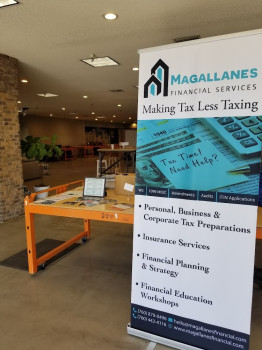

Magallanes Financial Services

Reviews Summary

About This Listing

Who Can Work with a CPA?

*Note: CPAs may specialize in different areas. Be sure to check credentials and service offerings.*

First-Time Clients

If this is your first time working with a CPA, don’t worry — most professionals offer a free consultation and will walk you through what to expect. You may be asked to complete an intake form, share financial documents, or set clear goals for your session.

What to Know Upfront:

*Note: Every CPA operates a bit differently. Don’t hesitate to ask questions before committing.*

What to Bring

*Tip: Organize your documents in advance to save time and ensure accuracy.*

Preparing for Your Appointment

*Note: Preparation helps you make the most of your CPA’s expertise.*

How to Get Started

Other Helpful Info

*Note: Every CPA is different — take time to find one who fits your goals and style.*

Contact Information

Address

1503 N Imperial Ave

El Centro, California 92243

Phone

+1 760-879-0496Hours

Customer Reviews

Ms Magallanes is very professional and nice person

Margarita is professional and very helpful. I have nothing to worry when I do my taxes. They also offer different services with credit repair. Thank you Magallanes team for making this an easy process for me. Highly recommend. Income tax and sales tax.

I have been a customer for the last 4 years and have been very happy with the professionalism of Margarita. I always recommend her to my acquaintances.

Best tax place I've ever been too, very knowledgeable, prompt to answer questions. Always willing to help and get all my questions answered. Highly recommend it, you will not regret it!

Always a great service with Maggie 100 % recommended.

Professional, Fast and effective for tax and accounting highly recommended.

Excelent and neat service!

(Translated by Google) If I could give her zero stars, I would! She took advantage of the fact that it was my first time doing my taxes and I'd already filed an identity theft report. Honestly, very poor service. I tried to talk to her several times, but she played dumb about my case! (Original) If I could put zero stars I would! Se aprovech? que era mi primera vez haciendo mis taxes y ya met? reporte de identity theft. Muy mal servicio la verdad trat? de hablar bien con ella muchas veces y se hac?a tonta

(Translated by Google) Highly recommended, excellent service in the preparation of my taxes, very attentive, she resolved all my doubts and guided me to register my business, which was my best option in terms of the type of business that I do and they did the entire registration process for me. Super recommended. (Original) Muy recomendada, excelente servicio en la realizaci?n de mis tax muy atenta, resolvi? todas mis dudas y me oriento para la inscripci?n de mi negocio cu?l era mi mejor opci?n en cuanto

(Translated by Google) Magnificent; Service in both Spanish and English! NO DOUBT ONE OF THE BEST! (Original) Magnifico; servicio tanto en espa?ol e ingl?s! NO CABE DUDA UNA DE LAS MEJORES!

(Translated by Google) 100% recommended, good customer service and very impeccable work (Original) 100% recomendada un buen servicio al cliente y muy impecable su trabajo

(Translated by Google) Excellent quick and easy service. Very friendly 100% reliable. (Original) Excelente servicio facil y rapido. Muy amable 100% confiable.

(Translated by Google) I highly recommend the tax service, very good service and attention. (Original) Recomiendo ampliamente el servicio de taxes, muy buen servicio y atencion.

(Translated by Google) Very professional and responsible with his work. (Original) Muy profesional y responsable con su trabajo.