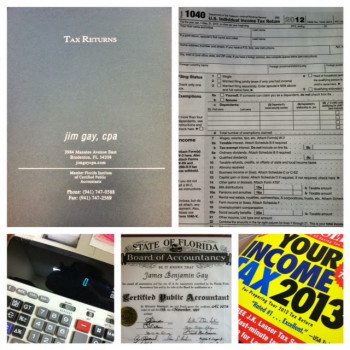

Jim Gay CPA

Reviews Summary

About This Listing

Who Can Work with a CPA?

*Note: CPAs may specialize in different areas. Be sure to check credentials and service offerings.*

First-Time Clients

If this is your first time working with a CPA, don’t worry — most professionals offer a free consultation and will walk you through what to expect. You may be asked to complete an intake form, share financial documents, or set clear goals for your session.

What to Know Upfront:

*Note: Every CPA operates a bit differently. Don’t hesitate to ask questions before committing.*

What to Bring

*Tip: Organize your documents in advance to save time and ensure accuracy.*

Preparing for Your Appointment

*Note: Preparation helps you make the most of your CPA’s expertise.*

How to Get Started

Other Helpful Info

*Note: Every CPA is different — take time to find one who fits your goals and style.*

Features

Contact Information

Address

3984 FL-64

Bradenton, Florida 34208

Phone

+1 941-747-0588Hours

Customer Reviews

I?ve been working with Jim Gay and his team for four years, and they?ve been an invaluable resource for both my personal taxes and my two small businesses. Their expertise goes beyond tax prep?they offer great advice and guidance on the complexities of starting and managing businesses. They?re always on time, highly organized, and their online portal makes handling paperwork a breeze. I highly recommend them for anyone looking for a knowledgeable and reliable accountant!

Jim and the team do a wonderful job and are very responsive, professional, and courteous. I highly recommend them for both business and personal tax preparations and advice.

Jim and the team are wonderful! They filed my return quickly and were able to provide professional advice for a small company like mine.

We have been using Jim Gay CPA for several years and they are outstanding.

Always a pleasure to spend a few minutes with Jim. We have always had trust and confidence in Jim's abilities. We also enjoy his easy-going, calm, professional approach. Thanx for your expert guidance. Happy Holidays to All, Stan & Julia Thurman

I have worked with Jim Gay on my taxes for many years now and they are so good that even though I live in the SWFL area (About 1.5 hours South of Jim) I have still continued to use their services! They are patient, informative and there is always someone there to answer my questions. Highly recommended!

I have been a client of Jim Gay CPA for 20+ years. He's an excellent accountant who pays attention to detail and always is responsive to my needs. Both my children who live in San Francisco and New York also use Jim and they are more than satisfied with Jim and his entire staff. I would strongly recommend Jim Gay !!

I have had Jim Gay due my taxes over the past 15+ years. He is thorough. Most of all he is trustworthy. As my wife and I move into retirement of this next year, I feel Jim will advise and direct my retirement to maximize my tax savings.

I have used Jim Gay's services for quite a few years now and have always found the service top notch and on the ball. The office staff is very friendly and a pleasure to deal with. I would not hesitate to recommend him to anyone.

Highly recommend their services. Jim and his staff were efficient, kind and he took the time to meet with us to make sure he knew what we needed. We never felt rushed and he answered all of our questions. We will be returning for both business and personal taxes! Thank you!

Jim and his staff are the best group of people to work with. From answering the phone, getting calls for more information, and getting my taxes done in a timely fashion. I would highly recommend Jim and his staff to anyone looking for a reliable CPA.

I can't say enough about the professionalism, courtesy and work ethic of Jim and his team. They have been taking care of our business and personal taxes for years and always leave us satisfied. We will continue to use them and encourage others to do so if you are looking for a tax home!

We can echo the sentiments of many other satisfied clients. We established a mutual trust, and maintain a relationship which began back when Jim and Kim's children were babysat by our daughter. Anything we ask of him is given personal attention. That's the way he treats all of his customers. If you are reading this because you are considering his services, let our experience help you decide. (BTW: We live in South America. We have 50 states to choose a tax-preparer from. He really is one of the best.)

Tax preparer made many careless mistakes, one would have cost thousands of $, no apology. I notified the office they offered no restitution just a lame apology. Alot of 5 stars from first time reviewers. I would not recommend at all.

Jim Gay CPA is a very professional & experienced business. They knew exactly how to handle my individual Federal tax situation. Very pleased & highly recommended.

Whether in person pre-Covid or distanced from the UK I have received a great, professional service from all at Jim Gay. Always there when needed with anything I require. A happy, supported, customer.

Jim Gay CPA is the perfect combination of attention to detail in the numbers and warm customer care! I always have a questions about my tax return and Jim Gay CPA takes the time to answer them. I recommend them to anyone.

Always professional best firm in my experience

1st time client, Fast, efficient and affordable. Now I know why Jim Gay has so many 5 star ratings. See you next spring folks.

Good hard nosed Accounting firm...well run.

I do appreciate every year Jim Gay?s office doing a great job, very friendly and accommodating as well as doing my returns in a timely manner.

I've been using Jim Gay CPA for approximately 10 years and have nothing but praise for their attention to detail and professionalism. Need accounting assistance give then a call. Fred Ferris

I called from out of state about a tax issue for my mother. Jim Gay was kind gracious and very helpful. Highly recommend.

Always a pleasure working with Jim and his staff. Prompt, courteous, and able to take care of all of my accounting needs.

Always helpful, always professional! Been going to Jim Gay for many many years and don?t plan to ever change! Thanks Jim for great service!

Jim and staff are responsive, competent and reasonably price. Been with Jim for two years and plan on many more.

Jim is very professional and has done our taxes since we moved here. I trust Jim implicitly and look forward to working with him for years to come.

Friendly and knowledgeable staff. This was my first time using this CPA, but planning to use them for tax preparation each year going forward. Highly recommend!

Jim has been our accountant for many many years. We are pleased with his excellent service..

We have been using Jim and his team for many years. They are the best!

Thankyou Lori for taking care of my business needs it takes a big weight off,we appreciate Jim Gay , CPA you guys are the BEST!!!

Jim is awesome. Definitely recommend working with him!

7 years of receiving excellent accounting service! I highly recommend Jim.

Professional and prompt service, highly recommend, has taken care of us now for 5 years

Great service and communication regarding taxes etc., all done at a reasonable price.

Scheduled a meet a month in advance to speak with Jim & he was a no show.

They handled a business startup for me. Smooth and knowledgeable staff.

Jim is not only a great CPA, but an even better person overall !!

Great option for my small business, friendly and helpful team.

The entire staff is responsive to my needs and has worked hard to help me and get everything in order.

Always helpful! ! even when your live is in a mess they help straighten it out!!

Very helpful and professional. Would recommend.

Amazing professionals and an exceptional team!

As always fast reliable service.

Excellent service, great people