Y & G Income Tax and Multi - Services

Reviews Summary

About This Listing

Who Can Work with a CPA?

*Note: CPAs may specialize in different areas. Be sure to check credentials and service offerings.*

First-Time Clients

If this is your first time working with a CPA, don’t worry — most professionals offer a free consultation and will walk you through what to expect. You may be asked to complete an intake form, share financial documents, or set clear goals for your session.

What to Know Upfront:

*Note: Every CPA operates a bit differently. Don’t hesitate to ask questions before committing.*

What to Bring

*Tip: Organize your documents in advance to save time and ensure accuracy.*

Preparing for Your Appointment

*Note: Preparation helps you make the most of your CPA’s expertise.*

How to Get Started

Other Helpful Info

*Note: Every CPA is different — take time to find one who fits your goals and style.*

Features

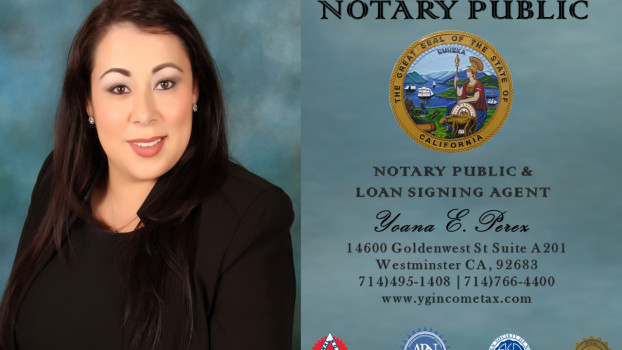

Contact Information

Address

14600 Goldenwest St a201

Westminster, California 92683

Phone

+1 657-600-4400Hours

Customer Reviews

Totally blown away by the experience. The staff members are amazing they go a step above and beyond with all of your taxes!! A shout out to the owner,Yoana thanks for everything sincerely ?? ??

What an amazing business! I arrived and was greeted by the staff and was quickly seated and assisted by the owner. She was very helpful and genuinely cared about getting me the best possible refund. She was able to answer all my questions and able to explain everything in full detail. I was a little nervous about doing my taxes for the first year, but she took all the stress out of the situation. I highly recommend this place to anyone and everyone looking to get their taxes done. Y & G Income Tax will defi

Where is the 10 starts at!? Yoana is the BEST! she works so fast right and then! the best customer service from her always on time with every detail, I recommend her 100% plus plus.. She divorce my BF in 4mths I'm always going to be so grateful that we found you. Thank you so much for everything!

Honestly best place! She's honest. Tells you exactly why you are getting the return your getting and explains how you can get more next time. She also offers a variety of different services

Walked in there very nice set up plenty off space. Was greeted nicely and literally 10 min I was in and out definitely coming back next year. When I have to get my fingerprints scanned again.

Great experience for notary. We will be back soon. We used to go to the UPS store until they closed. The woman that helped us was very nice and helpful.

Been to other professional places, yet all hold their own, but here I found everything I need, very professional and very well qualified to answer all my questions, most defiantly happy to refer all my student here! Amazing professional work! Thank you.

They will tell you the wrong DMV rules, making you to pay for the unnecessary processing fees and not getting exactly for your intended purpose from DMV. Do not let them do your DMV papers there.

I had trouble with my taxes last year. I came in she happily helped me fixed them explained them perfectly and did this year for so cheap not like other places with hidden fees !!! I recommend this place Satisfied :)

3rd year coming here and still very happy with the service. They take the time to answer all my tax questions. Will be back to file next year.

Great service. Walked in for a free consultation and was pleased with the information she provided with a great hospitality.

Easiest and fastest live scan fingerprinting service out there!

Excellent and professional service. I had my documents sealed in minutes.

Great customer service. Good people. Totally recommend this place.

I love it here so clean, professional and helpful.

Great place to make business!!

Really good customer service

(Translated by Google) Excellent services with reasonable prices. Thank you YOANA for helping me with my taxes and with the DMV service (Original) Excelentes servicios con precios razonables. Gracias YOANA por ayudarme con mis taxes y con el servicio de DMV

(Translated by Google) Bad experience! At first I was very happy until last year I changed the direct deposit of my taxes to my ex-wife's bank account!! And without consulting me! So personally that is not done! (Original) P?sima experiencia! Al principio estaba muy contento asta que el a?o pasado cambio el dep?sito directo de mis tax a la cuenta bancaria de mi ex esposa!! Y sin consult?rmelo! As? que en lo personal eso no se hace!

(Translated by Google) This girl is the best. I have been doing my taxes with her for 3 years. She charges a good price since many take advantage and charge too much and she is also fast and if there is a line, wait, remember that good things take time. I recommend that you go ball with her. If there were more stars, she would give them all :) (Original) Esta muchacha la mejor tengo 3 a?os haciendo mis taxes con ella cobra buen precio ya que muchos se aprobechan y cobran de masiado y aparte es Rapida y si

(Translated by Google) Good service! Kind, professional and honest. We have done taxes and the fingerprint service too. (Original) Buen servicio ! Amable , profesional y honesta . Hemos echo impuestos y el servicio de huellas tambi?n .

(Translated by Google) Very good service (Original) Muy buen servicio