J.S CPA PLLC

Reviews Summary

About This Listing

Who Can Work with a CPA?

*Note: CPAs may specialize in different areas. Be sure to check credentials and service offerings.*

First-Time Clients

If this is your first time working with a CPA, don’t worry — most professionals offer a free consultation and will walk you through what to expect. You may be asked to complete an intake form, share financial documents, or set clear goals for your session.

What to Know Upfront:

*Note: Every CPA operates a bit differently. Don’t hesitate to ask questions before committing.*

What to Bring

*Tip: Organize your documents in advance to save time and ensure accuracy.*

Preparing for Your Appointment

*Note: Preparation helps you make the most of your CPA’s expertise.*

How to Get Started

Other Helpful Info

*Note: Every CPA is different — take time to find one who fits your goals and style.*

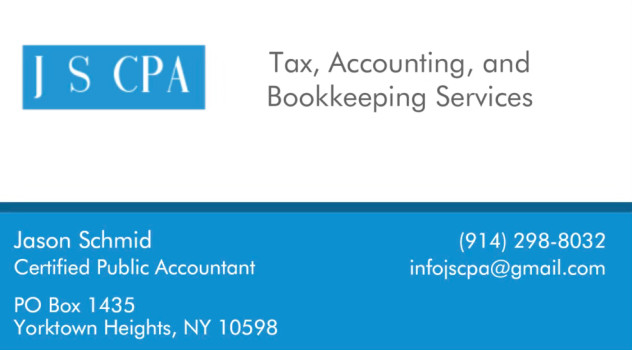

Contact Information

Address

Box 1435

Yorktown Heights, NY 10598

Phone

+1 914-298-8032Customer Reviews

Great experience working with a CPA for the first time! Jason was always available and responsive (always less than 24 hours for an email reply). Everything from start to finish was done via email and he was able to accommodate my non-traditional work schedule. He answered all of the questions we had and gave us some comfort during this stressful tax season.

Jason has been preparing my taxes for the past 7 years and has made the process seamless. He is quick to respond, jumps on a call if needed and is kind in answering the same three questions I ask him every about my taxes. For those in need of a great financial advisor Jason is your go to CPA!

Jason is an outstanding CPA who is timely and thorough. We highly recommend him and his services if you need a tax/accounting and overall financial help.

JS CPA in Westchester, is great partner for my accounting needs. I switched between many accountants and service providers before, and have now been with Jason consistently for over 5 years. As a sole proprietor, needing a professional accountant to help with bookkeeping and tax returns is important. Having JS CPA advising me regarding filing, providing insight to my business, and personal finance has been a great advantage to staying on top of my business. Highly recommending and thankful!

Jason is outstanding! Fast, efficient, extremely competent. He is easy to work with. He also is technically proficient. Since the pandemic, he performed all services remotely. I strongly recommend his services.

After recently moving back to NYC - we searched for a CPA to help with our particular tax situation and came about J.S - he helped us to understand the recent tax changes and got us a refund we were not expecting. he also was quick to respond and provided valuable information with out matters. We are definitely going to be going with his services moving forward for all things tax related.

I have been using JSCPA for three years now and Jason is wonderful. He is professional, on top of things and responds very quickly to emails. I would recommend his services any day!

Jason is very professional and communicated throughout the whole process. Promptly responded to all my questions. I highly recommend his services.

JS CPA is the best. Very thorough, great communication throughout. Made a stressful chore like tax preparation easy, highly recommend.

Jason made it very easy for me to get all of my documents sent to him electronically. I highly recommend him for your tax services .