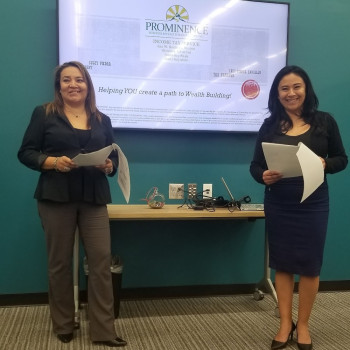

Prominence Business & Wealth Management Inc

Reviews Summary

About This Listing

Who Can Work with a CPA?

*Note: CPAs may specialize in different areas. Be sure to check credentials and service offerings.*

First-Time Clients

If this is your first time working with a CPA, don’t worry — most professionals offer a free consultation and will walk you through what to expect. You may be asked to complete an intake form, share financial documents, or set clear goals for your session.

What to Know Upfront:

*Note: Every CPA operates a bit differently. Don’t hesitate to ask questions before committing.*

What to Bring

*Tip: Organize your documents in advance to save time and ensure accuracy.*

Preparing for Your Appointment

*Note: Preparation helps you make the most of your CPA’s expertise.*

How to Get Started

Other Helpful Info

*Note: Every CPA is different — take time to find one who fits your goals and style.*

Features

Contact Information

Address

357 W Rte 66

Glendora, California 91740

Phone

+1 626-825-8249Hours

Customer Reviews

We've been coming to Prominence for a few years and we think very highly of Sugey and her team. She is extremely knowledgeable and take time to understand your goals and plans. Highly recommend Prominence.

Great service and well knowledgable with tax services. We highly recommend Prominence if you want to maximize your returns and learn about wealth management in the process.

I was very satisfied with the service at Prominence. The office was very welcoming. Sugey is awesome all the way around. My appointment was more than just numbers. Sugey advised and encouraged me in business and personal growth. I am so grateful and thankful for her.

Like many others taxes and me are the worst. I've always known we pay way to much in taxes. I am glad to have been introduced to Prominence Business & Wealth Management Inc. The staff is awesome and they know their tax law! I recommend them highly and will tell everyone I know! Tax Happy in TEXAS!

This is a hard post for me as I have had nothing but 5 star service from the moment I stepped into their office! In the beginning, I was terrified to do my taxes alone! My ex was continually claiming our children all while having no contact, and Promanance fought for me. I would tell friends and family how this women run company, empowered me and gave me the confidence and financial advice to become the head of my household. I recently tried to make an appointment only to learn that the prices have doubled

My husband Rafael and I met with Sugey in June and we let her know that I was leaving the teaching profession to join him full time in his small business. I was very nervous and anxious at the time, and she gave me great resources to read and assured us that she would be able to assist and guide us in this journey. I was so happy and hopeful to have found a business and a person who would really help us grow. My husband and I would have appreciated a pricing plan at that point so that we could have made

Sugey is awesome, she is so knowledgeable and really listens and cares about what's in your best interest for your business and well being. Her office is pretty too! I finally feel like I've found someone to build a relationship with to take my business to the next level. Thank you!!

They made major mistakes with our returns. When we tried to ask questions, they refused to return our emails or calls. We had to pay thousands of dollars to fix their mistakes. They don't know how to do taxes! Save your money and go elsewhere.

Couldn't be happier walking out the doors. Went in to get my taxes done. They had great customer service, and they answered all the questions I asked.They also helped me figure out my past student loan debts!!! Definitely recommend this place for anyone looking to get their taxes done with friendly professionals and at reasonable prices. GO PROMINENCE!

Cruz Piedra & Sugey Piedra - I've truly enjoyed working with you and I wanted to make sure other people know how skilled you at advising businesses with their Finance and Tax needs. If you ever need help supporting your business, please count on myself and our entire Southland Data Processing team!

Great service Sue is the best

Great people that made me feel at home from the moment I walked in!

Great service! Very knowledgeable and friendly staff.

Always a great experience with the entire team.

Great service, very profecional.