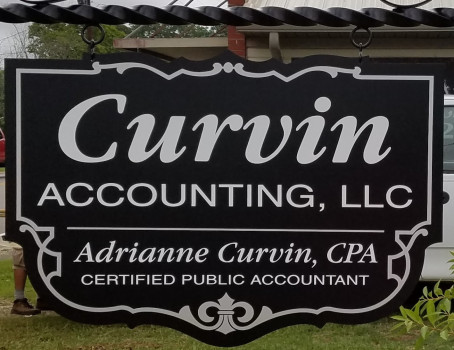

Curvin Accounting, LLC

Reviews Summary

About This Listing

Who Can Work with a CPA?

*Note: CPAs may specialize in different areas. Be sure to check credentials and service offerings.*

First-Time Clients

If this is your first time working with a CPA, don’t worry — most professionals offer a free consultation and will walk you through what to expect. You may be asked to complete an intake form, share financial documents, or set clear goals for your session.

What to Know Upfront:

*Note: Every CPA operates a bit differently. Don’t hesitate to ask questions before committing.*

What to Bring

*Tip: Organize your documents in advance to save time and ensure accuracy.*

Preparing for Your Appointment

*Note: Preparation helps you make the most of your CPA’s expertise.*

How to Get Started

Other Helpful Info

*Note: Every CPA is different — take time to find one who fits your goals and style.*

Features

Contact Information

Address

706 Mountain St NW

Jacksonville, Alabama 36265

Phone

+1 256-782-1188Hours

Customer Reviews

Adrianne and her team are absolutely wonderful!! We have used H&R Block and Turbotax in the past and Adrianne made the process 100x easier! All we had to do was email our tax forms and last years return info and fill out the client form provided on her website and she had our return ready in no time! The only time I even had to go in office was to pay her and sign my return. 5 minutes tops! We will 100% continue to go to her for all our accounting needs.

Adrianne is amazing. We have had her do our taxes the last several years. Last year we didn't have anything to file so I didn't contact her. She contacted me to see if I needed her to file an extension or anything! That's when I decided that she is the only to to ever do my taxes. She knows her stuff and is excellent at it. Always makes me feel like I'm the most important client. She gets them done in a timely manner and she's always quick to respond. She is amazing. Seriously go check her out!

Trust and respect, knowledge and wisdom are the foundation of my relationship with Curvin Accounting. Adrianne and all the team members are very professional and helpful. They respond quickly and with a friendly attitude that makes working with them so enjoyable! I couldn't ask for anything more.

We have been using Curvin Accounting, LLC for over 20 years. We have multiple businesses, as well as, our own personal taxes. No matter how difficult or simple our taxes end of being, we are made to feel like we are their #1 client. To say this business is top-notch would be an understatement. I highly recommend Curvin Accounting, LLC for your yearly taxes, monthly book keeping, and basically all your business needs. ??

I have been using Adrianne for over 10 years. As a dentist, most of my time is spent on patient care, I have very little time in my work day to look at numbers, so Adrianne handles all my payroll and tax needs. She is a blessing!

Mrs Curvin is a knowledgeable accountant and or taxes were done extremely quickly even with the amount of extra forms that had to be completed what with retiring, getting married, selling a house, moving, etc . I wouldn't hesitate to use her accounting service again!

Great to work with! Very knowledgeable! I would definitely recommend!!!