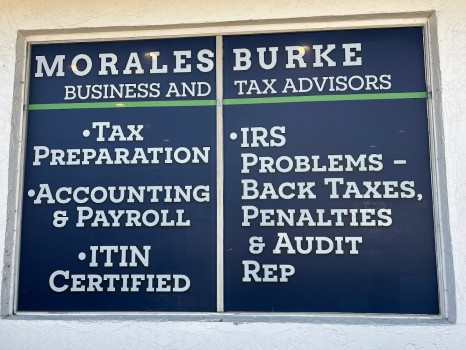

SPC CPA's and Associates (formerly Morales Burke)

Reviews Summary

About This Listing

Who Can Work with a CPA?

*Note: CPAs may specialize in different areas. Be sure to check credentials and service offerings.*

First-Time Clients

If this is your first time working with a CPA, don’t worry — most professionals offer a free consultation and will walk you through what to expect. You may be asked to complete an intake form, share financial documents, or set clear goals for your session.

What to Know Upfront:

*Note: Every CPA operates a bit differently. Don’t hesitate to ask questions before committing.*

What to Bring

*Tip: Organize your documents in advance to save time and ensure accuracy.*

Preparing for Your Appointment

*Note: Preparation helps you make the most of your CPA’s expertise.*

How to Get Started

Other Helpful Info

*Note: Every CPA is different — take time to find one who fits your goals and style.*

Features

Contact Information

Address

5420 Central Ave

St. Petersburg, Florida 33707

Phone

+1 727-344-9220Hours

Customer Reviews

I had been a continual customer of The Burke Company for over 20 years; and was always satisfied with how my account was handled...even when the unexpected situation arose financially. When Cindy S. (from the Burke Company) joined with Nichole to form Morales Burke, I was happy to follow suit. My taxes were once again done efficiently and quickly. I appreciate having the peace of mind to be able to trust this company completely with my taxes. I will be a life long customer. Linda T. Johnston

My husband had been working with this company to file his 2022 taxes before we were married, and didn't have any issues during that time, but his taxes were simple at the time. For our 2023 taxes, it has been a disaster. During my first experience with them, I had reached out about needing to file for my TPT license. It was a month overdue, and I didn't know how to do it by myself. A TPT license is a transaction privilege tax license that small businesses that resell items are required to have. The first re

Nichole Morales has been my accountant since 2012. She has been a tremendous resource to me. I own my own business and I have greatly relied on her advice and guidance from the time I started it and while it has grown. She is always available when I need personal and professional advice and guidance regarding finances and taxes. I highly recommend her and her firm!

I have been using the services of Morales Burke and Associates for all my income tax needs both business and personal for my entire family for the last six years. They have been extremely helpful and expedient in navigating the complicated ongoing tax law changes resulting in lowering my overall tax liability. I highly recommend this company without reservation for anyone needing the assistance of a tax professional. Tom Harrington

When it comes to having your taxes prepared by experts, pricing isn't the main reason for selecting a firm. I have been using accounting firms for many years back in Boston, and when I moved here to Treasure Island Morales Burke was recommended to me by a very dear fiend ,whose judgement I trust without hesitation. I have been totally pleased with the responsiveness and thoroughness of the firm , and will continue to use them and recommend them.

0% recommend this business unless you want to be taken advantage of & overcharged. As a first year entrepreneur I came to Nichole asking for guidance & very clearly expressing that I had zero idea what to do with taxes & management - later to find out I was charged the same amount for filing one business that someone else was charged (at a different firm) for 3 businesses. If you?re clueless with taxes save yourself the extra $1,000 they?re going to charge you here & use Turbo Tax, you?ll receive better cu

We've worked with Cindy Stepp for several years now (first at The Burke Company and now at Morales-Burke). I am a retired commercial banker and in my banking days worked with many local accounting firms, book keepers and accountants (that represented the many small businesses and individual borrowers I assisted). And I can say, without reservation, that Cindy Stepp, of Morales Burke, is one of the best when it comes to tax return work (both business and personal). She is experienced, responsive, and tho

Nichole has been my accountant for years. Morales and Associates are always quick to respond to my questions and my accounting needs. Most importantly Nichole is proactive in helping my business and personal tax needs. This helps me out greatly at tax time. It also takes away the stress and anxiety I may have as April approaches. If you have a business or need a personal accountant where you are treated like a friend and not just a number; you should contact Morales and Associates.

Pleased from A to Z with this firm. Cindy Stepp, has been expertly doing my taxes since I moved back in 2007 - and has done my father's for longer than that. Always pleased, and I always go back. Thank you to the entire team, and especially to you Cindy. See you next tax season!!

Nichole Morales has been my personal and business accountant for over 10 years. Every year, my financials and taxes have been timely and accurate. My business would probably fail without the assistance of Morales and Associates.

We've been using Morales and associates for over 3 years now and would never use anybody else, she is so knowledgeable and very easy to get along with. We look forward to seeing them every year.

I would recommend Morales Burke to any business. I have recommend Cindy to 2 of my friends. She is the best.

Absolutely terrible service. No communication, took advantage of lack of knowledge from my end, and misfiled my tax return losing me thousands of dollars. Do not waste your time & money.

This is a great company and an outstanding staff. They always deliver great service. I highly recommend them and will continue to use them!

Very efficient and most helpful with my questions. I appreciate the assistance. I was referred by Helen Ballweg, a neighbor in my park.

Please note the review on this page from "Debra C" is not from me! I do not know who this review was written by but it was not my husband or myself.

Nichole could learn how to be more professional but they meet your needs

Professional, efficient, courteous. No negatives, highly recommended.