Lorena's Income Tax

Reviews Summary

About This Listing

Who Can Work with a CPA?

*Note: CPAs may specialize in different areas. Be sure to check credentials and service offerings.*

First-Time Clients

If this is your first time working with a CPA, don’t worry — most professionals offer a free consultation and will walk you through what to expect. You may be asked to complete an intake form, share financial documents, or set clear goals for your session.

What to Know Upfront:

*Note: Every CPA operates a bit differently. Don’t hesitate to ask questions before committing.*

What to Bring

*Tip: Organize your documents in advance to save time and ensure accuracy.*

Preparing for Your Appointment

*Note: Preparation helps you make the most of your CPA’s expertise.*

How to Get Started

Other Helpful Info

*Note: Every CPA is different — take time to find one who fits your goals and style.*

Features

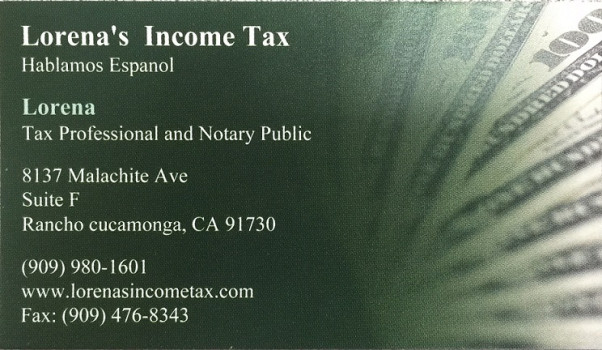

Contact Information

Address

8137 Malachite Ave B

Rancho Cucamonga, California 91730

Phone

+1 909-980-1601Hours

Customer Reviews

I've been coming to Lorena?s for years! I am so thankful for all of her knowledge and experience w taxes. She is kind, charismatic and is always willing to go the extra mile to help. I'm a nurse and I work crazy hours, Lorena has not only accommodated my crazy schedules in years past, but this year I filed super late in the year and she was able to give me a next day appointment at 8:30pm(after a long day at work) and was patient and thorough while going through all of my documents. Absolutely the best in t

I have been doing my taxes with Lorena for over 10yrs and will continue to do business with her. I have never had someone advise me and care about my situation as much as she has. Now my children are doing their taxes with her. She is amazing

I've been getting my taxes done at Lorenas for years and I've had nothing but the best experience. I've referred friends and family and they all say the same, she does an amazing job. I highly recommend Lorenas Income Tax.

I still can not believe the way she was able to help me with my taxes. She did the impossible any one that has question about unfiled taxes she is the best. Thank you Lorena for all of your help!

At first everything seems okay until she doesn't tell you about all these other fees and your almost 400 short on your refund. Horrible never coming back again ...She will be losing business from me and my entire family .. Do not come here or make sure she give you a copy of all the extra fees she doesnt tell you about

I was late with filing this year and she helped me out a lot. I'd absolutely recommend her.

(Translated by Google) I want to report the Mrs. She filed my taxes on April 24, 2024. It is time that I do not receive my refund of more than 9 thousand dollars. I did them after a while, I imagined it would take but not that long, I called the IRS, I took out my account and they confirmed that no one had filed my taxes for the year 2023. Well I said it was Mrs.'s mistake. I'm going to call her to fix it. But after days and days he doesn't answer me, I left him voicemail, msg on Facebook, message from Tex.

(Translated by Google) Excellent attention. Excellent punctuality. Very good service. Lorena A very kind person. Thank you for your service. (Original) Exelente attention. Exelente puntualidad .muy buen servicio.lorena Una persona my amable.gracias por su servicio.