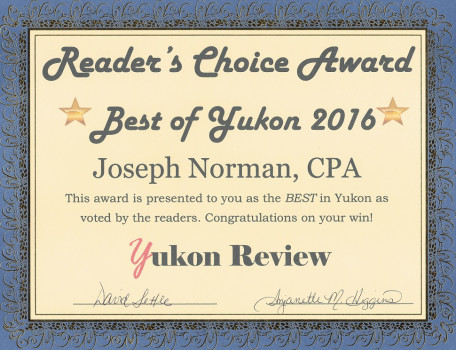

Joseph P Norman CPA, PC

Reviews Summary

About This Listing

Who Can Work with a CPA?

*Note: CPAs may specialize in different areas. Be sure to check credentials and service offerings.*

First-Time Clients

If this is your first time working with a CPA, don’t worry — most professionals offer a free consultation and will walk you through what to expect. You may be asked to complete an intake form, share financial documents, or set clear goals for your session.

What to Know Upfront:

*Note: Every CPA operates a bit differently. Don’t hesitate to ask questions before committing.*

What to Bring

*Tip: Organize your documents in advance to save time and ensure accuracy.*

Preparing for Your Appointment

*Note: Preparation helps you make the most of your CPA’s expertise.*

How to Get Started

Other Helpful Info

*Note: Every CPA is different — take time to find one who fits your goals and style.*

Features

Contact Information

Address

800 W Main St

Yukon, Oklahoma 73099

Phone

+1 405-354-1402Hours

Customer Reviews

I had a complicated tax return to work through. I met with Joseph and he was able to make sense of it right away and was knowledgeable about write offs I didn?t even know about. I was anticipating having to pay taxes but as it turned out I even got a return. The people were friendly and the facilities were pleasant and professional. I highly recommend.

I started using this firm, when I lived in Yukon, OK, and have continued using them even after moving to Montgomery Texas in 2015. They are prompt, friendly, and have always been there to answer my questions all year round. Highly recommend!!

We have been using them for many years. They get my returns done as soon as they can after they receive my materials. Pricing is more than fair. Professionalism is great; they answer my questions year round and have helped with both personal and business tax matters.

Turned in my tax documents on a monday. I had to call them that following Thursday to check on my return. No one called to update me after 4 days. They will not give me an estimate of when the taxes will be done. A week later I still did not hear anything and I had to pick up my stuff and go somewhere else. Their communication sucks and for them not to give an estimate of when they will be done is because they don't want to be held accountable. Honesty is important especially in tax business.

What I love about the firm is that if you have any questions that isn't during the tax season they are they for you. They make time for you and makes sure you understand. If you are looking for a CPA these are the people.

My husband and I have been coming here since we moved here in 2011 and I had called this past Monday, Feb. 13th to see if I could get a Saturday appointment...I was told that they could see us on Feb. 18th at 12 PM and if for some reason they could not keep it, someone would call me to reschedule...well I never received any call to reschedule so I showed up at 11:45 AM and no one was there...I was a little early so I waited...going on 12:30, no one still there...decided to call and no anwser..left at 1 pm

Very friendly and responsive! They were excellent to work with, and I would highly recommend them to anyone.

They always do a great job for me and my family, highly recommend.

Rude receptionist that answers the phone.

Does a great job for us!