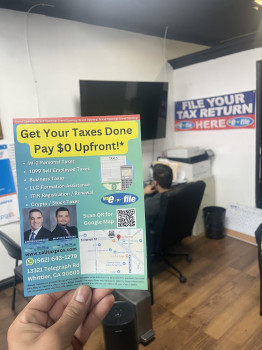

Gonzalez Tax Services

Reviews Summary

About This Listing

Who Can Work with a CPA?

*Note: CPAs may specialize in different areas. Be sure to check credentials and service offerings.*

First-Time Clients

If this is your first time working with a CPA, don’t worry — most professionals offer a free consultation and will walk you through what to expect. You may be asked to complete an intake form, share financial documents, or set clear goals for your session.

What to Know Upfront:

*Note: Every CPA operates a bit differently. Don’t hesitate to ask questions before committing.*

What to Bring

*Tip: Organize your documents in advance to save time and ensure accuracy.*

Preparing for Your Appointment

*Note: Preparation helps you make the most of your CPA’s expertise.*

How to Get Started

Other Helpful Info

*Note: Every CPA is different — take time to find one who fits your goals and style.*

Contact Information

Address

1151 N Euclid St

Anaheim, California 92801

Phone

+1 562-536-9551Hours

Customer Reviews

My first time doing taxes with Andres will definitely be going back for next year! He explained everything to me made sure I understood everything very fast and easy experience. Very trustworthy for anyone looking!

Been filing my taxes here for the second year now. Andres is very knowledgeable and helps you get the maximum refund possible. You especially want to see him if you have a business or side business or trying to claim your work expenses, he guides you through the process and deduct every penny! Best tax filing experience I've ever had. Will go back next year for sure

Andrew is a highly professional and helpful individual. I visited him with numerous questions regarding my taxes, and he patiently explained everything to me and answered all of my questions. This is the second year I have used his services, and I am incredibly grateful for his assistance.

After looking around for a new tax person I'm glad I found andres and I'm definitely going back to him next year! he filed my information in a efficient manner and he was very friendly. I enjoyed how the whole process was simple and very laidback and I also appreciate how he made sure I understood everything too! Definitely recommend him if you're looking for a new tax person also he's bilingual so that's a plus for our Latino peeps :)

Highly recommend, have been getting my taxes done with Andr?s for the past 4 years! Never fails in getting everything done for me in time and leaves me stress free for tax season.

Went in to get my taxes done was recommended by a good friend and let me say it was a pleasant and easy process Andres and Geo are very professional and get you what you deserve so if your looking to get your taxes done right make sure to stop by.

Excellent service, very detailed explanations and answered all of my questions

Super knowledgeable! Answered all my questions with a smile and made the process super quick and easy! Excellent customer service and even follows up !

Great experience every year! Highly recommended??

(Translated by Google) Very good attention, explanation, patience, kindness and professionalism. Thank you Andres for your assistance. (Original) Muy buena atencion, explicacion, paciencia, amabilidad y profesionalismo. Gracias Andres por tu asistencia.