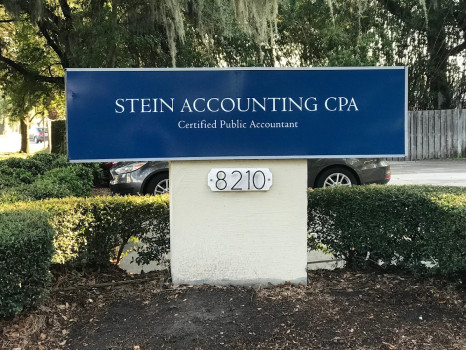

Stein Accounting CPA

Reviews Summary

About This Listing

Who Can Work with a CPA?

*Note: CPAs may specialize in different areas. Be sure to check credentials and service offerings.*

First-Time Clients

If this is your first time working with a CPA, don’t worry — most professionals offer a free consultation and will walk you through what to expect. You may be asked to complete an intake form, share financial documents, or set clear goals for your session.

What to Know Upfront:

*Note: Every CPA operates a bit differently. Don’t hesitate to ask questions before committing.*

What to Bring

*Tip: Organize your documents in advance to save time and ensure accuracy.*

Preparing for Your Appointment

*Note: Preparation helps you make the most of your CPA’s expertise.*

How to Get Started

Other Helpful Info

*Note: Every CPA is different — take time to find one who fits your goals and style.*

Features

Contact Information

Address

8210 White Bluff Rd

Savannah, Georgia 31406

Phone

+1 912-925-2500Hours

Customer Reviews

In 2024, my girlfriend and I decided to seek professional help for our personal taxes. The process was straight forward although we had some discrepancies with some of the lower tier staff. Mr. Neville Stein smoothed it over and showed us his appreciation for our business, he is an honorable man who keeps his word. We are not rich, nor do we own a business, but his services were top tier and his appreciation for our business was displayed in the up most way. Due to this ? we plan to use Stein Accounting aga

Had the opportunity to do some detailed discussion with Neville Stein regarding business matters. This firm has many existing clients. Finding time to talk about business strategies was a bit challenging, but once there, we were able to cover everything. I never felt rushed and the meeting went past the 90 minutes allocated. Before our discussion I looked through this company?s social media. Stein and his firm have a broad practice portfolio, from individuals to small and mid sized businesses. It did not su

I went in to see Mr. Stein After receiving a letter from the IRS. I walked in a nervous wreck and walk out totally relaxed, confident in Mr. Steins knowledge of my situation. I was totally at ease through the whole experience. I would highly recommend this accounting firm.

Stein Accountant is a great accounting office. The owner, Neville, Mrs. Karen Miller(senior accountant) and all office personnel are very knowledgeable, and wonderful people. When I was looking for a new accountant for my business 15 years ago, a friend of mine introduced Neville. He just opened his office, with one employee. My first impression of him that he is a very humble, polite, knowledgeable accountant, qualities that are important to me, and I have been a client since . Stein Accounting handles all

As a small business owner, Stein Accounting and team have been such a huge aspect of running my business well. Their extensive experience in accounting gives you the client trust that your getting the best direction possible for your individual needs. I?d highly recommend their firm!

I have been using Stein Accounting for many years - more than 15! They consistently provide excellent service. They not only provide tax services each year, but handle my monthly books. Great team!

I have a small business here in Savannah. Stein Accounting is reliable, accurate and is considered to me a great value for all that they do for us. Whenever I have a question, they are extremely fast in responding. I can always count on them !!! :>) !!!

Hired for tax services. Once I started pointing out discrepancies in my returns, they did not try to fix the issues. I ended up having to hire another firm to do it correctly. No knowledge of distribution codes or Rollover experience.

I've been a client of Stein Accounting CPA for many years. Very dependable and knowledgeable staff for my annual business and personal taxes. Highly recommended.

Professionalism, expertise and excellent service. The entire process with Stein Accounting is great customer service. I highly recommend this company.

Very pleased that I found Mr. Stein...he's done a great job for me and I would definitely recommend him to friends and family.

A wonderful small business go-to for all accounting needs! We highly recommend Neville and his staff.

I had some issues that needed sorted out so i met with Neville Stein . His office gave me good information and helped clear things up.