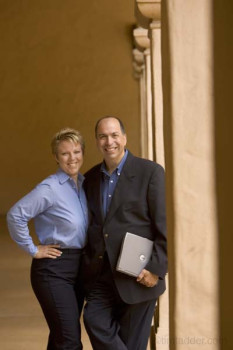

Ross & Mary Hunt, Inc

Reviews Summary

About This Listing

Who Can Work with a CPA?

*Note: CPAs may specialize in different areas. Be sure to check credentials and service offerings.*

First-Time Clients

If this is your first time working with a CPA, don’t worry — most professionals offer a free consultation and will walk you through what to expect. You may be asked to complete an intake form, share financial documents, or set clear goals for your session.

What to Know Upfront:

*Note: Every CPA operates a bit differently. Don’t hesitate to ask questions before committing.*

What to Bring

*Tip: Organize your documents in advance to save time and ensure accuracy.*

Preparing for Your Appointment

*Note: Preparation helps you make the most of your CPA’s expertise.*

How to Get Started

Other Helpful Info

*Note: Every CPA is different — take time to find one who fits your goals and style.*

Features

Contact Information

Address

Ross & Mary Hunt, Inc, 29970 Technology Dr #120

Murrieta, California 92563

Phone

+1 951-696-5292Hours

Customer Reviews

I was floundering with my investments before I met Mary and Ross Hunt. Since then, they have organized me and increased my net worth to the point where I am comfortable. They are always available to talk one-on-one.

I have worked with Ross and Mary Hunt on my financial planning for almost a decade. They make a good team as Ross provides the financial advice and Mary handles the many forms and details of setting up and monitoring accounts. They are very responsive to my questions (I have many!) and provide quick and efficient replies. They have helped me to connect with other tax and estate planning professionals in the area to make sure I have prepared for my present and future financial obligations and well-being.

I have been working with Ross and Mary Hunt for over 20 years. They have provided guidance in the areas of investing, financial planning, preparation for retirement and estate planning. Over this time they demonstrated excellent knowledge in their field and are extremely attentive to detail. Ross and Mary were also very sensitive to our risk tolerance when recommending investments. I highly recommend them to anyone seeking financial planning services.

I have been a client of Ross & Mary for over seven years. It has been a pleasure to work with them. Prior to consulting them, our several retirement investments were a patchwork of accounts made up of savings and employee retirement plans developed during years of a two income, multi-employer family. As retirement drew near, it became necessary to get everything coordinated in order to maximize opportunities. We became very comfortable with Ross & Mary providing advice and direction right from the beginni

My wife and I have been a client of Ross and Mary for over 15 years. Just a few years before we met Ross & Mary I had retired. In 2008 after financial & real-estate markets had collapsed, we were devastated. Ross, being an independent advisor, put together a plan that to this day is still working. It is our belief that the Lord placed Ross & Mary in our path, and to Him, Ross and Mary we are so grateful.

For the last 30 years Ross and Mary have taken care of my financial guidance and investments well! Between IRAs, savings and an annuity, they have my wife and I on a good path for retirement and I thank them for all that. Communications with Mary and Ross are great too! I recommend RMH Advisors!

I've known Ross for over 40 years and have been a client for 30 years. In that time Ross and Mary have provided personal, financial and professional advice that has been honest, detailed, considered, prudent and much appreciated. I emphatically recommend them!

Thank you for your words of encouragement and wisdom. Be blessed.