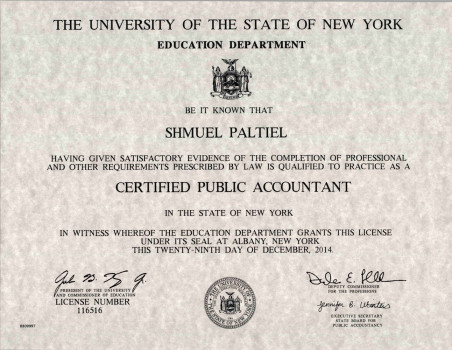

Shmuel Paltiel CPA, P.C.

Reviews Summary

About This Listing

Who Can Work with a CPA?

*Note: CPAs may specialize in different areas. Be sure to check credentials and service offerings.*

First-Time Clients

If this is your first time working with a CPA, don’t worry — most professionals offer a free consultation and will walk you through what to expect. You may be asked to complete an intake form, share financial documents, or set clear goals for your session.

What to Know Upfront:

*Note: Every CPA operates a bit differently. Don’t hesitate to ask questions before committing.*

What to Bring

*Tip: Organize your documents in advance to save time and ensure accuracy.*

Preparing for Your Appointment

*Note: Preparation helps you make the most of your CPA’s expertise.*

How to Get Started

Other Helpful Info

*Note: Every CPA is different — take time to find one who fits your goals and style.*

Features

Contact Information

Address

70-50, 1-14 Austin St Ste Ll

Forest Hills, NY 11375

Phone

+1 718-544-2914Hours

Customer Reviews

Sam has been my CPA for 4 years now, and I couldn't recommend anyone better! He is always prompt, respectful, and provides the highest quality of work while answering any questions. Any time I have trouble with my taxes, I reach out to Sam and he gets back to me within a day. Incredible service, amazing prices, and overall great person with integrity. Thank you Sam, and I have always recommended you to my friends.

He was very helpful in explaining the pros and cons for each entity type and helped me understand the taxation method for each. So far my experience with Shmuel has been very positive. Looking for new accountant, so I called to schedule an appointment, He called me back in a timely manner and even sent a follow up email which I appreciated. Excellent customer service thus far?Affordable and solid service......!!!

This accountant is as good as It gets. I am a business owner and a family man; Sam just makes everything that?s complicated in life much easier. He is not only knowledgeable but he?s a pleasure to work with. I have complete trust in him in regards to business as well as my personal affairs. He manages to get the best return possible for me and is just always available to me for assistance all year round!!! I cannot ask for more. His office is easily accessible for me and he gives me the one thing I can say

I have filed my last three years of business and personal tax returns with Sam, who was always available for me and responded to my calls almost instantly. Sam gave me the right type of advice both for business and personal and gave me the personal attention I needed from him. I highly recommend Sam as a good and knowledgeable CPA.

Sam is an amazing CPA very knowledgable. He handles by business and personal return and am very satisfied with the service. I had other accountants before, none of the compare to Sam. I highly recommend him, you will not regret it.

I have been with Samuel Paltiel CPA for 3 years now and am very pleased with the service I get. I own a unisex hair salon and he is very knowledgeable about the industry and how my business operates, so it makes it so much easier to work with someone who understands your concerns. I defiantly recommend him to anyone who is looking for a good CPA who knows what he is doing.

Shmuel was amazing. I've never had a CPA before and I just started a small business. He made the super complicated process of taxes super easy. No Hassle, straight forward and everything was settled in a matter of days. Highly recommend!

I found Sam through Craigslist two years ago. My previous CPA was retiring. Sam had answered an ad that I posted with some very specific tax needs for me, my wife and my real estate business. I own many properties in New York and Arizona, my wife and I also have jobs in New York City, so consequently our taxes are very complex. Sam takes the information that I supplies him and does a bang-up job, and is very conscientious to my needs. He gets right back to me when there is information missing or when he see

Best accountant in the area hands down. Fast, reliable and actionable process. Sam is the top guy for businesses and individuals looking to build wealth. Highly recommended!

Shumel is an attentive and caring accountant., an asset to any business. He helps you threw the process and answers any questions. He is knowledgeable, takes pride in his work and delivers great, timely results.

Knows his stuff!! Always available 24/7 for me and my ridiculous tax questions all year long. Pays close attention to detail and gets the job done efficiently and works diligently to get me the best return available. don?t go anywhere else this guy is it

I have been with him for the last three years. I have a company that he helps me with. To me it seems very complicated but he explains and makes it seem very simple for me to understand. So far very happy with the service and would recommend him to all my friends and family. Thanks

Sam made the process very comfortable and quick. He's a great communicator, efficient, knowledgable, and I'm happy to have him!

I Have been with this accountant for the past 8 years and I highly recommend him. He is very knowledgable about the tax laws and gets me the maximum return I can get.

Sam is a top-notch CPA. Efficient, responsive, well-informed, and dedicated. Highly recommended!

Very knowledgeable, efficient, & professional! Fantastic work - I highly recommend using Mr. Paltiel's Services!

Looking for easy jobs.