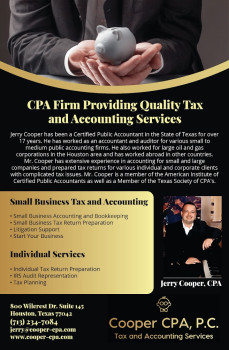

Jerry Cooper CPA

Reviews Summary

About This Listing

Who Can Work with a CPA?

*Note: CPAs may specialize in different areas. Be sure to check credentials and service offerings.*

First-Time Clients

If this is your first time working with a CPA, don’t worry — most professionals offer a free consultation and will walk you through what to expect. You may be asked to complete an intake form, share financial documents, or set clear goals for your session.

What to Know Upfront:

*Note: Every CPA operates a bit differently. Don’t hesitate to ask questions before committing.*

What to Bring

*Tip: Organize your documents in advance to save time and ensure accuracy.*

Preparing for Your Appointment

*Note: Preparation helps you make the most of your CPA’s expertise.*

How to Get Started

Other Helpful Info

*Note: Every CPA is different — take time to find one who fits your goals and style.*

Features

Contact Information

Address

800 Wilcrest Dr SUITE 145

Houston, Texas 77042

Phone

+1 713-234-7084Hours

Customer Reviews

Listen!!!!! Jerry Cooper CPA, will save your life, your pockets and your time. Jerry is extremely knowledgeable about taxes. The tax process with Jerry was sooooo seamless and undreadful. I walked away an extremely satisfied customer. I was greeted with a huge smile, conversation and professionalism. Jerry does not judge. Please go see Jerry and let him walk you thru your tax journey. You will not regret it!!!!

He helped me so thoroughly and I was so lost with how to do taxes. He gave me very good rate and was super understanding. I would recommend him to everyone that needs their taxes done. He is the best cpa ever. ??

Jerry Cooper is an amazing CPA. We have not had great service like this in a long time. We always receive highest quality services from him. We look forward to continuing a long relationship with him, and we recommend that anybody that needs to get their taxes done will seek services from him.

Working with Jerry Cooper has given us the best tax experience we could of imagined! As someone who didn't understand taxes, rules etc. Jerry went in and explained it to us. He takes his time, is very organized, fast, efficient, and consistently followed up. He put our tax return together in no time. I highly recommend him to anyone seeking tax services.

I entrusted Jerry Cooper to handle my tax needs after years of being with another CPA and he didn't let me down. Professional and informative, which is helpful for folks like me that do not totally grasp the system. Thanks Jerry!

Jerry was referred to my wife and I, and as a newly self employed individual, there was a lot to learn. Jerry is very professional and is extremely knowledgeable, making him the best in Houston Texas. I will definitely recommend his service to any one in need of a CPA.

Jerry has been such a pleasure to work with. I recently started my business and wasn't quite sure how to manage the accounting side of it. He did a wonderful job at keeping me in the know and in the loop each step of the way and was available to answer all of my questions. So glad to find a CPA like him! I will be sure to refer him to family and friends in the future.

I was referred by a friend to Jerry, who did a fantastic job at not only filing my taxes but also my small businesses taxes. Jerry always was quick to respond and always had an answer to my questions. I would highly recommend using Jerry for any of your tax filing needs.

After moving BACK to Houston, my wife & I were looking for a respectful CPA that was familiar with Calif state tax filing. Jerry found the time to schedule us in. We sat with him, explaining what our tax and personal financial needs were; Jerry was professional and very personable. My wife felt good about sharing our personal financial information with him. Thanks Jerry

My husband and I have been looking for a CPA for months, for ourselves and for our small business, to fill out our IRS tax forms. I found Jerry Cooper, CPA, on-line, called him, and left a message. He called me back within the hour, and we set up an appointment for today, June 7, 2021. We could not have found a better CPA, he was the best. We are so glad we found him. He was easy to talk to, responsive, efficient, personable, professional, quick, and reasonably priced. We highly recommend him.

Jerry is very thorough when doing my taxes both business and personal. Jerry also takes time to answer any questions and is great on return time on filing. Really recommend him!

Where do I start, Jerry is a stand up guy. He helped me with the most patience. I showed up really unorganized but Jerry did a great job at doing everything he could with what I had. He listened to everything I had to say and also gave me great advice. He?ll be seeing me every year for sure. I?m also recommending him to all of my friends and family and also all of my clients as well.

Jerry has been very thorough and efficient at handling all of our business taxes. We greatly appreciate that he reminds us of due dates to stay on track which is much appreciated when running a business! Thanks for all you do, Jerry!

I would highly recommend and refer Jerry Cooper to anyone needing a CPA. He is patient, professional and answers emails in a timely manner. He is one of the best in his profession.

I would absolutely recommend Jerry Cooper! He was very quick to respond to my inquiry. He was able to help me with my taxes immediately. Very knowledge and professional.

Jerry is so helpful and responsive to all of my questions. I can text, call, email and have an answer that I know is legitimate at any time. I highly recommend Cooper CPA!

I would definitely reccomend Jerry. Jerry is a very patient and prompt person. If he doesn't know the answer he will find it for you. Great guy all around.

Jerry Cooper was great help when needed and fast responsive,kept it professional and helped out a lot without charging me any $$$$,would highly recommend him for any help.

I don't think that I can shorten this guy awesomeness if I wanted to..Therefore I can say this is a awesome guy.Thanks Jerry

Thank you for Mr. Cooper, Hands down great customer service, experience. Was very nice to have met with you Sir

Very professional, fast service and great communication. Highly recommend.

Good knowledge. Helped me out with all my questions. Would recommend.