Puzdrak and Stortz CPAs

Reviews Summary

About This Listing

Who Can Work with a CPA?

*Note: CPAs may specialize in different areas. Be sure to check credentials and service offerings.*

First-Time Clients

If this is your first time working with a CPA, don’t worry — most professionals offer a free consultation and will walk you through what to expect. You may be asked to complete an intake form, share financial documents, or set clear goals for your session.

What to Know Upfront:

*Note: Every CPA operates a bit differently. Don’t hesitate to ask questions before committing.*

What to Bring

*Tip: Organize your documents in advance to save time and ensure accuracy.*

Preparing for Your Appointment

*Note: Preparation helps you make the most of your CPA’s expertise.*

How to Get Started

Other Helpful Info

*Note: Every CPA is different — take time to find one who fits your goals and style.*

Features

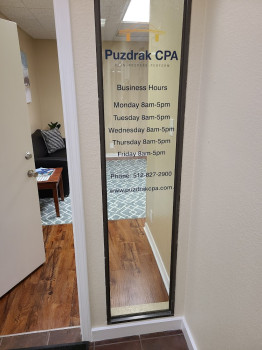

Contact Information

Address

11754 Jollyville Rd #102

Austin, Texas 78759

Phone

+1 512-827-2900Hours

Customer Reviews

My husband and I needed help figuring out an issue with our small business tax return. He was super knowledgeable and informative. Mark gave us insight on how to resolve the issue, was quick to respond, and sent us referrals for other services we needed. His online booking was very easy to navigate too! Definitely recommend Mark!

Mark has been wonderful to work with. I worked with Mark earlier this year on reviewing my Tax return. He was really helpful in providing me a second set of eyes and making sure that I filed accurately. Additionally, I had some tax questions about an investment and he was available to go the tax implications and provide some options. I'll definitely keep working with him in the future.

Mark has been a tremendous asset to my small business. His communication is second to none and his advice has saved me countless headaches. I highly recommend.

Marks upbeat personality and services are excellent. He speaks with clarity and keeps abreast of new tax changes. As a non-profit corporation he taught me some skills to save money for next year's taxes.

Amazing experience with Mark. This year, our taxes got a bit more complicated due to me changing jobs at the end of 2020 when a new w4 process went in place. I found Mark online and left him a message. Knowing this is the busiest time of the year for CPAs, I was not expecting much of a response but he called me that Saturday and even offered for me to come see him at his office that same day to help. He was amazing! He explained everything that happened, reviewed all of my documents and recommended how to t

Working with Mark was a great experience. He set me up to provide all my information and turned around the completed returns. He also explained the process and reviewed the returns in a way that was easy to understand. I will definitely use Mark?s services again in the future!

I went to Mark as a very small business, and with little experience. Mark never made me feel like I was a bother with my questions and was very patient in working with me. I can highly recommend him whether you are a large firm or a small independent entity just starting out.

Mark has been wonderful from the start of our personal and business tax returns until he submitted our returns electronically. We switched to him after being with a different CPA for over 20 years. He's immensely knowledgeable, patient, personable and professional. We highly recommend Mark for anyone's personal or business accounting and tax returns.

Mark was wonderful. His website was easy to use and I was able to setup an initial consultation appointment for the same day. I look forward to working with Mark for my CPA needs now and in the future.

This was our first year doing our business?s taxes and we didn?t know what to expect, we were for sure overwhelmed. Mark not only made everything go smooth in regards to paperwork but made us feel like our small business was as important as any other. He is now stuck with us, 100% recommended.

Mark was great - I ran into issues with the IRS not sending me a PIN and he was so on top finding a solution so that we did not miss the deadline. I really appreciated the high level of service and would refer him happily. Thanks Mark!

I'm starting an international real estate operation in Austin Texas, and I got Mark?s reference from a local realtor friend of mine. I can say that Mark always answered my questions in a proper, savvy, and timely manner and let me know that my operation was not within his experience scope and took the time and effort to contact me with somebody else. I really appreciated his honesty.

Mark has been such a pleasure to work with! He is very knowledgeable and patience and easy. I trust him to help my growing business fully.

I spoke with Mark this morning to get some consulting on handling cost basis for a more complicated situation. I was very impressed on his information gathering and providing straight-forward solutions that were easy to understand. Definitely will be coming back to Puzdrak CPA for all future needs. Thanks Mark!

Mark sat with me with his whiteboard and went over several tax saving strategies. He provides wonderful service. So glad I was referred to him!! Thank you Mark!

Had to find a new CPA this year and was told about Puzdrak CPA. Found Mark and his office to be super easy to work with. Very communicative, easy to reach, and very resposive. Prices were very fair. Overall was very satisfied with our experience and will continue to use Puzdrak CPA in the years to come.

Mark was extremely helpful and quick to provide guidance to a unique situation of mine. It was a very smooth experience and I would definitely use him again.

Had an free consultation with Mark about starting a business. He was very informative and helpful explaining what to expect and how to take these early steps. Highly recommended!

Very knowledgeable and extremely helpful about real estate taxes when we were thinking about purchasing our new home.

Mark. Is. The. Man. Dude saved our a$$ as our previous accountant was a complete tool. HIghly recommended.

Easy going, communicates well, very helpful and knowledgeable.