F-IRS! Tax Technicians

Reviews Summary

About This Listing

Who Can Work with a CPA?

*Note: CPAs may specialize in different areas. Be sure to check credentials and service offerings.*

First-Time Clients

If this is your first time working with a CPA, don’t worry — most professionals offer a free consultation and will walk you through what to expect. You may be asked to complete an intake form, share financial documents, or set clear goals for your session.

What to Know Upfront:

*Note: Every CPA operates a bit differently. Don’t hesitate to ask questions before committing.*

What to Bring

*Tip: Organize your documents in advance to save time and ensure accuracy.*

Preparing for Your Appointment

*Note: Preparation helps you make the most of your CPA’s expertise.*

How to Get Started

Other Helpful Info

*Note: Every CPA is different — take time to find one who fits your goals and style.*

Features

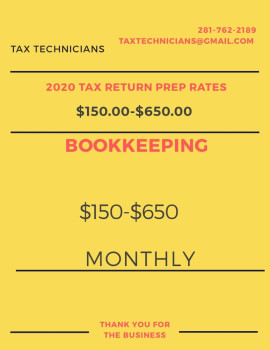

Contact Information

Address

930 S Central Ave

Compton, California 90220

Phone

+1 855-855-8455Hours

Customer Reviews

I am pleased to give a 5-Star review to Ms. Ronnie as another tax professional. I referred an IRS case to her, and within a couple of months (literally 2?and mostly because of the client lol) the $86k bill was gone! She is very professional and communicative and will continue to refer my resolution cases to her. She is very knowledgeable in this area of practice and coaches you along the way!

Ronnie is excellent. She helped me appeal a tax penalty with the California Franchise Tax Board. She is professional, competent, and courteous. I highly recommend her. Thank you, Ronnie

LaRoyna (Ronnie) helped us with a critical issue we were facing in our business and the IRS. She was the utmost professional on both sides and was able to quickly remedy our situation with positive results. Also, Ronnie truly cared. She was focused on our results and not how she maximized her billable hours. We appreciated that and without a doubt will look to Ronnie as our expert going forward.

I would like to give a shout out to La Ronya aka Ronnie Hines at Tax Technician. Ronnie and her team has been a huge success to our Personal and Business Taxes. Thank you Ronnie for your Compassion, Integrity and Knowledge of the Internal Revenue Service and the Franchise Tax Board law and bylaws to help your clients.

I was fortunate enough to be referred to Ronnie Hines and her firm F-IRS! Tax Technicians. She was specifically hand-picked to handle my tax situation. Right off the bat it was a positive and stress-free experience speaking to her. Her professionalism, expertise, and dedication to me is a testament to making her a standout choice for anyone dealing with tax-related issues both at the CA state level and Federal level. Ronnie, as a former IRS auditor, Appeals Officer/CA state FTB tax officer carries a combine

Ronnie Hines and her team are AMAZING! Always quick to respond to any questions and or concerns. Ronnie is so helpful and knows the questions to ask to determine how to best help serve her clients. I can not recommend her enough.

Thank you Ronnie! Extremely knowledgeable about my situation. Very helpful and explained what was happening (no one else was able to do so previously). Appreciate being pointed in the right direction and calmed my stress levels massively. Thanks.

From start to finish Tax Technicians has been professional and efficient. We have really enjoyed and are looking forward to our business relationship continuing.

Latonya Hines was able to help me in a timely manner with my tax needs. Very helpful. Communication was great. Definitely coming back for more help!

Excellent service, and an excellent tax consultant. I am so happy with Ronnie?s constant attention to details.

Tax Technician do and excellent Good on my tax every year! Thank you for your services!

Highly qualified professional service. Ms Hines helped me close on my first home.

The best service!! Quick and easy, and very fast return!