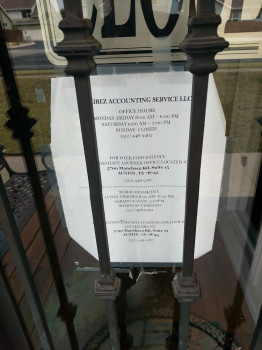

Ramirez Accounting Service

Reviews Summary

About This Listing

Who Can Work with a CPA?

*Note: CPAs may specialize in different areas. Be sure to check credentials and service offerings.*

First-Time Clients

If this is your first time working with a CPA, don’t worry — most professionals offer a free consultation and will walk you through what to expect. You may be asked to complete an intake form, share financial documents, or set clear goals for your session.

What to Know Upfront:

*Note: Every CPA operates a bit differently. Don’t hesitate to ask questions before committing.*

What to Bring

*Tip: Organize your documents in advance to save time and ensure accuracy.*

Preparing for Your Appointment

*Note: Preparation helps you make the most of your CPA’s expertise.*

How to Get Started

Other Helpful Info

*Note: Every CPA is different — take time to find one who fits your goals and style.*

Features

Contact Information

Address

610 E Stassney Ln Suite C3

Austin, Texas 78745

Phone

+1 512-448-9462Hours

Customer Reviews

We started to do business with Ramirez Accounting for about 5 years ago, and all of these years working together is like working with family. All of the staff is always willing to help with all of our needs.

Checking process very efficient. Adds you via phone # so you can see when you will be attended. Didn?t wait long maybe 15 mins max. Rigo helped me and my husband with our taxes. He explained everything & you can tell he works with great ethic! Went pretty fast and first time coming here and won?t be the last! Recommend coming here especially if your looking for a great bilingual or Spanish speaking firm!

Great service! They are eager to help and I recommend them whenever I can.

Been having this acct. firm doing my Taxes for several years,(Maria B) The staffs are all great/professional with the services they render.For great services & help getting your Taxes prepared or questions about your taxes?.[with five?????????? I recommend this firm & staff to lead you in the right directions? SS

best place to get your taxes done at Rose is the best very professional and i would not go anywhere else.

I had to amend my tax return and didn't know where to begin but I found this small CPA firm on the IRS website. I really had no idea what to do but they handled everything for me. Appreciate the work of Rigo who was kind, patient, had an answer for all my questions and was able to have everything completed the next day. They are in south Austin which is the opposite of where I live and work but I will be going back whenever I need assistance. They have earned my trust and business.

This is the second year i do taxes for my business. Rosa the owner is knowledgeable and explains everything. I will be a long time customer for sure.

I have used Ramirez Accounting to file my taxes for the past three years. Rigo was very responsive, reasonable, and helpful throughout the whole process. 10/10

I have been a client for five years and can say I?ve only had positive experiences with Ramirez Accounting, attentive staff, usually very little wait time and no issues at all with my tax returns. Thank you for being an asset to the community!!

I received notary services here and they were fast, friendly and affordable. I will be coming here for any other notary needs in the future and will recommend them to others.

I was referred to Ramirez by Tax Professionals of Austin, who said Ramirez could help me with an unusual tax situation. The folks at Ramirez said they would have to refer me to someone else, but could file an extension for me in the meantime for $30 (this was in April). They charged me $40 for the extension and referred me back to Tax Professionals of Austin... Who referred me to Ramirez again.

Sari was great! Really thorough and professional experience from start to finish.

Friendly and efficient staff. Rosa Imelda Ramirez is very knowledgeable and helpful. Highly recommend them.??

Great service, efficient and professional service from staff.

Great Bilingual Staff. I did my personal and business taxes with them

More than One hour to do a simple notary, unacceptable!

Professional, accurate, and courteous. Above all, trust in there capability.

Fast friendly service

(Translated by Google) The service they provide is extraordinary. Very friendly, accurate and honest. They will always explain to you with all detail, for you to know exactly what the process is and they will ask questions to make you double confirm everything to not make any mistake. Have been a customer for many years now and I highly recommend them. They also speak Spanish (100%) if they need it, it is better that they explain all the details of this type of process to us in our language. In this office

(Translated by Google) Very bad experience, they are rude and that person who is the only one who speaks Spanish named Efra?n is not polite and unprofessional. (Original) Muy mala experiencia son unos groseros y esa persona que es la ?nica que habla espa?ol llamado Efra?n nada educado y poco profesional

(Translated by Google) Everyone does a great job, they are very kind and treat people with a lot of respect. Hello, let's continue with business, thank you very much. (Original) Todas las personas asen muy buen trabajo muy amables tratan ala jente con mucho respeto hola sigamos con los negocios igual muchas gracias

(Translated by Google) Excellent service, 18 years as a customer, very professional. Thank you for providing service in Spanish and English. (Original) Excelente servicio 18 a?os como cliente, muy profesionales. Gracias por dar servicio en espa?ol e ingl?s

(Translated by Google) Happy holidays to you all too, thank you all for your work, thank you for always being there for your clients, Merry Christmas and a Happy New Year (Original) Felices fiestas para ustedes tambi?n gracias a todos por su trabajo gracias por estar siempre al pendiente de sus cliente feliz navidad y un a?o nuevo

(Translated by Google) The best service to make taxes. Charly helped me, it was an excellent experience. I highly recommend it. (Original) El mejor servicio para hacer taxes. Me atendio Charly fue una experiencia excelente. Lo recomiendo ampliamente.

(Translated by Google) Exceptional level of service! The way they treat the customer, always looking for a solution and always going the extra mile, highly recommended! (Original) Nivel de servicio excepcional! La forma de tratar al cliente, siempre buscar una soluci?n y siempre dan la milla extra, s?per recomendado!

(Translated by Google) Super services from these accountants, no problems or setbacks. (Original) Super Servicios de estos contadores, ningun problema ni contratiempos.

(Translated by Google) It is very good, they serve well. (Original) Es muy buena atienden bien