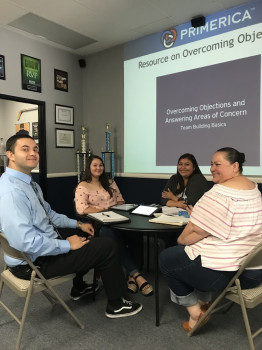

Pedro Ramon Carreon: Primerica - Financial Services

Reviews Summary

About This Listing

Who Can Work with a CPA?

*Note: CPAs may specialize in different areas. Be sure to check credentials and service offerings.*

First-Time Clients

If this is your first time working with a CPA, don’t worry — most professionals offer a free consultation and will walk you through what to expect. You may be asked to complete an intake form, share financial documents, or set clear goals for your session.

What to Know Upfront:

*Note: Every CPA operates a bit differently. Don’t hesitate to ask questions before committing.*

What to Bring

*Tip: Organize your documents in advance to save time and ensure accuracy.*

Preparing for Your Appointment

*Note: Preparation helps you make the most of your CPA’s expertise.*

How to Get Started

Other Helpful Info

*Note: Every CPA is different — take time to find one who fits your goals and style.*

Features

Contact Information

Address

155 Cawston Ave N Suite 215

Hemet, California 92545

Phone

+1 951-652-6190Hours

Customer Reviews

I can't say enough good things about Pedro. From day one, he made the whole process so easy and stress-free. He took the time to really listen to what I needed, explained all my options clearly, and helped me find the perfect coverage for my situation. What really stood out to me was how patient, honest, and genuinely helpful he was. I never felt rushed or pressured ? just supported and well-informed every step of the way. It's clear he truly cares about his clients and wants the best for them. I feel compl

Pedro Carreon has been a great great friend and a huge help to our family during our times of need. He helped us see beyond tomorrow for a brighter future. Pedro has gone above and beyond when it comes down to helping out family and friends that we have recommended to him. When my wife and I first looked into Primerica and what it represented, Pedro took the time to explain and answer any questions that we had. Whether you have questions of life insurance, retirement plans, investing or life goal I wou

What can say, I've know Pedro since I was a teenager he has been helping my parents with insurance questions and needs. As an adult he has been there to help answer any questions I've had or any needs or changes I've had to make. He can help answer questions you may have regarding insurance, investments or if you need a homeowners loans. He's also available to talk and walk you through the process and set goals to get you where you want to be. Pedro is very friendly and easy to talk to so don't be afraid to

Pedro has been helping our family out since I can remember . He is very professional and efficient. He will go above and beyond for his clients. He currently helps my whole family with insurance and financials . I wouldn't trust anyone else as a financial advisor .

I've know Pedro for about 20 yrs and I will not go any where else. Hands down the most patient and honest person I've delt with Im my opinion. No matter how big or small what your needs are it is treaded with the utmost importance. You can not go wrong and will not be disappointed with the professionalism and experience of having something done rite and with piece of mind. ??!!

Petrol is amazing. Was always very, very efficient on everything, Very professional, Punctual, Very honest and understanding. Highly recommend him. Can't say enough Good things about him.

I'm very satisfied with Pedro and the way he does his job, he's been doing my personal finances for the last 8 years and not only he helps me with my finances he also helped me refinancing my house from an interst of 10.5 Down to an interest of 5.6 He really takes his job with great passion, honestly and professionally.

Pedro has handled my finances for 20+ years and when it comes to my finances or questions he is the one I always call because he always delivers.

It's only been a few years that I've known Mr. Carreon but he has been very professional and helpful.

Amazing team that provides amazing service! Primerica has helped me with my finances and I will always continue to work with them!

Always have the Best experience!

(Translated by Google) Very good customer service, always very friendly and professional. (Original) Muy buena atenci?n al cliente, Siempre muy amable y profesional.