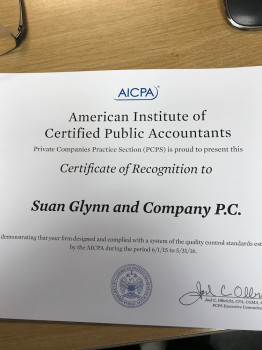

Suan and Company P.C. - CPA

Reviews Summary

About This Listing

Who Can Work with a CPA?

*Note: CPAs may specialize in different areas. Be sure to check credentials and service offerings.*

First-Time Clients

If this is your first time working with a CPA, don’t worry — most professionals offer a free consultation and will walk you through what to expect. You may be asked to complete an intake form, share financial documents, or set clear goals for your session.

What to Know Upfront:

*Note: Every CPA operates a bit differently. Don’t hesitate to ask questions before committing.*

What to Bring

*Tip: Organize your documents in advance to save time and ensure accuracy.*

Preparing for Your Appointment

*Note: Preparation helps you make the most of your CPA’s expertise.*

How to Get Started

Other Helpful Info

*Note: Every CPA is different — take time to find one who fits your goals and style.*

Contact Information

Address

3290 W Big Beaver Rd Suite 510

Troy, Michigan 48084

Phone

+1 734-513-2731Hours

Customer Reviews

My last tax person retired to Florida and I was worried I wouldn't find another like her. When I walk into a CPA, the first thing I do is look to see if there are papers, pencils and calculators on the desks or is it just a neat and tidy office with banks of computers and keyboards. I can go to H & R block or do my own if it's just computers doing the work. The Suan company works off experience and brainpower, not relying on just a computer program. Being self employed, my taxes are a nightmare and I feel t

This is the second year Suan & Co. have taken care of my taxes for me and I am very pleased with the exceptional, personalized service I have received. As a travel nurse, my taxes can be a bit confusing (at least to me!), but Suan & Co. always completes them quickly & is able to answer any questions I have. I will continue using them!

Wilmar has more patience than I do and is willing to work through all my worries and frustrations when it comes to paying taxes. Being self employed is more work and Wilmar always makes sure we are content and understand the process Kinda is also super sweet and very helpful ??

Wilmar has been extremely friendly and professional with me and my family's CPA needs. He has explained everything in detail and is very timely with responses. Their client portal also makes it a breeze to upload, view, and/or sign documents. Definitely recommend their services!

We originally went to Suan and Company because we have an in-home Day Care and taxes can get a bit crazy, Wilmar Suan was able to help us with ease and was very friendly, I normally don't leave reviews, but they deserve all of the stars and more, We cannot thank them enough for the quick turn around, professionalism and assistance.

This company and Mr. Suan did a fine job on my taxes! I got a refund from both Federal and State, which I was not expecting! Thank you!!

Wilmar and team are extremely professional and efficient. Highly recommended for all your accounting needs/tax needs.

I have been using Suan & Co. For my tax accountants for many years. I am very happy with them and always get a substantial refund!

Wilmar, Kinda and the entire Suan and Company team did a great job. They are highly recommended.

After the documents sent he got to working on our files right away. The next week already got refund which I?m in shock how fast and efficient he was in taking care of our documents being only as first time client... Highly recommended.

Suan and Company has always given my family and I high quality service and knowledge regarding my tax needs for many years.

Suan & Company deserve the 5 star rating i have given them they are friendly great people and i would recommend Wilmar Suan and his team to everyone i know:}

They?re always so quick and helpful to respond to any questions I might have. They?re also very friendly and overall a great company to work with. Highly recommend!

Wilmar was very professional and answered all the questions. Very happy with the service.

Detailed and fast service !