heart and soul into building my company, hitting the five-year mark was both exciting and overwhelming. I knew it was time to find a CPA and business advisor I could fully trust?someone who would be a true collaborator in helping me grow. I found exactly that in Courtney CPA. The level of detail and accuracy in Marietta?s work is unmatched. As a very organized and detail-oriented person, I immediately appreciated her precision. She identified errors that previous

Working with Marietta has been so helpful for my business! As a health care professional running my own practice, finding someone to help me understand the financial and business side of things was imperative. I am someone who had been avoiding the financial part of my business due to my own inexperience and anxiety but talking to Marietta has helped me feel more confident. Would definitely recommend her services!

Marietta is much more than an accountant. I think of her as part of my team and do not feel my company would be where we are now without her. Her ability to not only help with the accounting side of things, but also be a business adviser and walk us through extremely complicated things in a manner that someone like myself can understand is a quality that I did not expect when hiring a CPA. She helped my company move from a small DBA with 3 employees working out of my house, to a corporation with 15 trucks,

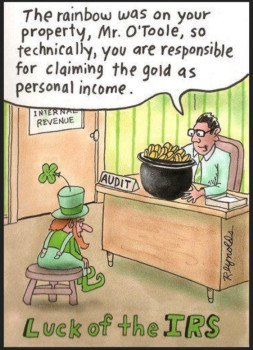

I have been using Marietta since 2012, and since then, she has helped keep my practice in compliance with all federal and state laws. We even had an audit in 2016, which went event free, due to her stellar accounting principles and advice as to how to manage our assetts and accounts. I am sure it pained the IRS when they mailef us the letter saying that our taxes were in order and they were closing our file. Marietta is very personable, knowledgeable and more importantly, responds to emails qu kly!! Highly

So impressed by the comprehensive process Marietta and her team have created to help businesses understand their financial picture and grow effectively. Her knowledge, clarity, and approach gave me the space to be totally open about my financial strengths and challenges, and I'm looking at the year ahead with much more confidence. Thank you!

I've worked with Marietta now for five years and I'm so happy with our decision to engage her. I'm now starting to engage her as I start my own business and feel so much peace of mind with this big life change. I know I am in excellent hands with Marietta!

Marietta and her team have been a tremendous asset to our growing business in more ways than I can explain. No questions go unanswered no matter how stupid. Problems that we did not even know we had solved before they became an issue. From simple payroll to complicated tax problems the Courtney Team has had our back.