John Yanni, CPA | Realtor

Reviews Summary

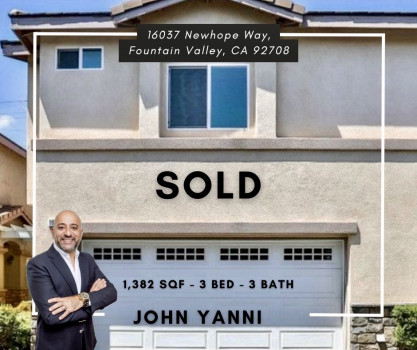

About This Listing

Who Can Work with a CPA?

*Note: CPAs may specialize in different areas. Be sure to check credentials and service offerings.*

First-Time Clients

If this is your first time working with a CPA, don’t worry — most professionals offer a free consultation and will walk you through what to expect. You may be asked to complete an intake form, share financial documents, or set clear goals for your session.

What to Know Upfront:

*Note: Every CPA operates a bit differently. Don’t hesitate to ask questions before committing.*

What to Bring

*Tip: Organize your documents in advance to save time and ensure accuracy.*

Preparing for Your Appointment

*Note: Preparation helps you make the most of your CPA’s expertise.*

How to Get Started

Other Helpful Info

*Note: Every CPA is different — take time to find one who fits your goals and style.*

Contact Information

Address

1973 Foothill Pkwy #111

Corona, California 92881

Phone

+1 626-272-5029Hours

Customer Reviews

John has prepared out taxes for more than a decade now. He is super knowledgeable and very professional. He always took the time to answer all the questions we had. John went above and beyond to ensure we get all possible credits and whatever deductions we qualified for. He was always a great advisor for tax planning as well. John is excellent in communication and has always been very prompt with responses. We will definitely be using John as our realtor too once we're ready to upgrade to a new house. Highl

For over 11 years, John has been handling our tax preparation with honesty, professionalism, and reliability. His experience and knowledge make him a great resource for understanding tax matters and helping you make well-informed decisions. He always provides thoughtful advice and ensures everything is handled with care. If you need help with your taxes, I highly recommend John. You can feel confident that he will guide you through the process and provide the support you need. Know that you'll be in good ha

I cannot recommend John highly enough! As a CPA, they bring a level of professionalism, knowledge, and attention to detail that gave me complete peace of mind throughout the entire tax process. They took the time to understand my specific situation, answered all my questions clearly, and found deductions I didn't even know I qualified for. Everything was done promptly and accurately, and I truly felt like I was in the best hands. If you're looking for a trustworthy, responsive, and highly skilled tax profes

I've been working with John for my tax services, and I couldn't be more satisfied. They are knowledgeable, professional, and incredibly efficient. Every step of the process was smooth and clearly explained, and they made sure I got all the deductions I was eligible for. I truly appreciate their attention to detail and timely communication. Highly recommend them to anyone looking for reliable and trustworthy tax support!

If you are looking for someone to do your taxes look no further! Go to John! He is the best honestly! He is very professional, great communicator with I and other clients. He is very trustworthy, I assure you with him you are in great hands. I would recommend him to everyone who needs help with taxes services or real estate. Appreciate his support, advice?s and his patience.

John has been preparing our LLC tax filing for years. He is extremely savvy and takes time to explain the process and steps needed. His recommendations saved us thousands of dollars, it is very helpful that he's also in the real estate biz. You need someone like John who knows the business inside out to get the best out of your investment journey. We couldn't be more satisfied!

John is amazing!! He explained everything to me, provided me with all the information I needed, made it very simple and easy and got it done quickly! Tax season might be stressful, but not if you have John helping you. I wasn't stressed for even a second. I will use John every year going forward. Highly recommend! Thanks so much John!

Before you start any trip, make sure of your companions because they are the ones who will make it enjoyable or miserable. In many cases, a careful choice makes you see the future of the trip and its results. This is what happened when John Yanni was chosen to accompany us on our new home buying trip. He is a professional person who knows very well what he is doing to make you feel comfortable at every step. He is honest to the extreme and the most important thing that distinguishes him in my opinion is his

John is a highly competent, hard working, sharp, and professional realtor that puts the interest of his clinets first every step of the way. He also has a wonderful and experienced support team that's one of the best I've worked with to ensure the success and seamlessness of the process, and respove any issues. Our experience with John exceeded all our expectations. From the first day we worked with him to look for a home, he has consistently went above and beyond in every interaction to get us where we wa

John is a great guy to work with, he is very professional and passionate about his work, and he makes sure to explain every step along the process.

Amazing experience with an amazing agent John has helped us sell our home above asking and he made the process seamless He hosted countless open houses and was very patient to get us what we needed Truly amazing Really recommend him for any purchase or sale

Truly recommend for any transaction Best agent we saw Patient and made the process seemless

Best experience with honest and efficient CPA covering all concerns #John Yanni

Excellent service, top notch service. Great guy

John is very reliable and trustworthy.

Excellent service and one of the best