Reliance Consulting CPAs

Reviews Summary

About This Listing

Who Can Work with a CPA?

*Note: CPAs may specialize in different areas. Be sure to check credentials and service offerings.*

First-Time Clients

If this is your first time working with a CPA, don’t worry — most professionals offer a free consultation and will walk you through what to expect. You may be asked to complete an intake form, share financial documents, or set clear goals for your session.

What to Know Upfront:

*Note: Every CPA operates a bit differently. Don’t hesitate to ask questions before committing.*

What to Bring

*Tip: Organize your documents in advance to save time and ensure accuracy.*

Preparing for Your Appointment

*Note: Preparation helps you make the most of your CPA’s expertise.*

How to Get Started

Other Helpful Info

*Note: Every CPA is different — take time to find one who fits your goals and style.*

Features

Contact Information

Address

13940 N Dale Mabry Hwy

Tampa, Florida 33618

Phone

+1 813-931-7258Hours

Customer Reviews

An oversight by a CPA has caused an issue with the IRS for me. The managing partner has limited knowledge with regards to some of the tax laws. Customer service is lacking when a problem arises, and you then become just a number. Maybe it?s because I wasn?t one of their highest paying clients. Im having to go through another CPA to fix their mistakes. I may have to hire a tax lawyer. DO NOT USE THIS COMPANY!

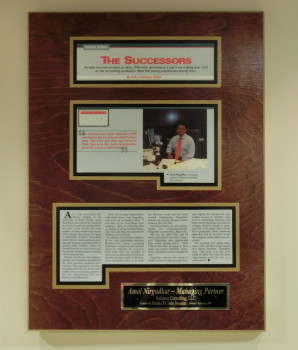

Amol provides accounting, tax and business advisory services for multiple businesses that I own. In addition, his accounting firm has done my personal taxes for over 9 years. He is an expert CPA and keeps abreast of all the tax law changes. He is very personable and takes a pro-active advisory role in my personal and business affairs. Another differentiating factor about Amol is that he goes above and beyond his call of duty to help business partners resolve disputes amicably by providing advice that is fa

Amol is a phenomenal CPA that has helped many businesses, not only with traditional accounting work but also by serving as a consultant. His intelligence and thirst for more knowledge exceeds almost all others. He is constantly reading, learning, and staying on top of an industry that issues new laws/rules/regulations daily. His experience and resume speak for them self. Do yourself and your business a favor and call Amol.

Reliance Consulting and Amol's initial approach to analyzing our business is why I keep going back. He is a highly creative consultant who provided great advice when we evaluated our entire business model. With his added expertise as a CPA, hiring Amol was a great decision to help our company succeed. I highly recommend Amol and his wonderful team at Reliance Consulting.

Reliance Consulting has been a tremendous resource to our real estate private equity firm. The entire team consists of solutions oriented professional who takes a very determined approach to solve client problems. I have enjoyed working with everyone from Raju and Amol on strategy, Christina on tax research and planning, and Kim who has been diligent in paying attention to our 20 plus entities on a monthly basis. We have worked with the firm for over 13 years. They have consistently fought on our side to

I've used Amol, Raju and Reliance for over 15 years. Their service and knowledge is second to none. They prepare financials and tax returns for over 20 entities as well as our personal tax returns. They've also recently helped through a tax audit and their knowledge and expertise with the IRS agents was superb. They're timely and provide creative tax planning for our Dental businesses, various real estate ventures and and personal taxes. I've found Amol and his staff to be very accessible and prompt in

Amol brings an insightful perspective to his clients, always looking at the bigger picture as well as being mindful of the details. His unique expertise in the dental arena extends well beyond the typical CPA practice, allowing him to offer his clients innovative ideas and new methodologies for growing their practices.

I have been with Reliance for over 10 years. Kim, Nicole and now Bre Spears are the best. They are very attentive, knowledgeable and more importantly, very responsive to your questions. I am in GA, but will not go anywhere else for accounting.

Amol has been a huge asset to navigating the confusing world of small business taxation and accountancy. I hired Amol for two of my start ups, and in both cases he has provided exceptional insight beyond just accounting service. Structuring the companies, location of incorporation - both within the US and international, payroll management, issues around year end filings, issues around raising venture capital and equity issuance, are just a few areas that he has helped in. Most importantly, he has shown prac

This will be my 3rd year using Reliance, and Amol is our accountant. I use him for my company, as well as my personal. He really knows what he is talking about, even if he tells you something you do not want to hear. But, when it comes to keeping the (_Blank) off your back, its better he tells you the truth/law, rather than just filling out the forms. He is ethical, and knowledgeable.

I have used many different accountants over the past couple of decades in different states. I finally settled in Florida, and have found this company. Our accountant Kim is always responsive and if she doesn't know the answer she finds it out...although I have yet to post a question to her that she did not know the answer to. She is literally a finance and accounting genius. I have zero complaints about this company or their accountants. I would recommend them to anybody at any stage of their career. There

My connection to Amol goes back over a decade. We met while completing our Masters in Accounting. I am now in Seattle and am thrilled to find out he is a leading financial force for the CPA industry in Tampa Bay. If you live in the Tampa Bay area and need an accountant, look up Amol Nirgudkar! He's always been wicked smart to me...while I was playing the "nerd" for Beta Alpha Psi skits (a co-ed honorary accounting fraternity), he was soaring to the top of our class. (Although, I do remember him starring in

Amol is a dedicated individual who has a keen ability to sniff out opportunity in favor of his clients. I have recommended him to several people and companies and will continue to do so.

Amol at Reliance Consulting has done an outstanding job. He is a thorough professional, knowledgeable and shows genuine concern for his clients.

Reliance CPA, led by Govindaraju Rudrapatna, CPA, is by far the best accounting firm I have ever had the privilege of working with. Govindaraju is much more than just an accountant. His wise counsel (which always includes planning ahead for next year?s taxes), and expert, up-to-date tax advice, has helped us produce accurate and crystal clear accounts. His fees are straightforward, easy to understand and fair, and a great value for the personalized service that Govindaraju and his wife provide. If you?re lo

Raju is an amazing professional to deal with. My company has worked with them for years and have always been highly impressed!

I had previously left a below par review. They have since reached out to me and we are in process working things out. Will be looking forward to working with Amol.

Nicole was able to provide excellent, quick, thorough and concise service during such a busy time of year. Greatly appreciated.

NARASIMHA SOMAYAJI is Rude and not helpful at all.

Great professionals, I highly recommend

Great people and phenomenal service