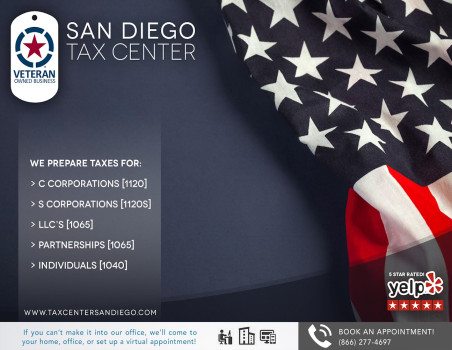

San Diego Tax Center

Reviews Summary

About This Listing

Who Can Work with a CPA?

*Note: CPAs may specialize in different areas. Be sure to check credentials and service offerings.*

First-Time Clients

If this is your first time working with a CPA, don’t worry — most professionals offer a free consultation and will walk you through what to expect. You may be asked to complete an intake form, share financial documents, or set clear goals for your session.

What to Know Upfront:

*Note: Every CPA operates a bit differently. Don’t hesitate to ask questions before committing.*

What to Bring

*Tip: Organize your documents in advance to save time and ensure accuracy.*

Preparing for Your Appointment

*Note: Preparation helps you make the most of your CPA’s expertise.*

How to Get Started

Other Helpful Info

*Note: Every CPA is different — take time to find one who fits your goals and style.*

Features

Contact Information

Address

12636 High Bluff Dr #400

San Diego, California 92130

Phone

+1 866-277-4697Hours

Customer Reviews

I randomly called The San Diego Tax center to get information of hiring someone to market my business and the forms i was may need for tax purposes. I was fortunate to end up with Daniel Yowell who was extremely knowledgeable and super helpful to explain in detail the form and reason I needed to get it filled. My computor was having glitches as the time and he was kind enough to even send me the links for the forms to make things so much easier. Truly Great service and most appreciated Daniel.

Daniel of the San Diego Tax Center handled our family's joint filing return with care, respect, and professionalism. He made sure to ask all pertinent questions to make our return accurate and get it filed quickly. We highly recommend you go through this office and get the same kind of personal attention for your individual needs. Daniel gets our SEAL (pun intended) of approval and we will refer others to him without a doubt as well as he will have our continued business in years to come. Thank You Again!

When I was looking for someone to do my taxes I wanted someone who understood tax codes and tax law. I wanted someone who would help me keep most of my hard earned money. The valuable information shared on the website alone was golden for me. I knew from that moment I wanted Daniel to prepare my taxes. As an entrepreneur Daniel has been readily available to answer questions I may have regarding my business and taxes. Although I no longer live in the area I refuse to go anywhere else. If you are looking for

Very highly recommend! Daniel Yowell has been doing our taxes the past three years and we've always been impressed with his great work, responsiveness, and promptness in handling our filing. We always feel confident it will be well-handled. Also love the ease in providing documents and that he is able to handle most issues remotely without needing to set up numerous calls or meetings!

For several years I have used online software to do our taxes. I was worried that some money we should have kept in our pocket was being missed by the software and sent to the IRS. This year we chose to meet with Daniel Yowell and put his expertise in tax laws to good use. Daniel is experienced and trustworthy. We couldn't be happier and highly recommend him.

Daniel Yowell, EA at SAN DIEGO TAX CENTER has been doing our tax prep the last few years and we could not be more satisfied. Dan is smart, trust-worthy and very detail-oriented. Although, we no longer live in CA we continue to have Dan prep our taxes, because he is that reliable and an all around likeable guy.

My wife and I always have a great experience with Daniel. He is extremely knowledgeable and well organized. The filing process is convenient and every single year we have been very happy with the end result. I highly recommend Daniel's service to anyone who is looking for a personable and reliable tax professional.

Daniel has done my taxes every year since 2015. I know that there are plenty of online tax preparation and filing apps to do the job, but I'll keep engaging him, as he consistently does my taxes with the utmost professionalism and discipline that can be expected from a former Navy Seal.

I am a French Canadian who moved to San Diego 2 years ago. When it was time to do our taxes I didn't know anybody and found San Diego Tax Center online. I decided to give it a try. Even if there is nothing fun about taxes I was not disappointed. Daniel is really straightforward and keep everything as simple and as efficient as possible. Will keep using him for sure.

Great experience with Daniel. He's very knowledgeable and personable. Took the time to answer all of my complicated questions and even came to my office to drop off copies of my returns. He's handled my company and personal taxes for the past two years and hopefully for the foreseeable future. Highly recommend his service.

Daniel has been preparing my personal and business taxes and offering financial advice to me for the past few years. I have been extremely satisfied with his services and wouldn't take my business to anyone else. Not only has he prepared my taxes for years, he saved me thousands of dollars and a lot of headaches when he petitioned the state of California on my behalf to have them dismiss a tax balance that was completely unjust.

San Diego Tax Center (Dan) provided service that was exceptional.I had a 4 yr prior tax burden that was handled quickly professionally and was done without even having to go into there office ! Outcome was better than expected and would highly recommend Dan and San diego Tax Center for all your tax needs.They are highly professional and go out of there way to make sure you're satisfied .There advice provided was top notch and i will bring all my Tax needs to them in the future ! Thank you Dan and San Diego

Offered great advice to solve an error in tax filing. Saved me thousands of dollar and a lot of stress.

Troy is wonderful and always goes above and beyond for his customers. I have been a customer for 4 years and highly, highly recommend him.

Thank you so much Daniel. I really appreciate the time you spent elaborating on every question that I had. Daniel has a great knowledge and explained all the tax related issues and possibilities regarding an inherent money from outside the US. I recommend this tax office to anybody. Thanks again.

Daniel provides a great tax service and certainly helps my businesses get the most out of our taxes every year. Highly recommend.

Can't say enough good things really. If you want someone that knows how to get the biggest return on your taxes. Dan "The Tax Man" is the man. Best customer service you can ask for as well.

Had a quick question about an assessment from a previous year. Got an answer over the phone in no time! Highly recommended.

Daniel is great. Very knowledgeable and local.