Ideal Tax

Reviews Summary

About This Listing

Who Can Work with a CPA?

*Note: CPAs may specialize in different areas. Be sure to check credentials and service offerings.*

First-Time Clients

If this is your first time working with a CPA, don’t worry — most professionals offer a free consultation and will walk you through what to expect. You may be asked to complete an intake form, share financial documents, or set clear goals for your session.

What to Know Upfront:

*Note: Every CPA operates a bit differently. Don’t hesitate to ask questions before committing.*

What to Bring

*Tip: Organize your documents in advance to save time and ensure accuracy.*

Preparing for Your Appointment

*Note: Preparation helps you make the most of your CPA’s expertise.*

How to Get Started

Other Helpful Info

*Note: Every CPA is different — take time to find one who fits your goals and style.*

Features

Contact Information

Address

240 Progress Suite 250

Irvine, California 92618

Phone

+1 714-751-5200Hours

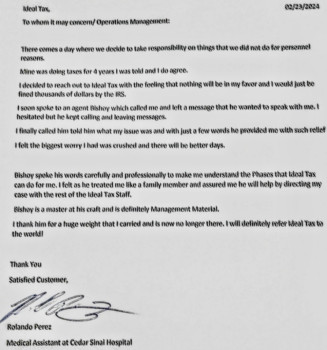

Customer Reviews

Many thanks to the Ideal Tax team! I had a lot of questions and worries because I own a small business, but they were really kind and helpful. They made sure I was getting the greatest possible result and assisted me in navigating the complicated world of taxes. I'm relieved and feel confident knowing that my taxes are in capable hands.

Decided to give them a try. The woman that helped me named Jacky did a great job walking me through it all. The irs was going to garnish my pay. But she and the company were able to stop that. Made things a lot less stressful for me. Ended up with their payment plan option to move forward without breaking my bank. Glad I gave em a shot.

My main contact Demetrius has been great he's very helpful. Has a very pleasant attitude and accommodating. I want to thank him for putting me at ease when it comes to taxes. It causes me anxiety and he has ease my burden today so I just want to thank him. He has been an excellent excellent contact

I want to give thanks and a great shot out to the people that got me out of a nightmare with The IRS tax work that was completed for me. The case Manager (Grace Miller) that handle my case was the greatest with professionalism and understanding which makes me so happy and excited about my future business in the Tax world. Thank you, Mrs. Grace Miller, for all your help and thank you Ideal Tax for handling your Business.

I had a great experience working with Ideal Tax. I spoke with Val, who was knowledgeable, professional, and took the time to clearly explain everything. Val made the process much smoother and helped me feel confident in the decisions I needed to make. Highly recommend!

I want to write a review of my outstanding service and stellar care that I have received from Ideal Tax Service. I was initially very distraught over my overwhelming situation, and this professional group has offered me assistance in every way,, especially peace of mind!! I highly recommend their services to take care of any of your tax needs!! I appreciate being introduced to them and following through with their meticulous care. Sharon June Wrinkle

Taxes are confusing, and I don't like dealing with the paperwork. I owed the IRS and used Ideal Tax to help me handle it. The process takes a while, but it's worth it. My tax associate was Robert, and he was patient enough to explain the programs and payment options twice. I got helpful advice that saved me a few thousand, and now I actually understand taxes enough to not freak out next year.

Fri 6/27 just got off the phone with my go to guy John at Idealtax ( for the record I'm terrible at writing) but I've had several phone visits with John and with each call John has been a first class guy.He's first of all nice and is interested in the person he's working with and his knowledge is unbelievable, the presentation is unbelievable and the way he presents it to you you don't feel stupid and that's a gift which I appreciate and I felt pretty dam good after he explained all the details he does not

Despite feeling nervous during the IRS audit, the team I worked with was incredibly composed and professional. They assisted me in preparing all the required paperwork and guided me through the full audit procedure. Their patience and knowledge were priceless.

When I first called Ideal Tax, I got the help I needed. There services is excellent and them helping me out with my taxes issues. I was able to start over again and focus with my daily life. I want thank you for your help. It forever changed my life!

I have been extremely pleased that I chose to go with Ideal Tax. Grace Miller has been working with my account and assisting me through the many details with the IRS that I could have never completed on my own. Thank you so much Grace for your knowledge and expertise with taxes and the IRS. Thank you, Ideal Tax!!

I had a pretty complex tax situation after switching jobs moving across states and doing some freelance work. I figured I'd owe a lot but Ideal Tax caught details I never would have noticed and helped me get organized without the stress. What really impressed me was how human the whole process felt I wasn't just a number to them!

I'd like to share my positive experience working with you on my taxes . Your: expertise and knowledge were impressive . Communication Style was clear and concise . Attention to detail ensured accuracy , friendly demeanor made me feel at ease . Thank you for yoir outstanding service , I'm grateful for your help! And your professionalism and kindness!! Thank you so much Mr. Dmetrius ??

I was anxious about an IRS audit, but the staff helped me get ready and guided me through the entire process. They were composed, competent, and well-versed in their field. Having them on my side made me feel much more assured.

It can be frightening to deal with the IRS, but Ideal Tax made it easy. They helped me work up a reasonable and equitable payment schedule. They have outstanding system knowledge and were able to get in touch with the IRS on my behalf. I'm appreciative of their assistance in simplifying a difficult task.

Started my process with this company today with Val. He made me feel such a relief with anxiety of the situation I'm in and gave me hope that I'll be ok. I have no doubt he'll follow through. Would highly recommend if you don't know what to do or where to start with your IRS debt issues.

I was in a panic because I was being audited for taxes. However, these professionals eased my anxiety and guided me through the entire procedure. They kept me informed at every stage and gave me comprehensible explanations of everything. They have excellent communication abilities, and I value their openness and sincerity.

DO NOT TRUST IDEALTAX. I worked with IdealTax to get caught up on my returns and address several years of debt. They promised me, and guaranteed me over the phone that I would save money by using them. I was hopeful. The service they provided was slightly better than pathetic. They gathered basic information and then waited a month to call me to request key information they obviously needed from the start. From then on, the pattern continued- I would send information, hear nothing, the case manager would ch

I was faced with a huge tax burden and was unsure of how to manage it. I then contacted them to ask for assistance with IRS payment options. They were courteous and assisted me in creating a reasonable payment plan. I'm so happy I found them, and the entire procedure was easy.

While the program wasn't for me at this time, the customer service was fantastic, both by my representative Jacky, and the rest of the team I worked with. All communication was resolved in a timely manner and any issues were always completely resolved. Thank you

This year, I was a little anxious about my taxes, but Ideal Tax's helpful staff made me feel better. They made the process very easy, were patient, and responded to all of my inquiries. They seemed to sincerely care about my financial security. I even got a bigger refund than I expected, and my return was done correctly.

Dealing with ideal tax has been the most emotional stressful time in my life. The first few weeks were seemless spoke with Kathrine and she was very helpful in explaining everything ,calling back, and very helpful through this emotional time. As soon as we started to make payments everything went downhill . Kathrine no longer was able to speak with us , Sara Clark NEVER answers the phone . For weeks and days you'll have to call to get her on the phone. Always an excuse . As soon as my tax papers were filed

Grace from Ideal Tax has provided great service and prompt response, taxes still being processed for resolution options, I'm hopeful all will be resolved in an affordable manner. Will update once everything is finalized.

I was rather nervous when I received a tax audit notice, but the people I dealt with made sure I understood every step. When it came time to deal with the IRS, they were informed and made me feel prepared. I'm really appreciative of their guidance and assistance.

Just got off the phone with Val and Cathy, and they were great to work with. Val was very knowledgable, informative and helpful. By the end of the phone call I felt confident that my case was going to be resolved correctly.

After months of putting it off, I made the decision to start paying my taxes and get some expert assistance. I'm very happy I did! The group I collaborated with was amiable, and informed, and made the entire process far less unpleasant than I had anticipated. They even guided me through a few complex tax benefits that I otherwise would not have been aware of. Everything went smoothly, and I'm thankful to have discovered a group of people who genuinely care about their customers. The quality of client servic

It's been a nightmare for me to deal with back taxes for years. However, this team has changed the game. They genuinely care about their clients, are very professional, and are a pleasure to work with. I am so grateful to them for helping me get my money back on track.

I had a lot on my plate the day I reached out, and honestly, I wasn't in the best mood. But the calm professionalism on the other end really softened me, it's rare to feel like someone genuinely wants to help without trying to upsell you or rush the call

It can be frightening to deal with past taxes, but I got great help here. They listened to my worries with patience and came up with a plan to fix my tax problems. The process was doable because of their individualized approach and meticulous attention to detail. I appreciate their commitment.

I was concerned about how I would settle my past taxes after the IRS sent me a notice about them. I was advised by a friend to consult a tax analyst with expertise in tax resolution. In addition to helping me navigate the process of modifying my tax returns to make sure I was utilizing all the deductions I was qualified for, they collaborated with me to create a customized plan to pay off my tax debt.

my name is joe hall, and i called val vallery at idealtax.com,and val answered everything that i needed too know and val vallery was understanding proffesional and easy too talk too val explained how the process works.i highly recommend idealtax.com ,let them talk too the IRS.thank you MR.Val

It wasn't until I contacted you that I realized I had some old tax problems, and I'm really happy I did! From explaining my alternatives to establishing a reasonable payment schedule, the crew guided me through every step of the process. I feel like I have a lot more financial control today.

You can tell the people here are used to dealing with folks who are nervous or overwhelmed. They were super patient, never talked down to me, and just helped me feel a little more in control

Recently, I had to deal with a tax audit, which made me really anxious. To ensure that I felt prepared, the experts here went above and beyond. They took the time to go over every step of the audit process, and their assistance gave me a lot more confidence.

My tax situation was causing me anxiety, but after speaking with the professionals, everything began to make sense. They guided me through the entire procedure and assisted me in locating a cost-effective solution. My burden was greatly reduced by their lucid explanations!

Good quality work. Check your emails everything will be sent through that most of the time. Grace M. was my case manager

A big thank you to Ideal Tax for helping me resolve any past due and back pay with the IRS. They helped me get back on track.

During my tax issues, Ideal Tax was a blessing. They made an effort to comprehend my situation and offered concise, useful guidance. They made a difficult procedure feel lot more achievable, and their staff is incredibly professional and helpful.

Dealing with anything IRS related used to give me so much anxiety, but this time felt completely different. They actually took the time to explain what was going on, step by step, without talking over my head or brushing things off

One of the most trying times of my life was dealing with a tax audit, but Ideal Tax supported me the entire time. Their well-informed personnel fully prepped me and helped me understand the procedure. Their advice gave me the confidence I needed to approach my meetings with the IRS!

Although paying my tax obligation felt like a mountain to conquer, I'm really happy that I asked for assistance. The experts I dealt with took the time to thoroughly explain each step and were quite knowledgable. They even assisted me in creating a budget-friendly payment schedule. Without them, I couldn't have succeeded!

I've been through my fair share of customer service calls, and I don't usually leave comments. But this young man was patient, clear, and never once made me feel rushed. That kind of courtesy doesn't go unnoticed.

Ideal tax really helped and even when things looked down they can through for me and got me on an affordable plan. Jerald was a huge help and such a pleasure to work with. Jerald got me taken care of he got my tax situation handled.

I was unsure of what to do after being notified that my taxes were overdue. The employees were really kind and courteous, and they assisted me in creating a payment plan that suited my needs. I felt like I had a lot more financial control when I left.

Val with Ideal Tax was extremely patient and thorough. He followed up to ensure my case was handled in the best possible way. Even after a case manager was assigned he made himself available if I ran into any problems. Courteous, professional, knowledgeable, customer focused. 10/10

Although handling a tax lien was a headache, the professionals I dealt with were invaluable. They guided me through the procedure and even helped me have a tax lien removed. I'm really appreciative of their support and advice.

Grace miller is the most nicest person ever she is very patient with me and explained everything so easily for me and she has a great costumer service and manners.

It's rare to feel heard when dealing with any company, but that's exactly what I felt here. No pressure, no jargon just people doing their jobs really well

I was absolutely blown away by Miss Katherine at Idea taxes. She helped me and lead me in the right direction towards resolving my problems with the IRS.

The IRS did hit me with a huge of amount of tax debt by mistake thru penalties and interest and I spoke with them and they were going to make me pay it all, then when I contacted Ideal Tax and they helped me out thru the process and now my tax situation is better and the IRS are off me

Best service ever?. Customer service truly amazing help me with all my issue ,Jacky was patient and very professional. Would definitely recommend this company to all my associates.

I had a complicated tax problem, with back taxes piling up for years. This team took over and helped me every step of the way, making sure I understood everything. They assisted in arranging a payment schedule that I could genuinely afford. To be honest, I feel as though a burden has been removed!

The gentleman I spoke with spent almost 2 hours with me on the phone explaining to me the possible solutions for my tax issue, also that I am not much of a Tech savvy he walked me thru the whole process and didn't make me feel uncomfortable, instead he gave me the enough time to understand my tax situation, and now my tax issues are being solved one at a time.

I don't think that any company that uses spam as a marketing tool is a company that any reasonable person would want to to business with. I have previously blocked email from this company but they keep changing their email address so I continue to get email from them. You would have to be an idiot to trust these spammers.

Ideal Tax actually made it way smoother than I expected. They were easy to talk to, explained things in a way that made sense, and kept me updated without me having to chase them down

I was able to handle a challenging tax problem with the support of Ideal Tax. Their staff was exceedingly kind and knowledgable, explaining complicated subjects in plain, easy-to-understand terms. They helped me avoid penalties and greatly reduced the stress of the entire process.

Company has an excellent customer service team, very helpful. I'm very satisfied with their performance and service

I had a challenging tax issue, but a skilled team guided me through it and helped me solve it. They made sure I understood my options and gave me a thorough explanation of everything.

Great communicator. Positive vibes and helped me with my questions a great deal.

My tax debt was causing me a lot of anxiety, but they helped me manage it much better. They helped me come up with a plan that I could actually manage and went over all of my options. The entire situation was much less daunting because of their assistance.

Gerald is the individual who helped me out with my tax situation. Just to name a few qualities; he is professional, knowledgeable, extremely patient, he listens well and gave me the time needed to express the key factors that are important to me. He is very dedicated to helping his clients and he is a genuine person and a delight to talk to. He tries to steer you in the right direction without being pushy. Thank you, Gerald.

Dealing with the IRS is not for the faint of heart, and I'd put it off way too long I was expecting judgment or cold answers but instead I got this team that made me feel like things were fixable

I didn't know what to do when I got a notification concerning my overdue taxes. The employees I interacted with were incredibly kind and understanding. They assisted me in weighing my options and establishing a convenient payment schedule. I felt so much lighter when I left!

They supported me at every stage, making sure I understood what was going on and what needed to be done. Throughout the procedure, I received a great deal of support.

Val is an awesome guy he went over and above where most people wouldn't have and I appreciate him so much but he is helped me take care of my issues and I can't tell him enough how much I appreciate him.

I was Very Blessed to get Val Vallery as my Ideal Tax representative! He is working extremely hard to assist me with my tax issues. He is a kind gentleman and has explained everything to me in terms that assures my understanding of how IRS works and the options that I have to resolve the situation. Thank you Val for all you are doing to assist me with this situation!

I wasn't sure what to expect with Ideal Tax but they made the whole process so easy and straightforward. They took the time to explain everything in plain language and answered all my questions without rushing

Excellent experience with Ideal Tax. They were professional, simple to work with, and kept me informed throughout the entire process. Definitely a good choice for tax help.

I really want to express my appreciation for Katherine today. Her knowledge and helpfulness was extremely informative and easy for me to understand the process I will have to go through to resolve my tax issues. I also want to thank Lisa for explaining to me information regarding my situation. Your company has at least two very competent women on your team and I do so hope that they are recognized for their work. I do wish to have Katherine represent me in all future transactions I have with Ideal Tax Si

Whoever?s doing training over there is doing it right everyone I spoke with was clear, calm, and seemed to genuinely care, It made a stressful week a little easier

This place was terrible about contacting me to keep me up-to-date about what was going on and they were not able to work out an ? offer and compromise.? Don't waste your money, I paid them $1,000 to do nothing! ****5/16/25***I retained your legal services, and you are discussing the specifics of my case in an open public forum, you have violated attorney-client privilege. You will be hearing from the NC Attorney General?s Office and the attorney I will be retaining in NC. This is proof of your incompetence

The minute I called Ideal Tax and spoke with Kathy, I knew I called the right person and company. I felt listened to, I was given the best information about my situation, and that she cared about me, as a person, which made me feel better about my situation. She took care of everything in the right way and in a committed manner that I knew I was going to be ok. The IRS can be scary, but from the minute I spoke with Kathy at Ideal Tax, I wasn't scared any more, in fact she made me feel better. I had all sm

It wasn't anything fancy, but it was solid help I had some IRS stuff I wasn't sure how to handle, and they made it less intimidating. That alone was worth it for me

Happy that I chose Ideal Tax! The team was friendly, patient, and kept things simple. They genuinely care about their clients.

I usually hate dealing with financial stuff but this was the first time I actually felt like I understood what was going on They broke it all down step by step and never rushed me or made me feel dumb for asking simple questions

Val was absolutely amazing. He made the process easy and explained everything in a professional manner. Tanks for your help ideal tax.

First time handling something like this on my own. I was kind of anxious about sounding dumb, but the rep talked to me like a normal person and even explained stuff twice without being weird about

Their company made things a lot easier. They took care of everything from start to finish, and they even helped me get a reimbursement for which I didn't know I was eligible. Many thanks!

Wow, Ideal Tax made the tax year so much easier! The staff was incredibly nice and knowledgeable. They helped me with everything swiftly, and I left with confidence.

It wasn't just about giving me answers it was the way they spoke to me, with empathy and clarity that stayed with me more than anything else

Even when I had last-minute questions, Ideal Tax answered quickly and thoroughly. They're incredibly reliable when it matters most

I was sooo worried about my tax situation with the IRS and I gave Ideal Tax a call after I was disappointed from the service of previous tax firms, but Ideal Tax helped, they're well spoken, very educated and very helpful.

I don't usually write reviews, but I figured this might help someone like me who's just trying to not mess things up with taxes. They were patient, which mattered a lot.

My experience was good I'm glad I chose to resolve my issue

Val was thorough, engaging, and informative during our initial conversation. I felt at ease.

Very friendly. This was a difficult call to make but Val made me feel safe.

Ideal Tax helped me a lot thru the process of resolving my tax issue and set me a payment plan to pay it back instead of having them garnishing %15 of my paycheck.

I didn't know what to expect going in, but the people here were seriously helpful without being pushy or scripted just normal and kind.