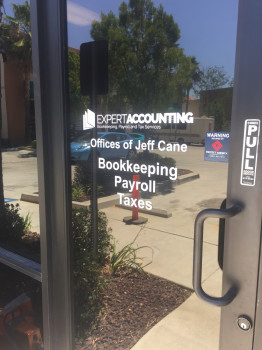

Expert Accounting Services

Reviews Summary

About This Listing

Who Can Work with a CPA?

*Note: CPAs may specialize in different areas. Be sure to check credentials and service offerings.*

First-Time Clients

If this is your first time working with a CPA, don’t worry — most professionals offer a free consultation and will walk you through what to expect. You may be asked to complete an intake form, share financial documents, or set clear goals for your session.

What to Know Upfront:

*Note: Every CPA operates a bit differently. Don’t hesitate to ask questions before committing.*

What to Bring

*Tip: Organize your documents in advance to save time and ensure accuracy.*

Preparing for Your Appointment

*Note: Preparation helps you make the most of your CPA’s expertise.*

How to Get Started

Other Helpful Info

*Note: Every CPA is different — take time to find one who fits your goals and style.*

Features

Contact Information

Address

41775 Elm St #201

Murrieta, California 92562

Phone

+1 951-926-6200Hours

Customer Reviews

Jeff and his accounting services are nothing short of exceptional. From the start, he took the time to understand my business and offered personalized solutions that made managing my finances so much easier. His expertise in tax strategies, budgeting, and financial planning has significantly improved the financial health of my business. What truly sets Jeff apart is his dedication to client success. He is always available to answer questions and simplifies complex financial concepts in a way that's easy to

These guys are awesome. Jeff and his team will go above and beyond in assuring you keep every dollar possible. They also do our business bookkeeping and are very affordable for the high level of service they provide. Highly recommend for bookkeeping and tax returns. Thanks Jeff for the continued support with our business.

Mr. Jeff Cane is the go-to guy. Incredibly helpful, knowledgeable and resourceful beyond accounting. Including forming your business entity/Business licensing. He really can get things done quickly, save time and headaches. I am very good at following through and executing things fairly quickly but I must say that he is better than me and that is very hard to admit. Money well spent, HIGHLY recommended. Thank you Expert Accounting and the staff for your excellent service. I'm very happy that I found y

Jeff has been our tax adviser for a few years and we have been so impressed with his knowledge, creativity and caring attitude that we have no intentions of ever leaving his firm. He's the absolute best, period!

Jeff has been amazing to work with! He has helped out business to get organized as well as our personal taxes. The staff is very professional and prompt.

I've been with this company for a while now and Jeff Cane has helped me out tremendously building my plumbing business. He is very knowledgeable in all aspects and has taught me how to run a business the right way. If your looking for an accountant he's the man!