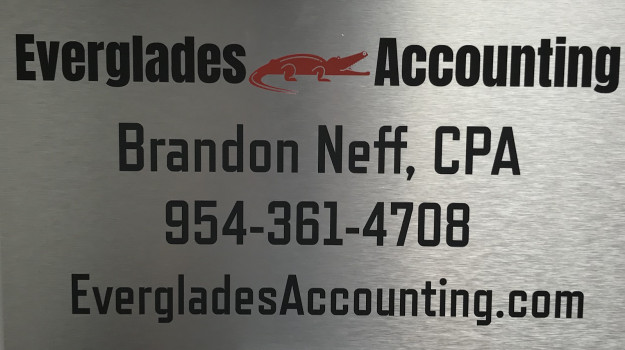

Everglades Accounting: Brandon Neff, CPA

Reviews Summary

About This Listing

Who Can Work with a CPA?

*Note: CPAs may specialize in different areas. Be sure to check credentials and service offerings.*

First-Time Clients

If this is your first time working with a CPA, don’t worry — most professionals offer a free consultation and will walk you through what to expect. You may be asked to complete an intake form, share financial documents, or set clear goals for your session.

What to Know Upfront:

*Note: Every CPA operates a bit differently. Don’t hesitate to ask questions before committing.*

What to Bring

*Tip: Organize your documents in advance to save time and ensure accuracy.*

Preparing for Your Appointment

*Note: Preparation helps you make the most of your CPA’s expertise.*

How to Get Started

Other Helpful Info

*Note: Every CPA is different — take time to find one who fits your goals and style.*

Features

Contact Information

Address

4480 NW 18th Ave

Fort Lauderdale, Florida 33309

Phone

+1 954-361-4708Hours

Customer Reviews

Brandon is a true professional?meticulous, reliable, and incredibly easy to work with. He takes the stress out of tax season and ensures everything is handled flawlessly every time.

I actually have zero stress around tax season as a small business owner thanks to Everglades accounting. Brandon provides information in a way that?s easy to understand and creates a seamless interaction. His outstanding customer service and years of experience takes the anxiety out of filing. Look forward to working with him year after year to take care of all of our accounting needs.

I recently had the pleasure of working with Everglades accounting for my U.S. tax filings and cannot recommend them highly enough. Their depth of knowledge and attention to detail made the entire process smooth and stress-free. Everglades accounting was not only professional and efficient but also took the time to explain complex tax concepts in an understandable way, ensuring I was fully informed about my tax situation. Their dedication to securing the best possible outcome for me was evident throughout ou

Brandon has been handling my taxes for the past 3 years. He is extremely knowledgeable and efficient. Whenever I have a question he is available by cell or email and answers back consistently and immediately. He now handles the taxes for my fiance, and our small business as well. HIGHLY recommend reaching out to him. It will be worth your time.

Brandon from Everglades Accounting did an exceptional job helping me with my taxes! He is professional, patient, and knowledgeable; he really dedicates the time to make sure that everything is in your best interest. Highly recommend!

Brandon is great! Proffesional, timely and knowledgeable. I am happy to have found Everglades Accounting and Brandon.

Brandon is so knowledgeable and takes time to come to our home to explain and educate us. We have and will continue to recommend him.

Detail-oriented work. Prompt communication. Meticulous involvement. Individualized planning. Everything you want in an accounting firm.

Extremely professional. Work was done in a timely manner. Mr. Neff explained everything to me before taxes were filed.

Fast, efficient, knowledgeable and accurate. I?ve been using them for several years now and have never dealt with anything but great service. Highly recommended.

Professional and efficient!