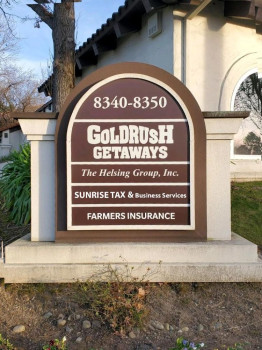

Sunrise Tax & Business Services

Reviews Summary

About This Listing

Who Can Work with a CPA?

*Note: CPAs may specialize in different areas. Be sure to check credentials and service offerings.*

First-Time Clients

If this is your first time working with a CPA, don’t worry — most professionals offer a free consultation and will walk you through what to expect. You may be asked to complete an intake form, share financial documents, or set clear goals for your session.

What to Know Upfront:

*Note: Every CPA operates a bit differently. Don’t hesitate to ask questions before committing.*

What to Bring

*Tip: Organize your documents in advance to save time and ensure accuracy.*

Preparing for Your Appointment

*Note: Preparation helps you make the most of your CPA’s expertise.*

How to Get Started

Other Helpful Info

*Note: Every CPA is different — take time to find one who fits your goals and style.*

Features

Contact Information

Address

8350 Auburn Blvd Ste. 145

Citrus Heights, California 95610

Phone

+1 916-722-5343Hours

Customer Reviews

My wife and I have been going to Sunrise Tax for 3+ years now. We have always worked with Gregg and have had no complaints. This year was the first year that we submitted everything online through the secure portal and it was a breeze. Everything was completed in less than a week. Gregg and I communicated back and forth via email regarding any questions. The e-signing of forms and online payment for services was easy to do. Very satisfied. I would recommend Gregg to anyone.

My family has been working with Gregg and Shelley for a few years now and we couldn't be happier. We get help from them in regards to our taxes, and they've always been great. Their processes are simple, and they always seem to catch something we had no idea about or forgot to add. They help with questions and take the necessary time to explain points we've ran into confusion around. The list goes on, but ultimately I would happily be a reference and recommend them to others given the outstanding experience

After having a bad experience with a previous tax advisor last year we decided to change and try someone new. Sunrise Tax Services was close to us and had good reviews however the experience we had with Shelley Russell was anything but good. The only positive thing was we got our return back in one week; however come to find out later after getting a letter in the mail from the IRS they were done incorrectly. When picking up our returns I wanted to review them with her to make sure we had no questions; whi

We have been going to Sunrise Tax & Business Services for the past few years and it has been a pleasure! They're always quick about getting us in for an appointment, they handle business professionally and in a very timely manner. The staff is always super informative and helpful with all my tax questions/concerns. I highly recommend them for all your tax needs!

Have been going to Sunrise Tax & Business services for years, can't say enough about the amazing customer service. Our taxes are taken care of in a timely matter and the professionalism is top notch. Thank you for your dedicated work and excellent service.

Gregg & Deanna Hapai are knowledgeable, helpful, honest people. Good friendly customer service. The staff is very professional and easy to work with. I would highly recommend having your taxes done here. We have been coming here for the last 5 years. Fast returns. We are very happy clients and will always recommend this service. Thank You Sincerely, Dave & Patricia Zinola

We recently moved to Washington, but Ray at Sunrise continues to prepare our taxes every year - we send him a package in the mail and he e-files when he completes it. He is reliable, professional, easy to talk to, and always has a suggestion to help us maximize our return. I love the fact that I can call or email him anytime through out the year with a question. He knows his stuff - you won't be disappointed!

I usually do my taxes with turbo tax...but turbo tax could not solve the problem I was having with my taxes...I was in a panic mode..I called Sunrise Tax Services and explained my complicate tax problem and Shelley said she would help me..I felt she was there to help me...She did my taxes and saved me so much money...I was shocked!!..I wish I had used her instead of doing the taxes myself all those years before...She was wonderful! Her fees were so reasonable.. I would certainly recommend her if you need a

Was very rude and made mistakes on our taxes.

I have nothing but good to say about Sunrise tax and business services. They are very good at what they do, they're very thorough, very professional, very honest and they will go out of their way to answer any questions that you have. Give them a visit you will not be sorry!!!!

I have used this great company on a number of occasions for personal taxes and trust/estate taxes. I have family members who also use Sunrise Tax. They have been in business for many years and are great to work with!

Gregg is a great guy who has done my taxes for years. Great work! I would always recommend his services

Top Notch professional and timely service. The folks at Sunrise Tax & Business services are the best.

Gregg and Deanna are great people and the staff are great people and easy to work with.

It is a pleasure doing business with honest, ethical, hard working people. That is exactly who these fine people are!

Everything I need in tax service. Great and easy to deal with!