Erick Robinson, CPA, PLLC

Reviews Summary

About This Listing

Who Can Work with a CPA?

*Note: CPAs may specialize in different areas. Be sure to check credentials and service offerings.*

First-Time Clients

If this is your first time working with a CPA, don’t worry — most professionals offer a free consultation and will walk you through what to expect. You may be asked to complete an intake form, share financial documents, or set clear goals for your session.

What to Know Upfront:

*Note: Every CPA operates a bit differently. Don’t hesitate to ask questions before committing.*

What to Bring

*Tip: Organize your documents in advance to save time and ensure accuracy.*

Preparing for Your Appointment

*Note: Preparation helps you make the most of your CPA’s expertise.*

How to Get Started

Other Helpful Info

*Note: Every CPA is different — take time to find one who fits your goals and style.*

Features

Contact Information

Address

1609 S Chestnut St STE 102

Lufkin, Texas 75901

Phone

+1 936-634-7711Hours

Customer Reviews

I had to switch tax professionals due to some things one of my prior contacts just didn?t have experience in; but Mr. Robinson has been nothing short of a lifesaver! He is professional, helpful, responsive, priced fairly, and knows the in?s and out?s of tax code. He either knows the answer or will get it for you. His office staff is also friendly and helpful. I have used Mr. Erick for 2 years now. I used to stress and ruminate over tax season for weeks; but he?s handled each year smoothly, and has minimiz

Erick was a big help with my tax questions. I had some questions on how to file and what I needed to file! He was able to answer all my questions with out hesitation and with out charge for a simple over the phone consultation. He was very kind and knowledgeable! He definitely is there to help you and to do what he can to save you on ur taxes !

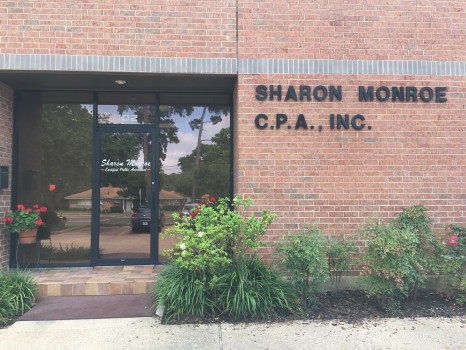

We have been with Sharon many years and she has always done a great job for our businesses. She always takes the time to explain and try to save me as much as possible when computing our taxes, as well as filing other documents in a timely manner (or reminding me to get them to her to complete)! I have been very pleased with the service she has provided all these years and would highly recommend her to anyone.

My husband and I have used Sharon Monroe's services for many years. She is so knowledgeable and her professionalism speaks for itself. Sharon has a kind and gentle spirit, a very gracious person and I will always use her services. She is like family and has a staff that is there to serve as well. Thanks for your service and thanks for the yearly pamphlet you send out every year that helps me make sure I have all pertinent information needed to file my taxes.

Sharon, has done our taxes for 22 years. We have great confidence in her ability to do an outstanding job. It's been a pleasure to work with her over the years, We highly recommend Sharon as a knowledgeable,competent, and respected CPA.

Have depended on Sharon for several years for help withour taxes. She is extremely knowledgeable in all areas of the tax form. Is also quite speedy in getting them processed. Has been a very, very large help and we consider her a friend. You could not ask for better in the whole area.

I am a first time client of Ms. Monroe's. She is very knowledgeable and answered all my questions. My tax return was completed on a timely basis. She is very friendly and treats you like a family member. I highly recommend her firm for all your tax needs. Her little dog is precious and friendly also.

This was the first time my husband and I have used Sharon Monroe. We were very pleased with her. She is a very pleasant and personable woman. I enjoy meeting SCOOTER as well. Please consider her if you need a CPA and say hello to SCOOTER for me.

Sharon has been doing my taxes for 4 years. I always feel like a valued customer. She goes into great detail on any concerns I may have.

We have used Sharon for several years. She is thorough and prompt in getting our taxes completed. I would recommend her for your tax needs!

Super cool guy easy to deal with highly recommend!

have been a very satisfied client of Sharon's since 2013. She is the first honest honorable CPA with whom i've ever dealt. She is true to her word.... unlike every other rotten thieving CPA by whom i've been victimized. If CPAs and attorneys "practiced" medicine, we'd be overcharged and dying Eric Robinson is s?per excelente? i am well pleased with Eric Robinson?. he took the reins from Sharon and is carrying on with honesty & integrity? very fine fellow? very trustworthy? a rarity among CPAs

Sharon makes tax season easy for me. She is always prompt in finishing my taxes. I know I'm going to be taken care of with her helpful staff.

Sharon has always done a great job and done it quickly. We've been using her for around a decade now.

We have been more than pleased with their tax services over the past 10 years, for multiple states, and Federal, in any given year, and on our Foreign earned income when working out of country.

Always great professional service. Sharon takes time with her clients to understand their needs. I highly recommend her services.

She is always well versed on the latest tax laws and always willing to help anyway she can. She is easy to work with and very friendly.

Best in town with lots of knowledge and he didn?t charge me anything

We have used her services for several years & are pleased with the professionalism of the entire staff.

We are pleased with her service and have used her for years. Fast friendly service.

Fast, friendly service. Treated as a valued customer.

Easy and fun to talk with. gets the job done.

Caring and professional.