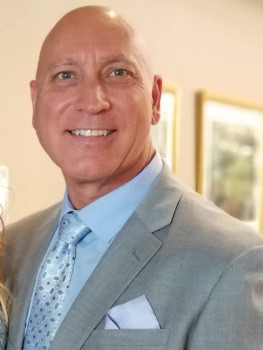

TRUST Management Inc. Aaron, THE Accountant

Reviews Summary

About This Listing

Who Can Work with a CPA?

*Note: CPAs may specialize in different areas. Be sure to check credentials and service offerings.*

First-Time Clients

If this is your first time working with a CPA, don’t worry — most professionals offer a free consultation and will walk you through what to expect. You may be asked to complete an intake form, share financial documents, or set clear goals for your session.

What to Know Upfront:

*Note: Every CPA operates a bit differently. Don’t hesitate to ask questions before committing.*

What to Bring

*Tip: Organize your documents in advance to save time and ensure accuracy.*

Preparing for Your Appointment

*Note: Preparation helps you make the most of your CPA’s expertise.*

How to Get Started

Other Helpful Info

*Note: Every CPA is different — take time to find one who fits your goals and style.*

Features

Contact Information

Address

2829 Townsgate Rd STE 100

Westlake Village, California 91361

Phone

+1 866-546-8660Hours

Customer Reviews

I've been using Aaron Woolley at Trust Management and his team for the past 15 years for my business management, accounting and tax preparation & tax planning. Aaron is extremely responsive and knowledgeable. He is patient with my questions and happy to jump on the phone when needed. His advice is helpful and guides me to make sound financial decisions. It is not hyperbole to say that Aaron has saved my business multiple times. I am forever grateful to have him as a trusted advisor on my team.

Six years ago, I hired Aaron to be my accountant based on a very good friend's recommendation. It was one of the best decisions that I have made over the last decade. At the time, I was a nervous wreck as I had just received my first (and hopefully my last) IRS audit. Aaron was calm, cool, and collected and very reassuring which helped me tremendously. He guided me through the process every step of the way and the result, though slightly painful, ended positively but could have been much worse. Ever since t

I have been working with Aaron for a few years now and he has helped me so much and has saved me so much money with my taxes. He always takes my calls and he is always so awesome and helpful to work with. I feel like I'm a priority and that he cares. I highly, HIGHLY recommend him and have referred him to multiple people.

Trust has become more important to me than some of my family. That's not a stretch. Aaron and his team are so above and beyond professional, helpful, and patient, that it's almost uncomfortable, because I'm not at all accustomed to most of the business world being that way. I'm truly the worst businessmen I personally know, and Aaron has been truly supportive and willing to work with me in several areas. Also, I can't believe the fair rates. I'm a client for life. Matt Svendson Nordic Woods Inc.

I have used Trust Management for my taxes for years. They are honest and easy to work with. I own multiple real estate properties as well that Aaron is an expert at handling during tax season. I am always pleased with how quickly my questions are answered and how simply the process is for filing. Thank you!

Aaron and Trust Management are the best. Aaron always makes himself available to answer any questions I might have. I know he always is watching out for my best interests.

Always helpful, always available for questions. Helps me understand the process and how to properly categorize expenses. Aaron also reminds me of timelines and doesn't get upset when I am lazy. He is very helpful.

I've used Trust Management for a couple years now and have been incredibly happy and satisfied with the services they provide. The responsiveness, customer service and ability to solve and provide for all my tax and accounting needs has been an incredible help for me professionally and personally. Would definitely recommend them.

Aaron Wolley is the most unprofessional CPA I have ever met.

Aaron is my rock and trusted place for my business.