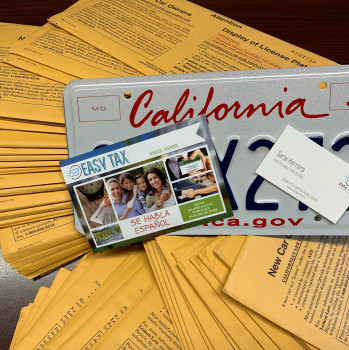

Easy Tax

Reviews Summary

About This Listing

Who Can Work with a CPA?

*Note: CPAs may specialize in different areas. Be sure to check credentials and service offerings.*

First-Time Clients

If this is your first time working with a CPA, don’t worry — most professionals offer a free consultation and will walk you through what to expect. You may be asked to complete an intake form, share financial documents, or set clear goals for your session.

What to Know Upfront:

*Note: Every CPA operates a bit differently. Don’t hesitate to ask questions before committing.*

What to Bring

*Tip: Organize your documents in advance to save time and ensure accuracy.*

Preparing for Your Appointment

*Note: Preparation helps you make the most of your CPA’s expertise.*

How to Get Started

Other Helpful Info

*Note: Every CPA is different — take time to find one who fits your goals and style.*

Features

Contact Information

Address

5305 N Fresno St Suite 102

Fresno, California 93710

Phone

+1 855-201-1367Hours

Customer Reviews

Been going here for years but their system to transfer a title seems to be down quite a bit. Sadly, I had to go elsewhere as I refused to go to the DMV. Other than that great service.

Fast,nice people,Love this place I will never go to the dmv again! Been going there for years.

First off, If I could give more than 5 stars I would. First time going after getting many recommendations on Facebook. We went to transfer a title and the girls were all amazingly. Sarai is the one who processed our transaction. Luz and Sarai were both very polite and attentive. Hands down best customer service I have experienced in a tax/insurance office. Its was better than the DMV, no long wait times and no rude staff. I highly recommend the ladies of Easy Tax. Thank you ladies, keep up the great work.

Very good and professional service. Highly recommend this office. They handle everything quickly without the headache of going to the DMV

I appreciate the service fast easy very helpful very easy to talk to and explain everything I would recommend their service very thankful I appreciate the service ??????

Easy tax is a great place to get your taxes and more done. I highly recommend this place and Sarai for your tax needs!

Super fast in and out. They know more than the dmv itself.

It's been nearly 2 months that Sarai was going to help with a vehicle transfer, her employees took the payment and the original documents, but they said their system was down that it would take 3-5 business days, I went into the office after 2 weeks they told me to not go to just wait for them to call. Now my tags are expired and DMV said I can't do anything unless they give me back my documents. But now all their phone lines are disconnected and nobody is at the office, I'm so disappointed! What can I do..

(Translated by Google) I submitted my paperwork for a change of ownership process for my car four months ago, and they still can't change the name of the car. I called to get my paperwork back, and they told me they couldn't, that I had to wait for the DMV to approve it. They said their system was down and they were no longer responsible for it. My car is stuck because I can't get the license plate, and I can't get my paperwork back. I highly recommend this company. I would give it 0 stars if I could. (Ori

(Translated by Google) I always do my tax services with Mr. Sarai, a very good person and good service. (Original) Siempre hago mis servicio de taxes con se?o sarai muy buena persona y buen servicio.

(Translated by Google) Very friendly with the tax service and car name change (Original) Muy amables con el servicio de taxes y cambio de nombre de los carros

(Translated by Google) Great . Very good Service. (Original) Great . Muy buen Servicio.

(Translated by Google) Very good service (Original) Muy bueno servicio

(Translated by Google) Excellent service (Original) Excelente servicio

(Translated by Google) Excellent service. (Original) Excelente servicio.