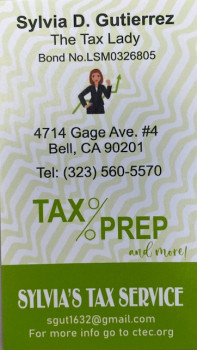

Sylvia Gutierrez Tax Services LLC

Reviews Summary

About This Listing

Who Can Work with a CPA?

*Note: CPAs may specialize in different areas. Be sure to check credentials and service offerings.*

First-Time Clients

If this is your first time working with a CPA, don’t worry — most professionals offer a free consultation and will walk you through what to expect. You may be asked to complete an intake form, share financial documents, or set clear goals for your session.

What to Know Upfront:

*Note: Every CPA operates a bit differently. Don’t hesitate to ask questions before committing.*

What to Bring

*Tip: Organize your documents in advance to save time and ensure accuracy.*

Preparing for Your Appointment

*Note: Preparation helps you make the most of your CPA’s expertise.*

How to Get Started

Other Helpful Info

*Note: Every CPA is different — take time to find one who fits your goals and style.*

Features

Contact Information

Address

4714 Gage Ave Ste 4

Bell, California 90201

Phone

+1 323-560-5570Hours

Customer Reviews

Been coming here for many years, Sylvia is honest and that's what keeps us coming here.

I went there to do my taxes. I called and set up an appointment at 8:00am, that's the time they open. Upon arrival, I noticed there was a group of 4 people waiting outside the establishment, it was around 7:50am. She let's everyone in at 7:55am and asks everyone to sign in on a notepad. Just when I'm about to sign in this lady yells at me that she got there before me, therefore she should sign in first. I'm thinking, no problem, I have my appointment at 8:00am anyway. As I'm signing in I hear Sylvia h

We have been going with Silvia even before my kids were born and now my oldest one is 30yrs old and we still go with her to do our taxes. She really is an amazing woman. Now my kids, uncles, mother in law go with her. If it is within her reach, she will definitely help you. Thank you Silvia.

Recently have been doing my taxes with this lady due to my parents having them done for over a decade with her. My tax returns have never came late nor have I had a problem regarding to the IRS. Only complaint I have though would be that getting an appointment is a pain and if you do a walk-in instead then be prepared to wait for a while. Then again if you are responsible enough to call for an appointment ahead if time, then you are good.

I been doing business with her almost ten years wonderful staffs and ms.Silvia always take care of me tells me what I have to do so Everything come out good ?????? thank you for been with me for a long time seeing me growing ??

Been going with her for years. Definitely worth the wait each year. Straight forward and explains everything with detail. Sylvia see you next year.

I've been doing my taxes with mrs.S for the past five yrs nd plan on doing em with her or her staff until I retire lol. But really great service never had an issue always get a good amount nd always fast delivery nd I found dat sum times Ive had to wait a bit it's totally worth it thanks Mrs. S... Highly recommend to every one nd anyone....

Professional service.....I've been coming here for 20yrs. I drive from Ontario to file my taxes with her. She tells you what to expect from the Gecko. No B.S

I have done my taxes at silvia's taxes for more than 9 years, i drive more than 60 miles just to have them done there.always with a great Customer service

My favorite place to get my taxes done. You feel very welcomed when you are here. Very sweet & reliable. ??????

My parents have been doing taxes since 2007 and love how delivery and professional she is. I highly suggest this place to everyone.

Have been going there for about 10yrs. And she does a great job, no complaints here.

She's the best, I drive 2 1/2 hours every year to do my taxes with her.

Book a appointment and you'll be in and out and explained everything 10/10 services.

Great service my dad has been going to Sylvia's tax service for years to get his taxes done

Great service. Be prepared to whait if you dont have an apppointment.

I now moved to NJ and I continue to use her services, best ever!!!!

Every year I come with her and she always have answers for me

She's the best very professional!

(Translated by Google) A very kind and very professional lady. (Original) Una se?ora muy amable y muy profesional.

(Translated by Google) It is a very good service, they explain it well (Original) Es un muy bueno el servicio te explican bien

(Translated by Google) Excellent service (Original) Excellente servicio

(Translated by Google) Excellent service (Original) Excelente servicio

(Translated by Google) Excellent service (Original) Excelente servicio