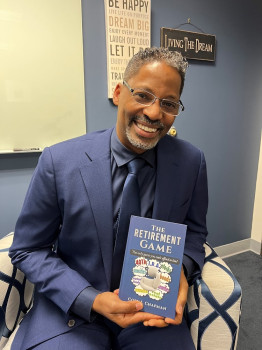

EFC Wealth Management Firm

Reviews Summary

About This Listing

Who Can Work with a CPA?

*Note: CPAs may specialize in different areas. Be sure to check credentials and service offerings.*

First-Time Clients

If this is your first time working with a CPA, don’t worry — most professionals offer a free consultation and will walk you through what to expect. You may be asked to complete an intake form, share financial documents, or set clear goals for your session.

What to Know Upfront:

*Note: Every CPA operates a bit differently. Don’t hesitate to ask questions before committing.*

What to Bring

*Tip: Organize your documents in advance to save time and ensure accuracy.*

Preparing for Your Appointment

*Note: Preparation helps you make the most of your CPA’s expertise.*

How to Get Started

Other Helpful Info

*Note: Every CPA is different — take time to find one who fits your goals and style.*

Contact Information

Address

5777 W Century Blvd #985

Los Angeles, California 90045

Phone

+1 310-645-0001Hours

Customer Reviews

This is a Wonderful very professional Company. Cory and his staff are very warm and welcoming from the day I walked into their office. I was never good at math nor did I have a clear understanding of all the LAYERS involved with investing and managing funds for my future retirement plan. Nonetheless, Cory and his staff made it plain and in an ABC sort of way, which has provided a retirement plan that I understand and I'm grateful. It has giving me a sense of peace to know that I will be able to live the

I highly recommend EFC. They were incredibly helpful in guiding me through planning for retirement. EFC is knowledgeable, patient, communicative, trustworthy, and personalized. They took the time to understand my unique financial situation and created a customized plan that aligned with my goals and risk tolerance.

EFC has helped us grow our money for the last five years. Cory Chapman and his staff are wonderful and truly care about you and your family. I highly recommend EFC Wealth Management.

After researching for a fiduciary advisor with a solid consistent client service experience, I selected EFC Wealth. They helped me realize that I had done a great job at saving BUT I needed a better plan for reducing my future retirement tax burden, asset diversification and options to consider in building a wealth sustainable portfolio for my hopeful long retirement years. They made sure I was comfortable with my investment choices and provided information to be a more informed client. I have been with the

We are new customers of EFC Wealth Management and really looking forward to working with Cory and the team. He is very personable and very transparent. So Happy!!

Cory Chapman and his team are working diligently to ensure that I have a secure retirement, with lots of $$$ for fun adventures. I trust EFC Wealth Management with my future. You should check them out!!

Cory and his team are awesome . I am very pleased and happy to have Cory as my financial advisor . Cory is very knowledgeable and care about his clients . I am happy I chose EFC Wealth.

EFC is awesome. The team is professional. They treat everyone as family, and really get to know you as a person and work with you to have the retirement you desire and deserve.

Attending EFC State of the Union program. This is my first introduction to the firm. Impressive presentations. A wealth (no pun intended) of knowledge shared. I look forward to learning more about EFC. Thank you EFC!

The EFC Wealth Management Firm has an active philosophy of "Helping You Turn Your Dreams Into Reality!" Partners Cory and Delilah Chapman are the Husband and Wife team catalysts at the helm of the EFC family of businesses, that is inspired to make a difference in the lives of their clients. My wife and I are extremely happy with the personal touch in the development of our sound retirement plan. The entire EFC Elite Team are excellent client service team members who are professional, knowledgeable, and alwa

EFC WEALTH Management CORY and his team are INCREDIBLE besides treating my family he educates all their clients they teach you and teach you about the money they tell you how they work behind the scenes he truly care about us and wants the best for everyone who wants to make sure we have the most money coming back to us when we retire I truly am invested and appreciateCory and the team

Cory Chapman's, 2025 State of the Union was very informative. Investing is very important for my financial success.

Very professional and welcoming atmosphere. EFC, Cory came highly recommended by a colleague and thus far are impressed with our portfolio performance.

Ever since Carmen and I decided to have our Chapman at EFC manage our retirement funds and financial planning, it has take a big burden off our shoulders. EFC has guided our investment decisions taking a comprehensive approach to preserve, grow, and secure our retirement funds yet plan for strategic withdrawals to minimize tax burdens. Cory, Delilah, and the EFC are dynamic and engage to help us every step of the way. I highly recommend them and hope that you too will find that peace of mind and secure you

Cory and Delilah and team have all the traits needed to successfully manage my portfolio. They: 1. Have a proven track record of performance and service 2. Get clients who stay with them and who recommend them to their friends 3. Have a deep understanding of the market 4. Have solid ?soft skills? (professional as well as kind) 5. Put my needs first 6. Are curious. They listen to my small details to understand and then put it all together to create my personalized portfolio. I highly recommend Cory

A very comfortable money management process... I was gently guided through EFC?s plan for my fiscal security & freedom. All of my questions (anticipated & asked) were answered to my satisfaction. Corey & the staff @EFC are warm & caring & professional... I'm Verrrry pleased with EFC.

Cory and his team take the time to understand your objective for retirement and provide the best strategy to attain that for you.

Very knowledgeable company who truly looks out for thir clientele. Very diverse investment strategies and great tax info.

If you are getting ready for your retirement, DO NOT start this journey without seeking financial planning from EFC Wealth Management!

I am a client and very happy with EFC! I encourage researching and considering their services!

Impressed beyond words with Cory and his wonderful staff at EFC--they are canny about investments, up to the changing events on the investment scene and caring about their investors. I feel safe and heard in their hands.

Everyone at EFC has been so warm and welcoming! Cory and Delilah are so knowledgeable and personable. I'm so happy I found a firm that I can trust.

Cory you're da best. Sherrie you're da best. Eileen you're the da best

Mr. Chapman and Ms. James are the epitome of ultimate professionals. Intelligent, warm, kind and knowledgeable. I'd give them a ten star rating but the max is a five star.

Cory is down to earth and took the time to really explain my options so I could make informed decisions regarding my financial situation.

I love my wealth management firm, they are professional and are always there to help with questions or concerns regarding finances, such as stocks and bonds, iRAs etc

The team is very professional, friendly and family oriented. Glad to be part of the EFC family.

EFC is full of advantageous benefits

Friendly service and great financial services

This is a great firm! I love working with EFC!

Great company! Great people. Great financial advice!