Orange Coast Tax

Reviews Summary

About This Listing

Who Can Work with a CPA?

*Note: CPAs may specialize in different areas. Be sure to check credentials and service offerings.*

First-Time Clients

If this is your first time working with a CPA, don’t worry — most professionals offer a free consultation and will walk you through what to expect. You may be asked to complete an intake form, share financial documents, or set clear goals for your session.

What to Know Upfront:

*Note: Every CPA operates a bit differently. Don’t hesitate to ask questions before committing.*

What to Bring

*Tip: Organize your documents in advance to save time and ensure accuracy.*

Preparing for Your Appointment

*Note: Preparation helps you make the most of your CPA’s expertise.*

How to Get Started

Other Helpful Info

*Note: Every CPA is different — take time to find one who fits your goals and style.*

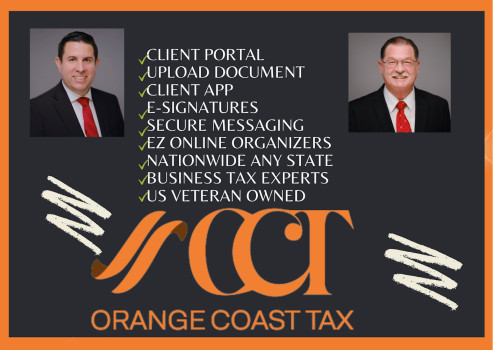

Features

Contact Information

Address

1475 S State College Blvd Suite 112B

Anaheim, California 92806

Phone

+1 714-862-1833Hours

Customer Reviews

I was in urgent need to file a form 8854 prior to leaving USA to be an expat. I had trouble finding an accounting firm willing to help urgently. I called Orange Coast Tax and talked to Sergio. The latter was very attentive to my urgent requirements. He promised to have his expat tax expert Jeff to call me back. The latter called me back the next day and provided all the help that I needed. I will definitely stick to these professional people for my upcoming tax returns as an expat. I fully recommend this ac

You will never see me using anyone else but Sergio and his team for all of our tax needs. From simply filing our taxes, to fighting with the IRS, Sergio has our business for the rest of our tax paying lives. We came in owing close to $30,000 - from our understanding - and are left paying a little over $1,000 and getting money BACK for the first time in 10 years. His rates are affordable and well worth every single pretty little penny. CALL HIM!

The best service! Sergio has taken care of my taxes for a few years now, I appreciate I can always go to him for any questions I may have. My taxes have always been filed in timely manner. %100 recommend.

I just got my taxes done, it was super easy, convenient, customer amazing! I would never go to anyone else, Sergio will always be my tax man. Sergio, explained everything in great detail, he answered all my questions. The portal they use is easy to use and share documents (user friendly!).

The service was quick and painless. I dread doing taxes every year because I'm not a person who likes to show face so the fact that everything was able to be done online with their client portal was a huge plus for me. My situation for this tax year was complicated but Sergio simplified it for me by being knowledgeable and attentive.if it wasn't for his professionalism, patience and friendliness; I would probably still have been stressing about my taxes.

Jeff at Orange Coast Tax was so pleasant and easy to work with. He was very thorough, and available to explain all the complexities over with us to make our filing as easy as possible. Their filing process helped to keep us organized and on top of what was needed. Thank you Jeff and Sergio!

I can't thank Sergio enough for the turn around results on my screws up filing. I have recommended his service to all my business owner friends & & family & will continue to. No one does it better. Thank you again Sergio.

Excellent service. Was able to make changes for what I needed to maximize my tax return.