ORANGE TAX & REG

Reviews Summary

About This Listing

Who Can Work with a CPA?

*Note: CPAs may specialize in different areas. Be sure to check credentials and service offerings.*

First-Time Clients

If this is your first time working with a CPA, don’t worry — most professionals offer a free consultation and will walk you through what to expect. You may be asked to complete an intake form, share financial documents, or set clear goals for your session.

What to Know Upfront:

*Note: Every CPA operates a bit differently. Don’t hesitate to ask questions before committing.*

What to Bring

*Tip: Organize your documents in advance to save time and ensure accuracy.*

Preparing for Your Appointment

*Note: Preparation helps you make the most of your CPA’s expertise.*

How to Get Started

Other Helpful Info

*Note: Every CPA is different — take time to find one who fits your goals and style.*

Features

Contact Information

Address

1445 3rd Ave a1

Chula Vista, California 91911

Phone

+1 619-484-2827Hours

Customer Reviews

I have been a customer for over 12 years. Mario is very knowledgeable, has been very attentive to all our questions and concerns. I have not had any issues filing my taxes. I always recommend Mario to my family and friends.

I have been coming to mario for my taxes for years,I have recommended him to my friends and family, he is amazing and he does not over charge.

Me and my husband got our taxes done by Mario; really appreciated his work. He was knowledgeable, and when in doubt he'd be honest and do the necessary research to get the answers. Practical, resourceful, courteous, and for a great price! Some tax places overcharge; so unfortunate for people that pay exuberant prices. And wait hours. Specially on tax season. Give ORANGE TAX FIRM a chance, and I feel confident their service will make you a returning customer.

HIGHLY RECOMMEND Great Price. Professional Service. Very Reasonable wait times. May need to be patient if they're busy, they care about every client, so even with appointment, they'll make sure everyone is treated fairly. Even so; very much worth the wait! MY FOUR YEARS OF LATE TAXES IN 3.5hours!!! What a burden off my chest? down to hearth people. Will definitely be come back for services. Thank you kindly Mario!!!

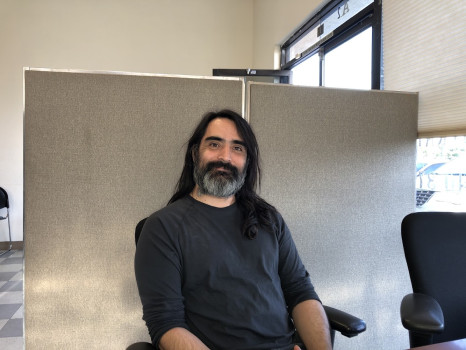

If your looking for a good value, a friendly professional staff, then I would recommend Orange Tax Firm. The environment may not be a lucrative office but the people and service make up for it! I definitely would consider coming back next year to have my taxes done! Thank you! Laurie

By far the worst service I've ever received, I came in with an appointment for 3 pm, only to be told I need to wait because he's helping someone else. I asked if I can register an ATV, the man tells me he's not sure if he has the stickers??? It's 3:50 pm and I'm still not being attended, after I was told it would take 15 min. If you need registration, don't come to this one stop everything shop, go to garibay auto registration down the street. I will never be stoping at this place again.

I really like to take moments to express myself as they are the most profesional people and well knowledgeable at what they do They will go out their way to help u as best as they can I am very happy with their services I will go back again every year

I had really high expectations they recommended this place. I had my appointment at 4pm by 4:20pm I was notified they were just lightly behind I patiently waited 5pm hits I'm still waiting ???????????? 1 hour wait with no one else waiting?? Insane!!! Front desk lady very nice btw. Not coming by this place ever again !

Good experience! Fast and very helpful Definitely recommend

Mario really helpful and guides you with knowledge advice

Best place in town!!!

(Translated by Google) Very bad service I had a terrible experience with the tax preparer. He presented himself as a kind person but not when it came to tax preparation. I carried all my papers WHICH SHE DID NOT ME I ASKED, in my ignorance. I trusted that person. He still blames me for not being prepared. I believe that as a tax preparer she is the ?right? person to guide us. I will not return nor recommend this place. Ehh here is your response in my messages when I commented that I was dissatisfied. ?? I s