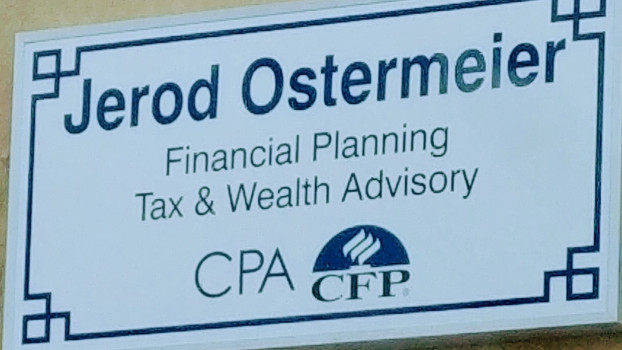

Jerod Ostermeier, CPA, CFP

Reviews Summary

About This Listing

Who Can Work with a CPA?

*Note: CPAs may specialize in different areas. Be sure to check credentials and service offerings.*

First-Time Clients

If this is your first time working with a CPA, don’t worry — most professionals offer a free consultation and will walk you through what to expect. You may be asked to complete an intake form, share financial documents, or set clear goals for your session.

What to Know Upfront:

*Note: Every CPA operates a bit differently. Don’t hesitate to ask questions before committing.*

What to Bring

*Tip: Organize your documents in advance to save time and ensure accuracy.*

Preparing for Your Appointment

*Note: Preparation helps you make the most of your CPA’s expertise.*

How to Get Started

Other Helpful Info

*Note: Every CPA is different — take time to find one who fits your goals and style.*

Contact Information

Address

1615 S Ingram Mill Rd Building A

Springfield, Missouri 65804

Phone

+1 417-256-9299Hours

Customer Reviews

Grateful! Jerod has helped me tremendously with personal and business taxes over the last few years. He is always so approachable with questions, takes time to explain things especially for a new business owner learning alot about taxes and he's efficient. You get responses fast to emails/calls and he's quick getting your taxes done.

I have been using Jerod for my taxes for as long as I can remember. He makes the time for my questions and answers them in a way I can understand. He is by far the quickest person, in ANY business I've ever had to deal with, as far as answering emails and returning calls. Before tax season last year he relocated his office over 2 hours from where I live. That will not stop me. 2 hrs it is! I'd never trust my taxes to any other CPA. Jerod, you are the best of the best! I thank you for everything all these ye

Jerod is great! My wife and I use him every year for tax work. Always helpful and very quick to respond to questions. Even when it's not tax season he's always provides great insight to any financial questions we may have.

Jerod is the most professional accountant I have ever had with all my business ventures. He has always taken the time to answer any and all questions I have. And he replies to emails during off business hours! I can't recommend him enough whether its personal or business needs!

If you are looking for a pleasant experience from start to finish with your taxes Jerod Ostermeier is the professional to have. I have been a client of Jerods for the last twenty years, and during that time Jerod has provided me with service beyond what I expect. He is prompt, knowledgeable and always available to answer any questions. Jerod has not only prepared my taxes, but has also assisted me in all my financial planning, from setting up my business LLC, to offering financial advice. For all your f

Jerod has been with my family since 2010 after Cam and I married. He is awesome. Knowledgeable, down to earth, honest, and always helps us choose what will be best for our future. We appreciate his staff and how helpful they have been since we have become small business owners as well. They never make us feel alone in navigating the unfamiliar areas that are related to being a well rounded business.

Jerod has been preparing my taxes for several years now. He's always very thorough, has everything completed in a very timely manner, and has always been happy to answer any questions that I may have. I'd recommend him to anybody.

I see Jerod every year for my taxes and I am very pleased with how quick, efficient, and knowledgeable he is. He is thorough and explains every step. This year, I even had questions about retirement and investments and he took the time to write out options that best fit my financial situation and again, explained it very well. I recommend Jerod for all your financial needs!

My wife and I have been working with Jerod since we were married and I can't say enough great things about him. He is patient, available, punctual and a nice guy. Not to mention he gets thing done faster than any other CPA I've ever worked with. Highly recommended.

I?ve been having Jerod handle my taxes annually since I moved here 3 years ago and have been more than happy with his efficient and knowledgeable handling of my issues. He has also been conveniently available thru out the year to handle any questions I might have and offers expert advice to help guide me away from trouble. Thanks Jerod!

My Husband and I have used Jerod every year since around 2007 or 08. We are not your normal W-9 people b/c we have several business ventures. Honestly, we have lots of CPA's that are closer to us, but we would rather travel to Jerod and know we are taken care of. He has our trust.

We have used Jerod Ostermeier to prepare our taxes for several years. The first year he discovered something that had been missed by the previous tax preparer and saved us a lot of money. Jerod is very thorough, professional, and makes the dreaded tax filing time quick & easy! I would strongly urge anyone to use Jerod Ostermeier, CPA!

Jerod has done my taxes for my business and personal for years. He is the only one we feel comfortable with. Never had any mistakes or problem . I highly reccomend him to everyone.

Jerod has been our go to tax professional for years. He is extremely knowledgeable and quick to respond to all our needs. I wish I could give him more than 5 stars!

Superior service in every aspect. Consistently providing excellent financial advise and accounting. Knowledgeable, skilled and professional. For the past 8 years we have been very satisfied with the services provided. We will continue to do business with Jerod Ostermeier, CPA well into the future.

Jerod Ostermeier is intelligent and professional and has a caring spirit. He and his very qualified staff will always deliver only the best service. I highly recommend his services.

I called to see if I could inquire about being a new customer. The person I spoke to immediately wanted me to schedule an appointment and only had time to do so. I asked if I could go over some of the things I am looking for as I was not prepared to just set an appointment. He told me he did not have time to talk to me as he had to be somewhere at 11:30. I got to have a 2 minute conversation and did not get any questions answered. I was excited about finding a new account/financial advisor for my small busi

I have worked with Jerod for over 10 years, and would never go anywhere else. Professionalism, accuracy and customer service are always top notch! Much recommended!

Amazing!!! I have been using Ostermeier CPA for years now and they are truly the best. I moved to Florida and I still use them. I would NEVER use anyone else :)

The most honest firm I have ever dealt with. Mr. Ostermeier advised me of my options and I could not have been happier. Highly recommend.

Very fast and thorough getting my taxes done. I highly recommend for all your financial needs.

Jerod is very knowledgeable and helpful. Excellent financial advisor!